I’ve been trading the market for over two decades, training thousands of people.

Without a doubt, there are five mistakes I see from traders over and over:

- Fear of losing money

- Going too big

- Trading without an edge

- Comparing yourself to other traders

- Becoming consumed with today’s profits and losses.

I want to help you avoid these altogether.

At some point in my career, I committed each of these sins.

Learn from my mistakes rather than falling into these traps yourself.

To drive this point home, I created a short training video to explain these concepts a bit further.

That way you can spot them before they happen.

Click here to watch my training video

Now, I want to give you specific strategies to help you keep these demons at bay.

Lean on these when emotions run hot and you can’t think straight.

1) Fear of losing money

Look, no one wants to lose money…though maybe someone out there has a good reason.

Being scared of danger is a healthy thing. Our ancestors used it to avoid animal attacks.

Today, it causes us to avoid unnecessary risks.

But, overdoing it creates problems.

Fear of losing money tends to cause one or more of the following problems:

- Taking profits to early

- Stopping out too quickly

- Jumping in and out of trades

Solution – Create a trading plan

Trading plans keep our emotions in check by giving us a series of steps to follow.

Trust me when I say that going to a checklist when your palms are sweaty and eyes straining from nervousness is an incredible tool.

You need to have trust or some faith in the plan. Otherwise, you’ll second guess it.

Why is it so important to stick to the plan?

A well-developed trading plan tells you:

- Which stocks to look at

- Where you would enter

- Your stop out

- Your target

It literally gives you a step by step play.

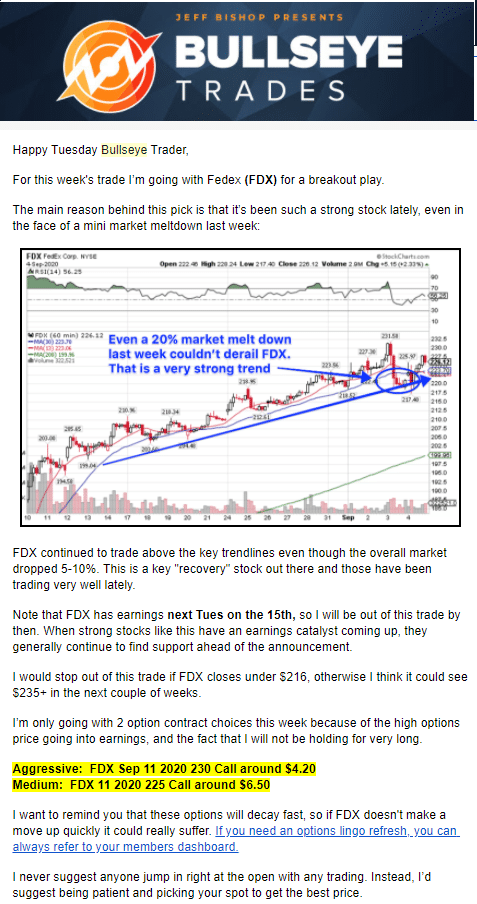

Check out an example with my Bullseye Trade of the week.

This is a full-fledge trading plan that I send to Bullseye Members each week with my best trading idea.

I include all the pieces of a trading plan that we discussed above.

Having something like this makes it much easier to trade than trying to fly by the seat of your pants.

Want to learn more about Bullseye Trades? Click here

2) Going too big

As I mentioned in the video, everyone is going to have their own risk tolerance.

Some people can handle risking 5% of their account per trade, others 0.5%.

Here’s what commonly happens.

You get on a run and make more in a few days than you have in the last few months.

All of a sudden, you’re thinking about what this would look like long-term if you created this kind of income each week.

You start sizing yourself with this in mind and then get stuffed with a monster loss that nearly wipes out your account.

Solution – Set risk management rules

Risk management rules tell me exactly how much I can risk each trade based on potential losses.

Many traders use a certain percentage of their account, such as 1% or 5%. Others use a fixed amount such as $100.

Whatever you choose, it needs to be something you’re comfortable with and can stick with.

It should also scale up and down at some point so that you can grow and shrink with your account as necessary.

3) Trading without an edge

Anybody with a brokerage account and a few bucks can trade stocks…well almost everyone.

It’s one of the few professions you can jump into without much training.

That’s probably while 90% of new traders fail within the first 6 months.

Part of creating consistency comes from an edge.

An edge can be a setup, skill, or anything really that gives you a leg up on the market compared to the average trader.

Solution – Stick with one setup

Trying to trade everything will quickly make you good at nothing.

Becoming an expert on one setup forces you do develop an edge.

And look, maybe the first one or second one doin’t work for you.

Eventually, you will come across one that does.

Log your transactions in a trade journal to track your progress.

Feel free to look back through charts and see how the strategy performed on paper before getting into the real thing.

4) Comparing yourself to other traders

We all do this, myself included. It’s a dangerous habit for one obvious reason.

No two traders are alike.

Even if two people use the same strategy and the same risk management, their results will often differ.

It could be as simple as one person was out for a week.

Solution – Give life to your opposite

The only person you should compare yourself with is you.

So why not create an opposite you?

Come up with a fictitious paper account that takes the exact opposite side of the trades you do.

See how that person performs compared to you.

Crazy as it sounds, this exercise can help traders who really struggle to turn a profit find a balance.

5) Becoming consumed with today’s profits and losses.

One of the worst things you can do is set profit and loss goals.

As a trader, everything we do is about probabilities, and probabilities take time to work out on average.

Depending on your style and strategy, some days may swing hard against you. Or, you might be prone to streaks of small losses with one huge win.

If your strategy generates positive expected value, it should make money over time on average.

Solution – Focus on making good decisions

Keep yourself off the money train and focus on making the right choices.

I found successful trading comes from replicability and repeatability.

That means I can find similar setups and make similar decisions over and over.

It doesn’t guarantee a specific outcome.

What it does is create a series of events that when adhering to a trading plan, should generate an outcome similar to the expected value.

Practice makes…well things easier

I’m willing to bet many of you finished this article and realized you never put together a trading plan like the one I shared above.

That’s totally normal.

It’s exactly why I created my Bullseye Trade of the week.

You get my best trade idea blueprint sent to you before the bell rings on Monday morning.

My goal for each trade +100% on the options contract.

Are you ready?

Click here to learn more about Bullseye Trades.