The best performing index year-to-date — Nasdaq 100 — is up over 40%.

When most traders see those returns, they stare in awe and think they should just buy an ETF and hold. While that may be a good strategy for some…

It’s not a strategy I love, when it comes to growing my wealth.

You see, a 40%+ return in more than 11 months just doesn’t get me excited…

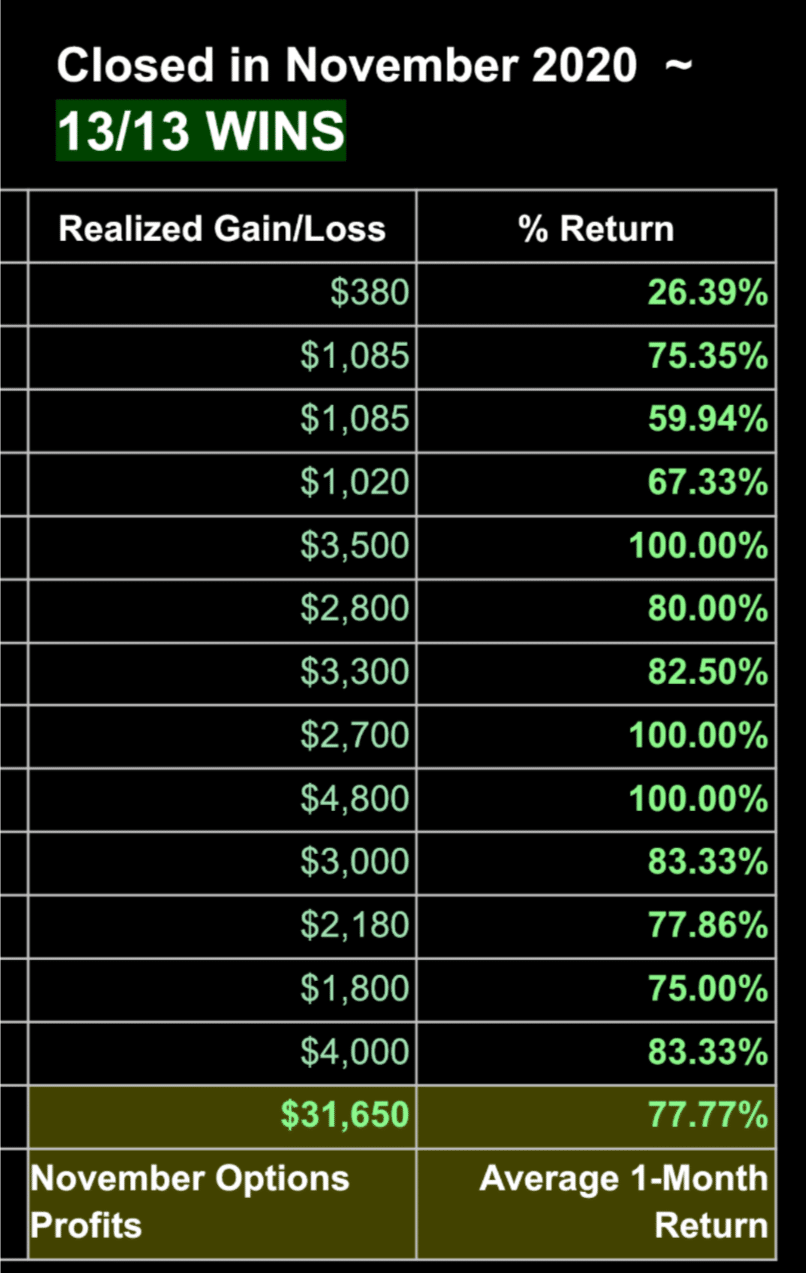

Especially when my Portfolio Accelerator, which used one options strategy that helped deliver a 77% IN ONE MONTH!*

That’s no typo.

*And all options trades turned a profit!

*See disclaimer below

Of course, not all the trades will be winners, and it’s important to learn how to manage risk.

You’re probably wondering how I achieved those returns…*

I took advantage of the enormous interest in small caps – interest so large the index began to OUTPERFORM the Nasdaq 100.

Now, a lot of people associate small caps with risk.

But, I use option strategies like cash covered puts to not just manage risk, but ENHANCE my returns.

Let me show you what I mean.

Supercharge with small caps

Are small caps riskier than large caps?

That depends on your point of view.

In general, they carry greater risk. But that’s proportional to the additional reward.

You see, large companies like Tesla (TSLA) or Facebook (FB) receive enormous amounts of scrutiny and study. Very little occurs that gets past the market.

With small caps, you might only find one or two analysts covering a stock. And more often than not, their businesses thrive or dive with the economy.

Think of it this way. How much bigger can a company like Apple (AAPL) get? Double? Maybe 5x its current size in a decade?

Now consider a small fintech startup payment processor. They could be 100x the current size in a matter of years.

But they could also be bankrupt. It’s unlikely anyone holding shares of Apple worries about their business folding in a decade, let alone the next few years.

Options enhancement

Let me dispel another myth for you.

Options carry no more risk than stocks when used properly. In fact, investors often use them to reduce their risk.

