Know what the number one problem is for small account traders?

Position Sizing.

Avoiding excessive risk with a small account seems near impossible.

But what if you could define your risk from the outset…

Limiting your potential losses while leaving a substantial upside?

I’m talking about an option debit spread.

And I want to show you why I love this idea for small accounts.

You see, even some of the cheapest call options cost $50 or even $100.

When your account is only $500, that’s 10%-20% of your total capital!

Hit a losing streak of 5 trades and you’re out of the game.

That’s why I like debit spreads.

With the right stock and trade structure, I can risk $25 to win as much as $100!

But would you believe that I’d rather take $10 than try for the full $100?

I know, it sounds crazy, but there’s a method to the madness.

So let’s start by understanding the debit spread setup.

Debit spread basics

Debit spreads are the other side of the credit spread.

They operate in a nearly identical fashion but with some key differences…

And those are what make them effective for small accounts.

Debit spreads come in two forms: call and put.

A call debit spread is a bullish bet that the stock climbs over both of the strikes by expiration.

Put debit spreads are bearish bets that expect a stock to fall below both of the strikes by expiration.

When you initiate the trade you pay a certain amount. If things go your way, you can take the trade off by selling it back and making more than you paid for it.

Your maximum potential profit is the difference between the two strikes less the amount you pay up front.

Your maximum potential loss is the amount you pay up front.

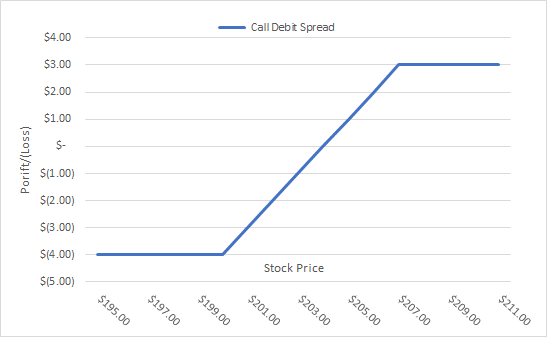

Here’s a look at what a call debit spread payoff diagram looks like.

Let’s use this chart to create an example.

- I buy the $200 calls in stock ABC for $7 that expire in two weeks

- I sell the $207 calls in stock ABC for $3 that expire in two weeks

- My net payment is $7 – $3 = $4 x 100 shares = $400

- This is also my maximum potential loss

- My maximum potential profit is $7 – $4 = $3 x 100 shares = $300

Now that we have the basics, let’s talk about setting this up for a small account.

Small risk setups

Let me make one obvious statement.

The lower your total risk, the lower the probability of success.

But, let me say something you may not be familiar with.

Taking your trade off earlier at a partial profit increases the odds of your success.

With this in mind, I want to talk about using out-of-the-money call debit spreads to lower my total risk.

Let’s say I want to get involved with Tesla (TSLA). The stock’s been going wild, so there’s a good chance it could make a big payoff.

But if it loses, chances are it’s going down hard.

That’s why I want to bet a small amount to limit my risk.

For example, if I want to make a bullish bet on Tesla going up, but don’t want to risk a lot of capital, I can buy a call debit spread.

If Tesla is trading at say $410, if I go out 18 days, I can buy the $425 calls and sell the $426 calls for $0.35.

That means my total risk is $35 per spread with a maximum reward of $65.

Taking the trade off early

Now, let’s take this one step further.

Say that the Tesla trade above only works out 40% of the time. That’s not as good as I would like it.

But, if I decide to take the trade off at 50% of maximum profit, or $32.50, my odds increase to 60%.

If I take it off once I make $15, they shoot up even higher.

Why would I do this?

Because with small accounts, the initial buildup is key.

I want to lock in wins and get growth in the account early.

How might this look?

Check out this math on the expected value (the amount I should make on average if I did the trade multiple times):

EV of taking the trade off at 50% = (60% x $32.50) – (40% x $35) = $5.50

EV of taking the trade off at 100% = (40% x 65) – (60% x $35) = -$5.00

By taking the trade off early, I change my expected value from negative to positive!

Practice makes perfect

It can take a little getting used to these trades before you get the hang of it.

One way to get started on your options education journey is my Ultimate Guide to Options Trading.

Here you get a crash course on options with the basics you’ll need to navigate the markets.

Click here to check out my Ultimate Guide to Options Trading.