There’s enough doom and gloom stories to fill your day— from crashing markets to government lockdowns.

Which is why you got lost in the media horrors this week…

And didn’t see a key data point …one that says that may be turning a corner.

Total Alpha traders look beyond the main headlines for the real scoop.

When the time is right, they swing into action!

Sometimes that means a homemade zip line with your dog and daughter!

So let’s jump into this week with the most important piece of news you missed.

For that, we look 4,500 miles to our East.

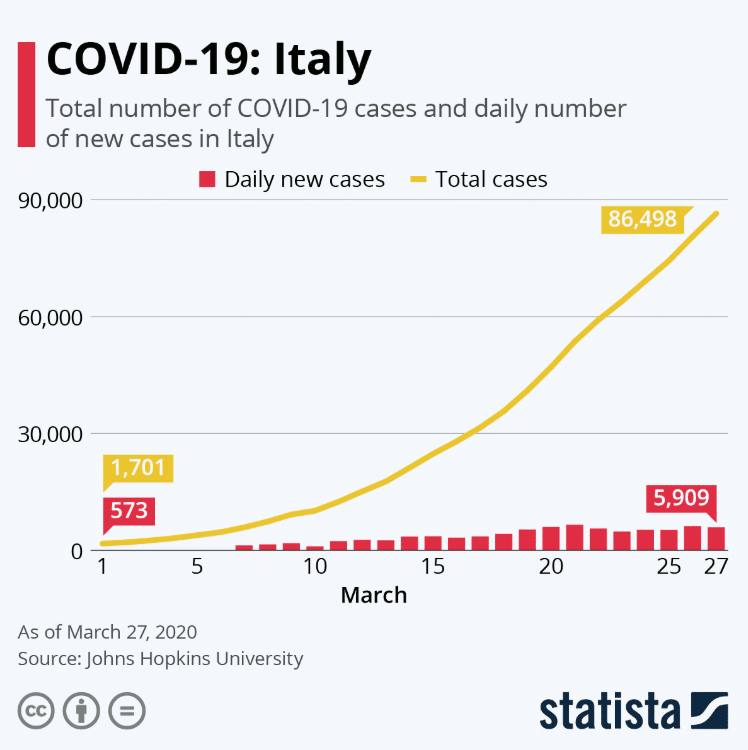

Daily Coronavirus Cases Drop in Italy

Governments around the world began locking down their countries after watching the run on Italy’s hospital system. They feared the casualty counts where nearly 10% of cases resulted in death.

Yet, this week marked a turning point in the fight against COVID-19. For the first time, Italy saw daily new cases meaningfully drop for several days in a row.

This is a major step towards reducing the strain on their healthcare system. We’re already seeing Spain take steps towards isolation in the hopes of avoiding a similar fate.

U.S. officials from Federal to local levels have worked in earnest to provide the necessary equipment and care to the areas that need it most. In New York, where the pandemic has hit hardest, of the 52,000 cases reported, only 728 resulted in deaths, or 1.4%.

Economic activity in the U.S. has slowed. However, there is another key number to focus on – $2.1 trillion.

The Largest Relief Package In History

President Trump signed the largest single relief package in history this week, turning the full force of the U.S. economy against the Coronavirus.

Here’s come key highlights:

- $150 billion will be made available to state and local governments.

- An extra $600 a week for up to for months on top of state unemployment benefits to make up 100 percent of lost wages

- $500 billion in loans to industries from airlines to cruiselines

- $1,200 for singles & $2,400 for couples for incomes up to $75,000 and $150,000 respectively plus $500 per child

- $100 billion for hospitals to cover costs

- $29 billion in grands and $29 billion in loans and guarantees for airlines

- Tax credits for businesses that keep employees on the payroll

The markets were looking for Congress to go big or go home. In this case, Congress went big.

Calamity has a strange way of bringing folks together. For now, there’s a large sense of bipartisanship and national pride that I don’t expect to leave us anytime soon.

What To Watch This Week

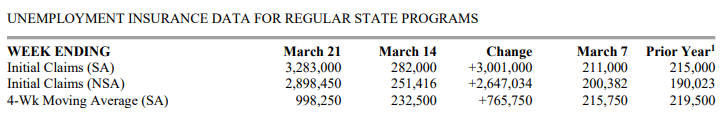

3.21 million….That’s the number of people who filed for unemployment last week in the largest number ever reported since they started in 1967.

Even during the depths of the Great Recession we never reached 1 million.

Initial Jobless Claims From The Department of Labor

Every Thursday at 8:30 a.m. from here on out, you should be watching the jobs numbers. At some point this should slow down if it hasn’t already. The key datapoint behind this will be continuing claims. That will tell us when folks head back to work.

Plus, this week we get the March jobs report on Friday!

In the meantime, pay attention to the lifecycles of the stocks out there. Not all of them are moving in sync. Each stock goes through distinct phases that has its own unique characteristics.

Find out how to identify and apply them in my upcoming masterclass. Get a front row seat to a first class education.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Mar 4), COST (Mar 5)

Stocks I want to buy…

MJ (none), UNG (none), XLE (none), WDAY (May 26), TWLO (M ay 3), OLED (May 7), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), CVNA (May 13), CMG (Apr 22), NFLX (April 21), AMZN (Apr 23), UBER (Jun 4), GDX (none), ROKU (May 13), MTCH (May 5), TDOC (May 5), ZS, AYX, RH, WORK, IWM

This Week’s Calendar

Monday, March 30th

- 10:30 AM EST – Dallas Fed Manufacturing March

- Major Earnings: Cal-Maine (CALM)

Tuesday, March 31st

- 7:45 AM EST – ICSC Weekly Retail Sales

- 9:45 AM EST – Chicago PMI for March

- 10:00 AM EST – Consumer Confidence for March

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: ProPetro Hldg Corp (PUMP), Conagra Brands Inc (CAG), Mccormick & Co (MKC)

Wednesday, April 1st

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:15 AM EST – ADP Employment Change for March

- 9:45 AM EST – Markit US Manufacturing March

- 10:00 AM EST – ISM Manufacturing March

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Lamb Weston Hldgs Inc (LW), PVH Corp. (PVH)

Thursday, April 2nd

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing Activity March

- Major earnings: CarMax, Inc (KMX), Walgreen Boots Alliance Inc (WBA), Chewy Inc (CHWY)

Friday, April 3rd

- 8:30 AM EST – March Jobs Report

- 9:45 AM EST – Markit US Service PMI & US Composite PMI March

- 10:00 AM EST – ISM Non-Mnaufacturing March

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Constellation Brands ‘A’ (STZ)