There may not be a lot of data points this week.

But that doesn’t mean there aren’t plenty of obstacles.

Money rotated with a vengeance from technology into small caps…

…while inflation came in hotter than expected.

That’s put a crimp on the treasury run and slammed the breaks on gold.

But the real danger this week comes from the Fed Minutes!

You would think that such a benign thing as recorded history should pass with barely a whisper.

Yet, I’m watching for dissent in the governing body – members who aren’t comfortable with further asset purchases.

And that could spell trouble for the markets.

So when they release their notes on Wednesday, here’s what I want to know.

Fed family feud

It’s no secret that the enormous purchase of debt assets broke the will of conservative investors, forcing them into equities.

Even before the pandemic, it was estimated that 20% of the market’s value was Fed-induced.

And with their record balance sheet actions, I expect the hawks will start to press on the breaks.

Their ‘Main Street’ lending program has been an abysmal failure, leaving non-public companies in the lurch.

It’s split the business community in two, with big bodies rolling in cash while small businesses struggle to survive.

That’s not going unnoticed by politicians.

Several Senate Republicans raised concerns about the massive expansion.

They’re rightfully worried that it’s gone beyond the lender of last resort and distorting price discovery.

Which is making it that much more difficult for Congress to agree on additional stimulus.

And that places them squarely at odds with several Fed presidents like Rosengren who praised lockdowns and expected a prolonged recession without further support.

While the Fed may be able to boost stock prices, they can’t do much to incentivize direct spending.

So far, that’s been a bright spot for the economy.

But that may all change…

When the money runs out

Americans managed to continue spending in large part from the $3 trillion stimulus package.

As that money fades, and evictions become prolific, there’s a real danger in the one area holding up the economy.

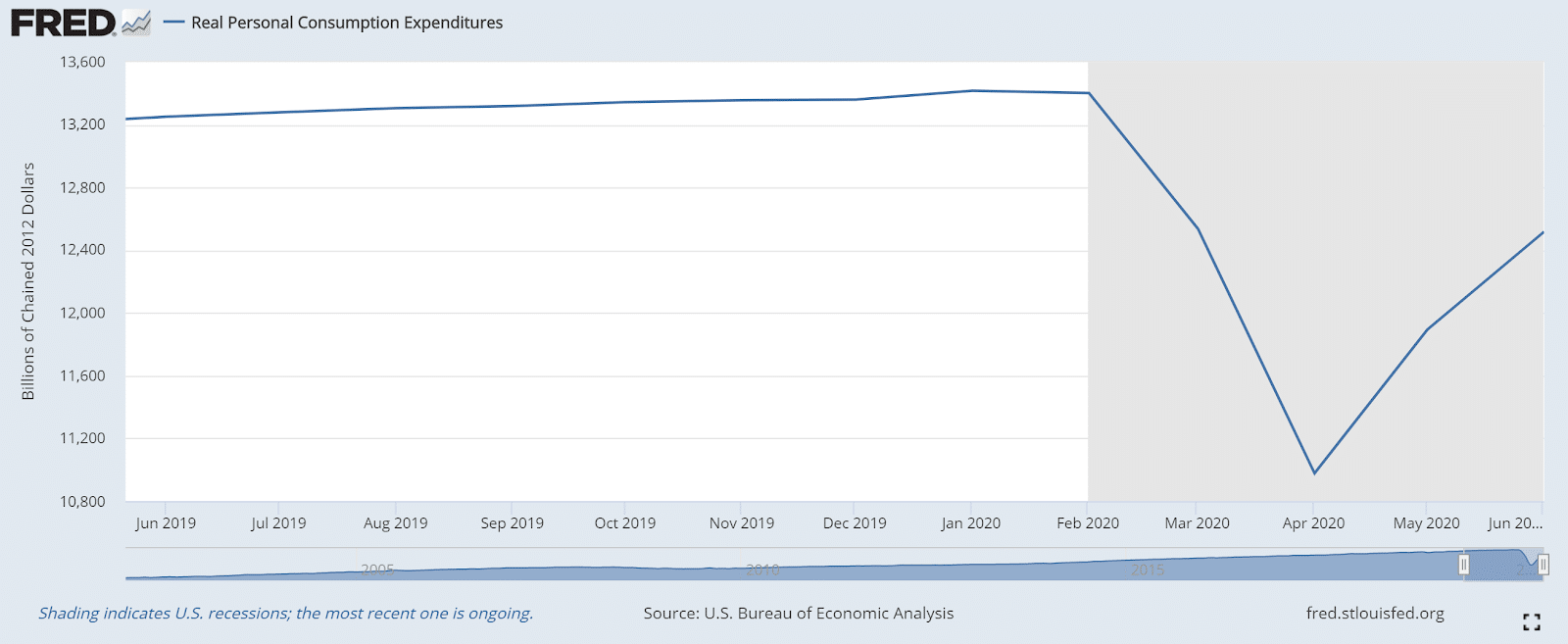

Consumption rapidly bounced back after a sharp decline in April.

