Buy the rumor… Sell the news.

Believe it or not, this cheesy old saying has helped me on more than one occasion.

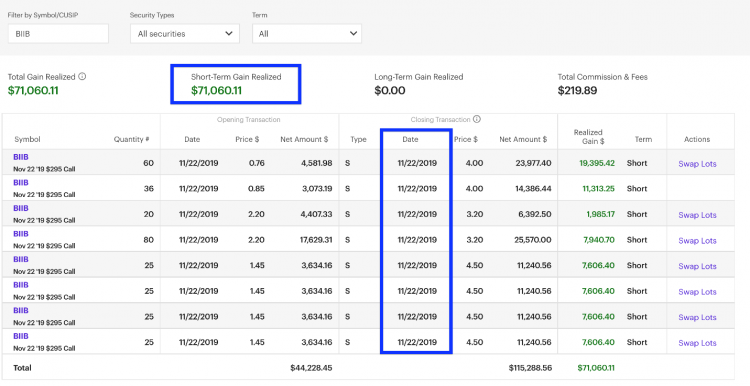

Heck, my massive payday in BIIB options the other day, was based on this very concept.

That’s $71,000 on one trade in my Total Alpha portfolio!

However, not all news catalysts are the same.

Ever get in a stock because you thought the news was super bullish (or bearish) but it turned out that it was a non-event and the stock ended up doing nothing.

It happens all the time.

There is actually a right and a wrong way to trade catalysts. And I’m going to teach you what they are, right here.

Selling premium into known events

We can’t know every possible event out there. But, there are quite a few you know well in advance. The easiest one… earnings.

Earnings announcements can move stocks aggressively or not at all. You really don’t know what will happen exactly. However, there is one thing you can count on.

Option premiums rise into earnings without fail (well most of the time). The closer you get to earnings, the higher the implied volatility of a stock climbs. This is because of traders price in the uncertainty around the earnings announcement. Once they see earnings, the implied volatility drops.

So why does that matter? Well, implied volatility determines the price of an option contract. High implied volatility means expensive option prices. Low implied volatility means cheap option prices.

Now that we know how implied volatility increases into earnings and immediately decreases afterward… plus what that means for option prices…let’s look at the best strategy.

My favorite thing to do is to sell credit spreads into earnings. These pay more when implied volatility is high. Once implied volatility collapses after earnings, I close the trade and take my profits.

The trick is to look at the historical move of a stock after earnings and compare it to the implied volatility. If a stock historically moves 5% after earnings, but implied volatility prices in a 6% move, you have a 1% advantage.

If you want to learn more about earnings strategies check out Kyle Dennis’ free article How to Trade an Earnings Event Using Options.

Trade options on probable catalysts

Kyle Dennis is probably the best trader I know to play biotech stocks. He scours the potential catalysts for drug trials and approvals as part of his Raptor 5 trading method.

He isn’t some medical doctor from Harvard, just a young trader who found the best ways to make money off these events. And it’s actually pretty straightforward.

Kyle learned that drugs and treatments come in phases and approvals. He combines chart analysis with possible catalysts for the company to create trading plans that he passes along to Raptor 5 members.

Just the other day, he rocked a trade for a $10,000 profit.

Product launches for tech companies work just as well. The new iPhone always creates a lot of buzz, whether it crashes or not. Elon Musk’s latest Tesla model always makes the news.

Trade the aftermath

I admit that I love to trade stocks. It’s a passion and a lifestyle. There’s a lot of great ways to trade the Fed announcement coming up this Wednesday. I always find tons of places to make a quick trade right after the decision.

But you don’t have to wait for a big known event. Unknown events that cross the wire also offer great setups. That’s how I made a trade in BIIB for $71,000.

The Friday before Thanksgiving, volume was down, and the market was quiet. So, it made the pop in BIIB trading especially noticeable.

BIIB 5-minute chart

I scaled into the trade as it retraced the big move. That’s what enabled me to average down my entry cost on my call options. It’s really similar to price action you find after Fed announcements.

Choose the method that works with you

The best piece of advice I can give you – pick the strategy that works with your personal needs and goals. Don’t try to execute day trades when you work full-time. Whatever you risk should allow you to sleep at night.

If you like probabilities, go with selling option spreads against earnings. There’s tons of ways to work events.

You can learn techniques just like these in Total Alpha. Techniques that let you find the next $71,000 winner.