2020 created amazing opportunities for traders and investors, flooding the market with new players.

Some of these players have been dumping their hard-earned cash into bankrupt companies, not knowing they could potentially lose it all.

Heck, some analysts have their heads stuck in the sand, thinking that a vaccine will cure sick businesses.

They don’t have skin in the game and realize how broken they were before the pandemic.

No matter what American Airlines does, they can’t prevent this outcome.

And if you think that high fliers like NIO (NIO) aren’t due for a huge pullback, think again.

Just because something is cheap or on a bull run doesn’t mean it’s a good investment.

Ignore the risks, and you could be staring down the goose egg in your trading account.

You can avoid this with some simple due diligence that I’ll help you with today.

Let me explain how I measure risk and what it looks like.

Then I’ll walk you through several examples and what to look out for.

Bankrupt or just really close

Companies don’t need to declare bankruptcy to crash and burn.

Just look at Luckin Coffee (LK). A good ‘ol fashioned accounting scandal is more than enough to send a stock into a tailspin.

In fact, exchanges can delist shares of a company for a variety of reasons that have nothing to do with bankruptcy.

This risk runs higher for foreign companies listed on U.S. exchanges (especially ones where governments aren’t allies like China).

Outside of that, bankruptcy comes in two forms: Chapter 7 and 11.

Chapter 7 is less common. That’s the kind where you walk by the old office and find one of these going on.

Chapter 11 allows a company to reorganize and restructure its debt.

In both cases, you get the short end of the stick as the stockholder.

So it’s important to evaluate whether a company is likely to run into issues.

During the pandemic, we saw Hertz (HTZ) go bankrupt quickly.

They didn’t have enough cash on-hand to survive, and any lengthy shutdown in operations pushed them over the cliff.

That’s been a growing concern as the Fed makes debt super cheap. It props up companies that shouldn’t be in business. They are barely afloat, and one event away from bankruptcy.

I look for companies with low cash on hand with high levels of debt as big risks. Businesses with more cyclical performance, like consumer discretionary items, are at the highest risk.

A great measurement to use is called the Altman Z-score. It measures the credit strength of a company and does a pretty good job of highlighting risk.

What you need to know are scores that fall below 1.8 indicate a high likelihood of bankruptcy while above 3.0 is unlikely.

The other metric that I find useful is the Piotroski F-score.

It measures the fundamental health of a company, and can even point to solid investments that span decades. It ranges from 0-9, with 0 being OMG the company is a disaster to 9 being a stable business.

When I select stocks for my Portfolio Accelerator, I go with a mix of high-quality balance sheets and fundamentals along with some that carry more risk.

However, I never go near ones that I worry might not exist in the future.

Speaking of which – let’s look at some of those corporations we’ll be saying so long to in 2021.

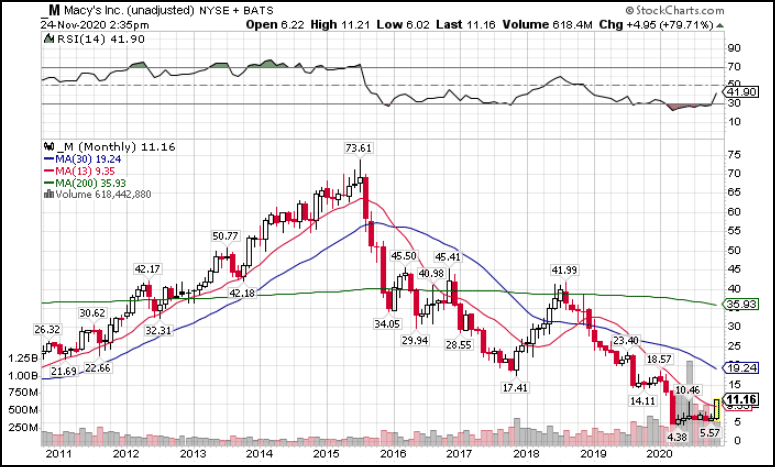

Macy’s (M) – Piotroski F-Score = 2, Altman Z-Score = 0.42

Imagine mortgaging your house to pay your credit cards.

That’s essentially what Macy’s is looking to do.

While the company managed to become cash-flow positive last quarter, they’re not doing well by any stretch.

Competitors like Neiman Marcus already filed for bankruptcy.

Macy’s hasn’t been relevant for years, and the pandemic only made it worse.

Just look at the long-term chart and you’ll see what I mean.

M Monthly Chart

If they survive, I don’t see them growing anytime soon.

The stock is dead-weight and not one I even want to trade.

3D Systems Corp (DDD) – Piotroski F-Score = 2, Altman Z-Score = 0.69

The way 3D printing blew up years ago, you would have thought everyone would have one.

Turns out that was a fad too good to be true.

While 3D printing technology still holds promise, you can’t run a company like garbage and expect to survive.

Here’s the funny part – the company boasts a 40% gross margin.