However, many of the Fed members worry that once the various moratoriums expire, they’ll be a sharp pullback in spending.

So far, we haven’t seen massive draws on consumer credit, which would be the first sign of future problems.

Yet, with over 10% unemployment, that could turn on a dime, shaking markets out of their bullishness as abruptly as the COVID meltdown.

Especially with complete inaction in Washington.

Can’t we all just get along

It’s not much surprise that the election season brought an immediate halt to the stimulus negotiations.

I think it’s unlikely that sides come together with their entire political fortunes on the line.

That is until they’re forced to by necessity.

In a sign of complete failure, Congress went on recess, without leaders being able to agree on a dollar amount.

A war or words quickly ensued, with each side lobbing barbs at the other.

In an effort to force Democrats’ hand, the President attempted executed several actions that ultimately aren’t likely to help much due to the limits on his legal authority.

It left us in a lurch as primaries close down, the national conventions start up, and the real mudslinging begins.

Watch out below

Markets can shrug off these calamities, but only for so long.

We’ve seen this movie before – politicians arguing, only forced together by a crashing market.

And that’s probably what it will take this time around.

I remember clearly how the daily moves in stocks lived and died by Congressional bailouts.

If that happens again, we need to be ready for it.

That’s why you need to educate yourself

Knowing what can happen is half the battle. But it means nothing if you don’t know how to execute the plan.

Trading is more than just coming up with good ideas.

It’s capitalizing on them.

That’s why I created my free Total Alpha Masterclass to get you started on this path.

Tons of players entered the options market this year with the click of a mouse.

Few had a sustainable advantage.

Give yourself an edge that they didn’t have.

Click here to sign up for my Total Alpha Options Masterclass.

Expected earnings dates listed in (…)

Stocks I want to bet against this week…

SC, DFS, PENN, IWM, SNAP, ROKU, SPOT, WK, EBAY

Stocks I want to buy this week…

MJ (none), DKNG (Aug 21st), PYPL (July 29), OKTA (Aug 26), ZM (Sept 3), TWLO (Aug 4), CVNA (Aug 5), ECL (July 28), CARR (July 30), GDX (none), RNG (Aug 3), NEM (July 30), CLX (Aug 3), VAPO (Aug 3), PTON (Aug 5), SHLL, RH (Sep 8), AVLR (Aug 5), SHOP (July 29), JNJ (Oct 20), MSFT (July 22), TTD (Aug 13), GOOGL (July 30), FSLY (Aug 5), WMT (Aug 18), WORK (Sept 2), TWTR (July 23), AVLR (Aug 5), SQ (Aug 5), JD (Aug 11), NET (Aug 6), ADBE (Sept 25)

This Week’s Calendar

Monday, August 17th

- 8:30 AM EST – Empire Manufacturing August

- Major earnings: Cinedigm Corp Cl A (CIDM).

Tuesday, August 18th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Housing Starts & Building Permits July

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Advance Auto Parts Inc (AAP), Home Depot Inc (HD), Kohl’s Corp (KSS), Wal-Mart Stores (WMT), Agilent Technologies Inc (A), Cree Inc (CREE), Henry(Jack) & Assoc (JKHY).

Wednesday, August 19th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:30 AM EST – Weekly DOE Inventory Data

- 2:00 PM EST – FOMC Meeting Minutes

- Major earnings: Analog Devices (ADI), Lowe’s Cos, Inc (LOW), Target Corp (TGT), TJX Companies (TJX), L Brands, Inc. (LB), Nvidia Corp (NVDA), Synopsys Inc (SNPS).

Thursday, August 20th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Philadelphia Fed Outlook

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: BJ’s Wholesale Club Holdings (BJ), Lauder (Estee) Co (EL), Keysight Tech Inc (KEYS), Ross Stores (ROST).

Friday, August 21st

- 9:45 AM EST – Markit US Manufacturing & Services PMI August

- 10:00 AM EST – Existing Home Sales July

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Deere & Co (DE), Foot Locker (FL).