Have we found a cure? Is the world safe?

Hardly.

But don’t tell markets that. They took positive news of a Coronavirus treatment and jammed prices to their highest levels since early March.

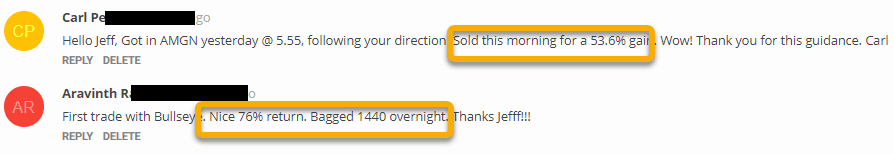

And I certainly knew how to take advantage of my Bullseye Trade of the week in Amgen (AMGN).

Just so happens I picked Gilead a few weeks ago for a sweet profit as well!

Although states began easy restrictions, traders shouldn’t get caught up in the euphoria. We need to look at the data and let analysis guide our decisions.

And my analysis of the markets isn’t quite that rosy.

However, here’s what you need to watch this week for clues on the market direction.

First, a word on treatments

I would be remiss if I didn’t highlight the positive news stemming from Gilead’s (GILD) drug trials. It showed a lot of promise and should see quick greenlighting from the FDA.

However, there are two major facts that keep getting glossed over. First, treatments are not vaccines. They can reduce the duration and severity of symptoms, but they are not cures.

Second, this is still an early trial with limited scope. It tested mainly patients with severe symptoms and there were still some fatalities.

So, while this is great news, it’s not a silver bullet.

Bad news gets less bad

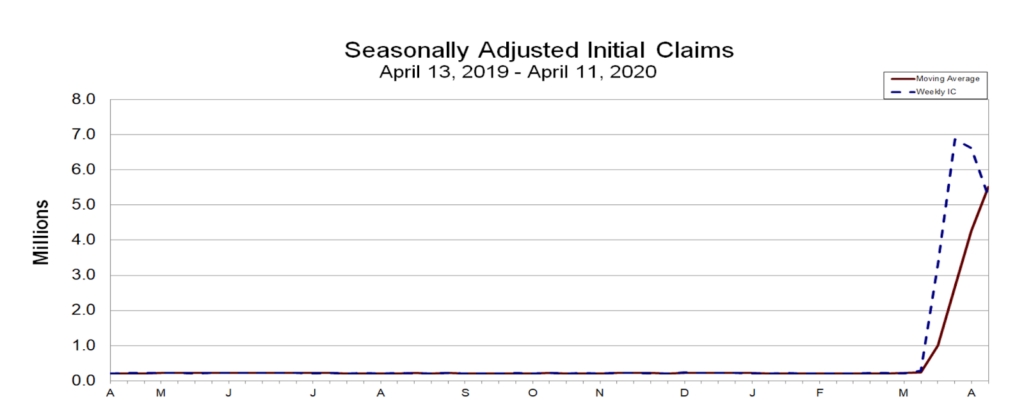

With over 22 million people now unemployed, we’ve lost all the jobs gained since the Great Recession. But, I don’t expect the pace to continue.

Department of Labor Jobless Claims

Thursday we get our weekly jobless claims. Hopefully, we start to see a meaningful reduction in the number of people filing for unemployment. We haven’t heard much about a second wave of furloughs. So, it’s unlikely we see another spike.

However, one major concern is the backlog. Horror stories relate tales of outdated systems taking weeks for people to file. On top of that, Federal money has been slow to reach those in need.

Oh, and the flagship Paycheck Protection Program ran out of money.

Neither of these problems are insurmountable. Yet, further delays mean further damage.

We should see movement early next week on funding the PPP. It’s expected they’ll be other pieces added from negotiations as well. So, hopefully, that clears the deck of one issue.

As far as jobless claims, I expect it to start declining within the next few weeks, especially as some state restrictions get lifted. Where we land as a regular weekly cadence will be the critical factor in all of this.

We’ve also started seeing the number of hospitalizations decline in New York and other hotspots. That’s our first sign that the social distancing measures are working.

Me practicing social distancing Johnny Cash style

As those measures take hold, we move into the next chapter of the story.

Easing The Lockdown

We’ve started to see some areas pull back on restrictions, with Florida visibly opening its beaches partially.

After a whirlwind week of epic whining and claims, we seem to have settled on states being in charge of their own economic restarts.

However, there’s been a real lack of clarity and cooperation from the national and state governments. Each state has its own needs that make a uniform approach unlikely. Yet, the patchwork of supplies and testing keeps the future outlook rather muddy.

The opacity surrounding testing and supplies remains one of the biggest impediments to the market recovery. You can have as many protests as you want around the nation. But, without seniors willing to leave the house as well as people who generally fear the virus, you won’t get a recovery that justifies anywhere close to current prices.

We also don’t know what happens as restrictions are lifted. If we immediately see a spike in cases, that’s going to bring any hope of a return to normalcy crashing down.

Don’t count out the Fed

In all of this, we have to remember one thing – never bet against the Fed. They’ve propped up markets for years and currently have unprecedented amounts of money hitting the market.

