I won’t mince words. Yesterday was a bloodbath that wiped out a lot of market cap and probably blew up a few funds along the way.

With over two decades of trading, I want to give you insight as to what I’m doing now. Hopefully, you take away valuable information that helps strengthen your hand.

Let me throw you some of the highlights:

- Oil dropped over 30% at one point

- Bond futures had one of their largest two day runs ever!

- Stock futures were halted overnight

- Upon the open stocks were halted for 15 minutes

No one escaped the carnage, not even me. My first move was to cut my risk down immediately – although it took awhile for my options to price.

That’s why right now, I want to do the following: Define my risk. cut excess risk early, selectively sell premium, set smaller position sizes, and keep a balanced portfolio.

1) Define Risk

These last few weeks remind me of why I prefer trading options. Options help me define my risk, letting me set the maximum losses in many cases.

Yes, days like yesterday can wipe them all out. But, I’ll live to fight another day and have some firepower. If I had held stock, that might not have been the case.

Plenty of people talk about how ‘risky’ options are. That can certainly be true. They’re leveraged products that move around a lot. However, that isn’t the way I trade.

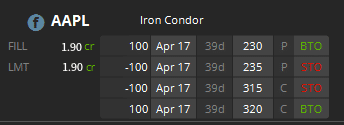

I like to use defined risk strategies like Iron Condors, Credit Spreads, and limit long calls and puts to limit exactly how much I can lose. When I buy options, I pay a premium for this right. I use these strategies extensively in my Total Alpha portfolio exactly because I want to be around another day.

This is a good example of an Iron Condor I put on today in Total Alpha

Trading is about making a lot of small trades often. Some trades don’t work out. That’s ok. I want to make sure that no one of them obliterates my account. Instead, I play the long-game, letting the averages work out over time.

2) Cut Excess Risk Early

In my years of trading, when I want to take a loss, I do it early. The longer I wait, the more I lose. That’s why I spent a lot of time today cutting off positions that were likely going to never make me money.

My focus was to mitigate my losses. Especially with selling option credit spreads, taking your lumps early prevents you from taking a maximum loss on the trade. Of course, the markets can swing bag the other direction, and we’ll certainly see big rallies. But we could also see a few more drops before that happens.

I start by viewing my entire portfolio, then assessing which trades hold the most risk. This can mean cutting trades that are just too large for my taste. It’s not worth it to wallow in what could have been. Once I make the decisions, I stick with it and wipe the slate clean.

3) Selectively Sell Premium

There is a lot of illiquidity in the options market today. Spreads are extremely wide and favor the market makers.

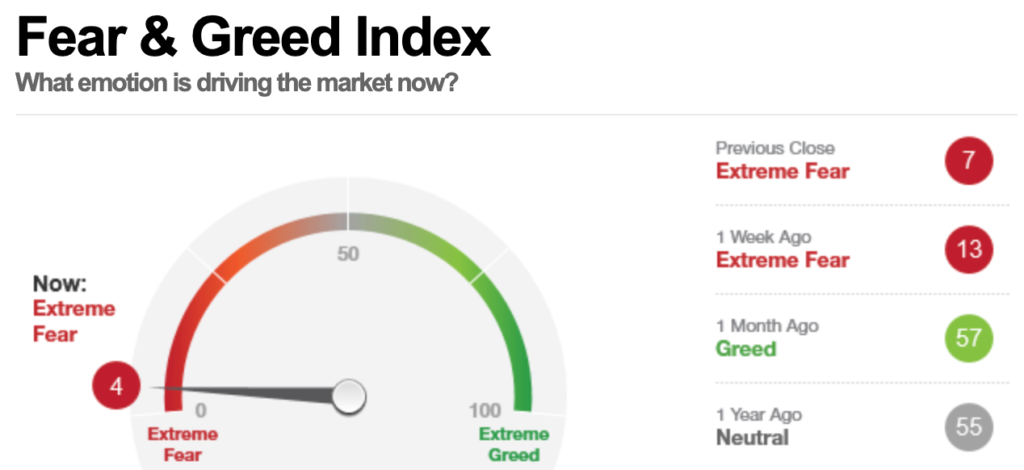

I don’t plan to take many trades, but I see today as a wonderful opportunity to sell some volatility.

There is too much fear and pessimism at the moment.

Looking across the sectors, I want to find trades with high probabilities of success that rely more on volatility contraction rather than the directional premise. Volatility will contract at some point. I have much better odds betting on that than guessing where the stock might go.

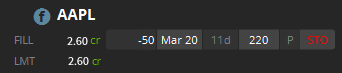

An excellent example of one I took today in my Total Alpha portfolio was in Apple. The stock showed a lot more strength than the regular market. With Implied Volatility so high, I decided to sell a cash covered put against this stock.

This is an amazing credit for this stock and expiration!

4) Set Smaller Positions

Volatile markets don’t require a lot of capital to make good money. When the Dow swings around thousands of points daily, I don’t need massive position sizes. Instead, I’d rather let the increased volatility work in my favor.

Part of trading is knowing when you have an edge. Right now, my edge is selling premium. It either pays more for similar trades a month ago, or I get an increased win-rate.

5) Keep A Balanced Portfolio

With implied volatility so rich, selling premium means I can play both sides of the market. This is what’s known as ‘Delta Neutral.’ Iron condors are delta neutral plays because you sell a put credit spread and a call credit spread. These positions offset one another.

There are a few ways to keep a balanced portfolio. The first is to create neutral trades like an iron condor. You then manage the delta by adding or subtracting other positions around it as needed.

Second, you can use positions in other stocks to balance out the delta. That means using a put credit spread in a stock like Google to offset a call credit spread in a stock like Facebook.

Lastly, you can hedge your positions. This involves things like covered calls or buying stock or futures to offset your option positions.

Work With Someone Who’s Been There Before

This isn’t my first rodeo and hopefully, not my last. I know it can be intimidating out there. That’s precisely why I created Total Alpha. This service educates you and lets you see exactly how I’m trading this market through a live stream of my portfolio.