That means they lose money on their sales, general, and administrative expenses – one area you should be able to control.

Yet their growth stagnated and debt increased the last few years…before the pandemic.

It highlights a failing business that has a rough road ahead of it.

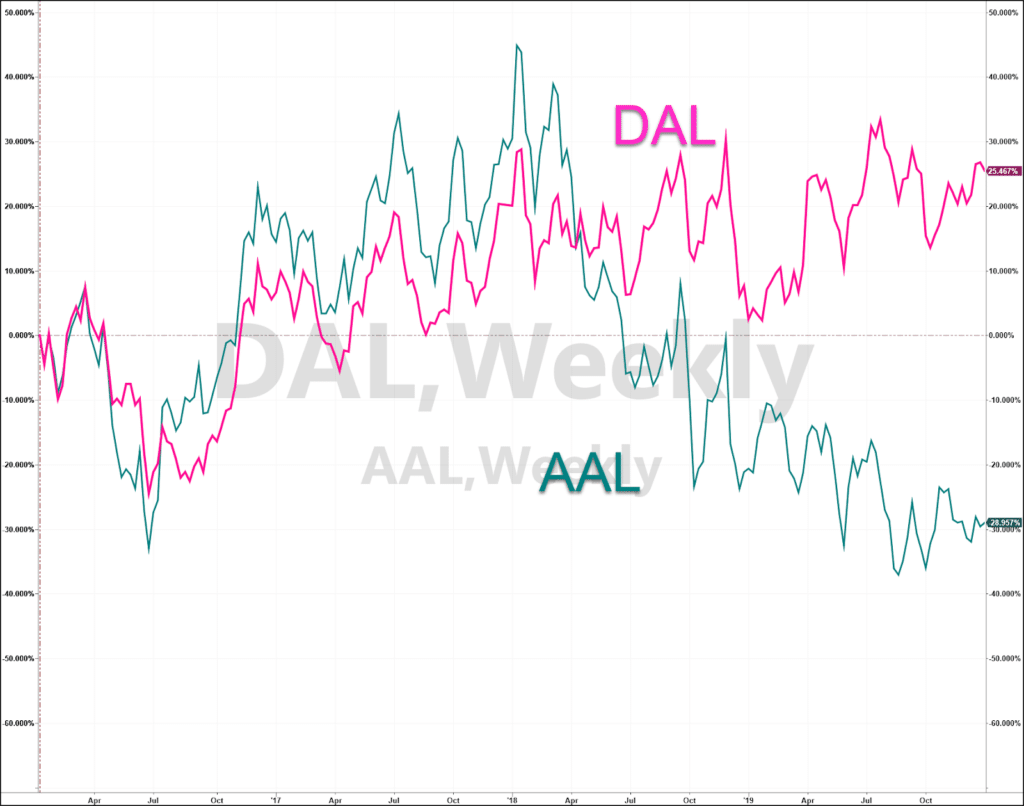

American Airlines (AAL) – Piotroski F-Score = 2, Altman Z-Score = -0.08

Let me give you a little comparison here.

Delta Airlines (DAL) has an F-Score of 3 and a Z-Score of 0.07.

Hawaiian Airlines (HA) has an F-Score of 3 and a Z-Score of 0.05.

So, why am I picking on American Airlines?

Well, because they were terrible before the pandemic.

Are you seeing a theme here? If your business sucked before COVID, it didn’t magically get better!

American Airlines hasn’t generated free cash flow since 2016 – an entire presidential cycle ago.

Delta Airlines managed to do that last year.

You can see the relative outperformance from 2016 through the end of 2019.

Delta Airlines (DAL – Pink) vs American Airlines (AAL – Green) 2016-2019

Unlike the other two companies listed above, I think American Airlines could get bought out by a competitor. However, don’t expect that to happen anytime soon.

They’ll wait until there’s blood in the water.

Stocks set to soar in 2021

I know that fundamentals have been out the window for some time in 2020.

But using a combination of F Score and Z Score is one of the purest ways to discover what is a sound business and what is a pile of junk on the verge of implosion.

I’m always looking for those sound businesses that are on the verge of the next megatrend.

And I can screen out all of the junk in the market. We’re going to get a pullback. But my system aims to limit risk, eliminates thousands of worthless companies, and focuses on the

More importantly, I want to squeeze every penny I can out of any stock I purchase.

I don’t just want to beat the market. I want to CRUSH IT.

That’s where my Portfolio Accelerator comes in.

With this exclusive service, I don’t just invest in companies. I also use simple options strategies to ENHANCE my returns. In the last week alone, I’ve closed out gains of 82.5%, 100%, 80%, 100%, and 78%… just selling simple options on the stocks I want to own.

I don’t just buy stocks with Portfolio Accelerator. I get paid by other investors to wait for the stock to fall to the price I want to pay for it. It’s that simple.

Stop buying useless penny stocks or speculating on broken companies.

Join my Portfolio Accelerator and get in on the REAL ACTION in the market.