While fundamentals may not justify current share prices, the Fed is as much a wildcard now as they have been for the past decade.

This is my opinion of earnings

Most companies stopped delivering guidance, and I couldn’t care less about what happened in the past. So, other than a few nice stories, I’d really only pay attention to any signs of bankruptcy or severe distress.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Mar 4), COST (Mar 5)

Stocks I want to buy…

MJ (none), UNG (none), XLE (none), WDAY (May 26), TWLO (May 3), OLED (May 7), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), CVNA (May 13), CMG (Apr 22), NFLX (April 21), AMZN (Apr 23), UBER (Jun 4), GDX (none), ROKU (May 13), MTCH (May 5), TDOC (May 5), ZS, AYX, RH, WORK, IWM

This Week’s Calendar

Monday, April 20th

- 8:30 AM EST – Chicago Fed National Activity March

- Major Earnings: Ally Finl Inc (ALLY), Halliburton Co (HAL), M&T Bank (MTB), Old Natl Bancorp(Ind) (ONB), Truist Financial Corp (TFC), American Campus Communities (ACC), Crown Hldg (CCK), Equifax Inc (EFX), Equity Lifestyle Properties (ELS), Hexcel Corp (HXL), Intl Business Machines Corp (IBM), Steel Dynamics (STLD), Zions Bancorp (ZION)

Tuesday, April 21st

- 7:45 AM EST – ICSC Weekly Retail Sales

- 10:00 AM EST – Existing Home Sales March

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: CIT Grp Inc (CIT), Comerica Inc (CMA), Dover Corp (DOV), Emerson Electric Co (EMR), First Horizon National Corp (FHN), Fifth Third Bancorp (FITB), Graphic Packaging Hldg Co (GPK), HCA Healthcare Inc (HCA), Coca-Cola Co (KO), Lockheed Martin Corp (LMT), Northern Trust (NTRS), PACCAR Inc (PCAR), Prologis Inc (PLD), Philip Morris Intl Inc (PM), Polyone Corp (POL), Synchrony Finl (SYF), The Travelers Companies Inc (TRV), Webster Financial Corp (WBS), Fulton Finl Corp (FULT), Navient Corp (NAVI), Netflix Inc (NFLX), Snap Inc (SNAP), Teradyne Inc (TER), Texas Instruments (TXN), W R Berkley Corp (WRb)

Wednesday, April 22nd

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Amphenol Corp A (APH), Biogen Inc (BIIB), Baker Hughes a GE Co Cl A (BKR), Delta Airlines Inc (DAL), Quest Diagnostics (DGX), Kimberly-Clark Corp (KMB), NASDAQ Inc (NDAQ), AT&T Inc (T), Thermo Fisher Scientific Inc (TMO), Wolverine World Wide (WWW), Alcoa Corp (AA), Coeur Mining Inc (CDE), CSX Corp (CSX), Discover Finl Svcs (DFS), Fidelity Natl Finl Inc (FNF), First Industrial Rlty Tr (FR), Graco Inc (GGG), Helix Energy Solutions Grp (HLX), Kinder Morgan Inc (KMI), Lam Research (LRCX), Las Vegas Sands Corp (LVS), SLGreen Realty (SLG), SLM Corp (SLM), Sempra Energy (SRE), Seagate Tech (STX), Texas Cap Bancshs (TCBI), Umpqua Hldg (UMPQ), Xilinx Inc (XLNX)

Thursday, April 23rd

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 9:45 AM EST – Markit US Manufacturing & Service PMI April

- 10:00 AM EST – Philly Fed Survey for April

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Alliance Data Systems (ADS), Air Products & Chem Inc (APD), The Blackstone Grp Inc (BX), CMS Energy (CMS), Citrix Systems Inc (CTXS), Domino’s Pizza (DPZ), Entegris Inc (ENTG), East West Bancorp (EWBC), FNB Corp (FL) (FNB), Huntington Bancshs (HBAN), The Hershey Co (HSY), Invesco Ltd (IVZ), Eli Lilly and Co (LLY), Southwest Airlines Co (LUV), Old Dominion Freight Line (ODFL), PulteGrp, Inc (PHM), Patterson-UTI Energy (PTEN), Tractor Supply (TSCO), Union Pacific Corp (UNP), World Wrestling Entr’A’ (WWE), Associated Banc-Corp (ASB), Cap One Finl (COF), CenterState Bank Copr (CSFL), eHealth Inc (EHTH), Empire State Realty Trust Inc (ESRT), E Trade Finl Corporation (ETFC), Edwards Lifesciences Corp (EW), FirstEnergy Corp (FE), Intel Corp (INTC), Limelight Networks Inc (LLNW), Merit Medical Systems (MMSI), Bank OZK (OZK), People’s United Finl Inc (PBCT), SEI Inv (SEIC), TRI Pointe Grp Inc (TPH)

Friday, April 24th

- 8:30 AM EST – Durable Goods Orders March

- 10:00 AM EST – University of Michigan Confidence

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: American Express Co (AXP), First Hawaiin Inc (FHB), Gentex Corp (GNTX), Portland General Electric Co (POR), Synovus Finl Corp (SNV), Verizon Communications (VZ)