Think about a fund that invests money in various stocks for clients. If they worry about a market drop, they might buy put contracts on the S&P 500 index or the like to hedge their portfolio.

That’s all option contracts are at the end of the day – insurance products.

As a trader and investor, I can take both sides of this trade.

And one of my favorite ways to pick up stocks at a cheaper price – cash covered puts.

Essentially, I set aside money to buy 100 shares of a stock per contract. Then, I sell a put contract to someone else, giving them the right to sell me (forcing me to buy) 100 shares of the stock per contract at a specific price.

It’s like a farmer locking in a sales price of at least $30 per bushel. I’ll buy X number of bushels at $30 until the expiration date. If the market price is over $30, he’ll sell at market price. If it falls below $30, then he might exercise the contract.

However, I wouldn’t just give the farmer this gift for free. He might pay me $2 per bushel as a lump sum for this privilege.

So, even though I might buy his bushels at $30, I get to keep that original $2.

That’s what stock options do.

Let’s use an example from my portfolio.

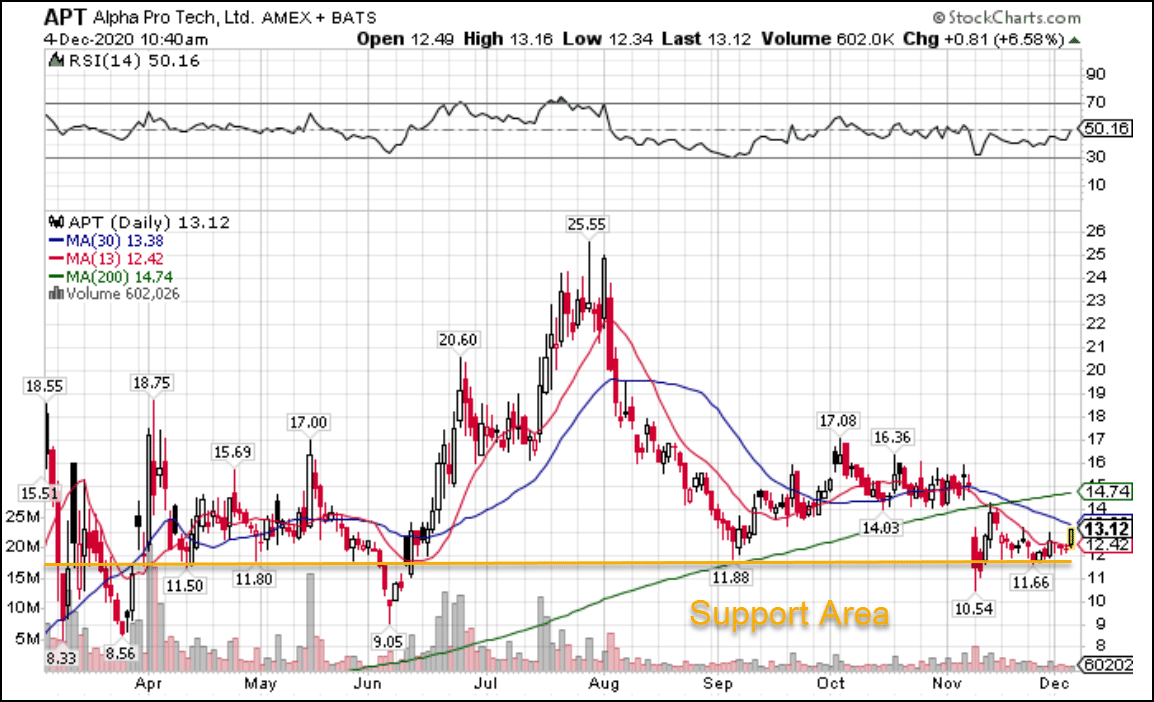

Alpha Pro Tech (APT) is a stock I wanted for my Portfolio Accelerator. Beyond the growth in the company’s industry, the chart looked extremely promising.

APT Daily Chart

After hitting a strong support area, I decided that I liked this price level for an entry point.

So, I sold the APT, December 18, 2020, $12.00 put contract for $0.70. That means my effective price, if I had to buy the stock, would have been $11.30.

For each contract I sold I needed to set aside $1200 (100 shares x $12 per share).

Since each expiration was about 17 days away when I took the trade, if we get to that date and the stock is over $12, the option expires worthless and I keep the $70.

Think about it this way. I could earn $70 on $1200 over 17 days, or a return on investment of 5.83%.

If I made similar trades back to back for an entire year, my annual return on investment would be 125%!

Sounds too good to be true.

Well, you can see that at the time of this screenshot, the stock is up at $13.12. If I simply bought the stock at $12, I would be up $1.12. So, there’s an opportunity cost if the stock takes off running.

Still, I can use this strategy to generate income against stocks I want to own. I can also increase my probability of success by going with option contracts further-out-of-the-money, although they pay less.

And best of all, I can take the trades off early for partial profit and further increases my odds of turning a profit.

A strategy every investor needs

Everyone wants to generate consistent income from the markets.

Few achieve it.

But you can never start that process without the right tools and information.

Portfolio Accelerator is more than just showing you my trades. It’s learning how and why I take them.

Don’t miss out on my next report coming in a matter of days.