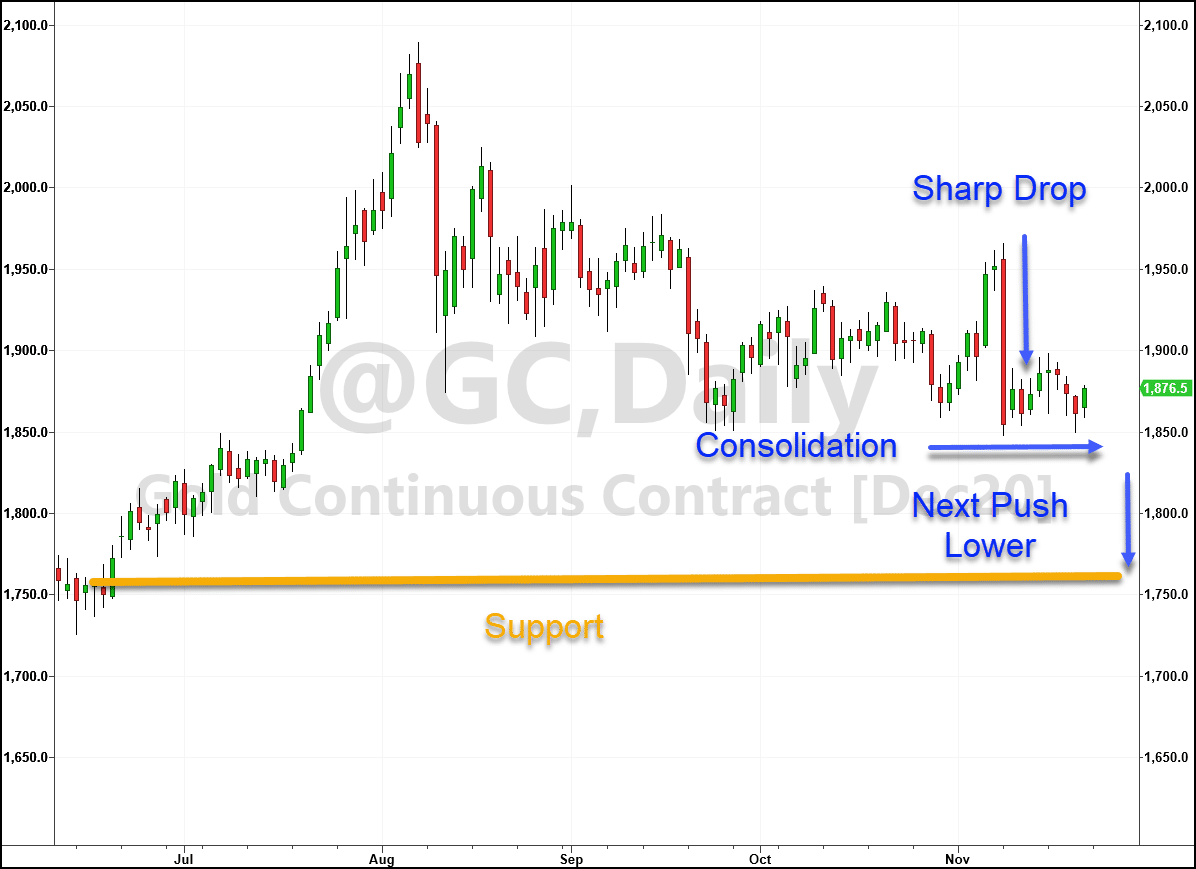

Short-term, gold is heading lower.

Take a look at the bearish chart pattern and you’ll see what I mean.

Gold Futures Daily Chart

But despite that…it could very well be 2021s BUY of the year.

Why?

Because we’re about to see MASSIVE INFLATION!

And for the savvy investor, there’s a mint to be made.

You see, markets price gold in U.S. dollars.

So when the dollar gets cheaper, gold prices head higher.

That means gold miners in the GDX and GDXJ stand to make a killing.

But it could be a disaster for stocks.

And I’m about to explain to you why, and how you can potentially profit from it.

Inflation nation

Most of us never think much about inflation. In the last two decades, it held near zero.

Yes, there has been some things that increased in price.

But overall, we haven’t seen it as we did in years past.

Which was surprising given how low unemployment got.

Classic economic theory said that low unemployment increased demand for goods and services.

That lead to prices increasing – hence inflation.

Yet, technology kept that in check.

So what’s different now?

Pandemic fatigue.

Despite lockdowns, unemployment improved much faster than most economists expected.

And there is a ton of pent up demand that is set to explode on the market in 2021.

Something supply cannot keep up with.

At the beginning of the pandemic, there was a real fear that the Fed couldn’t do anything since the problem was a lack of supply, not demand.

Global supply chains recovered some.

But there is still an exorbitant overhang from the pandemic.

Here’s the simple way to think about it.

Everything we buy has to be made, grown, or produced somewhere.

There is a limit to that output for a given period of time.

When demand exceeds supply, prices rise.

Ask yourself an easy question – once you get vaccinated, what’s the first thing you plan to do?

For most of us, that’s travel, eat out, and party our asses off.

But remember, airlines took tons of capacity offline.

And they weren’t the only ones.

Chances are, there will be many products where demand far outstrips supply for months if not years.

And thus we have inflation.

But don’t take my word for it.

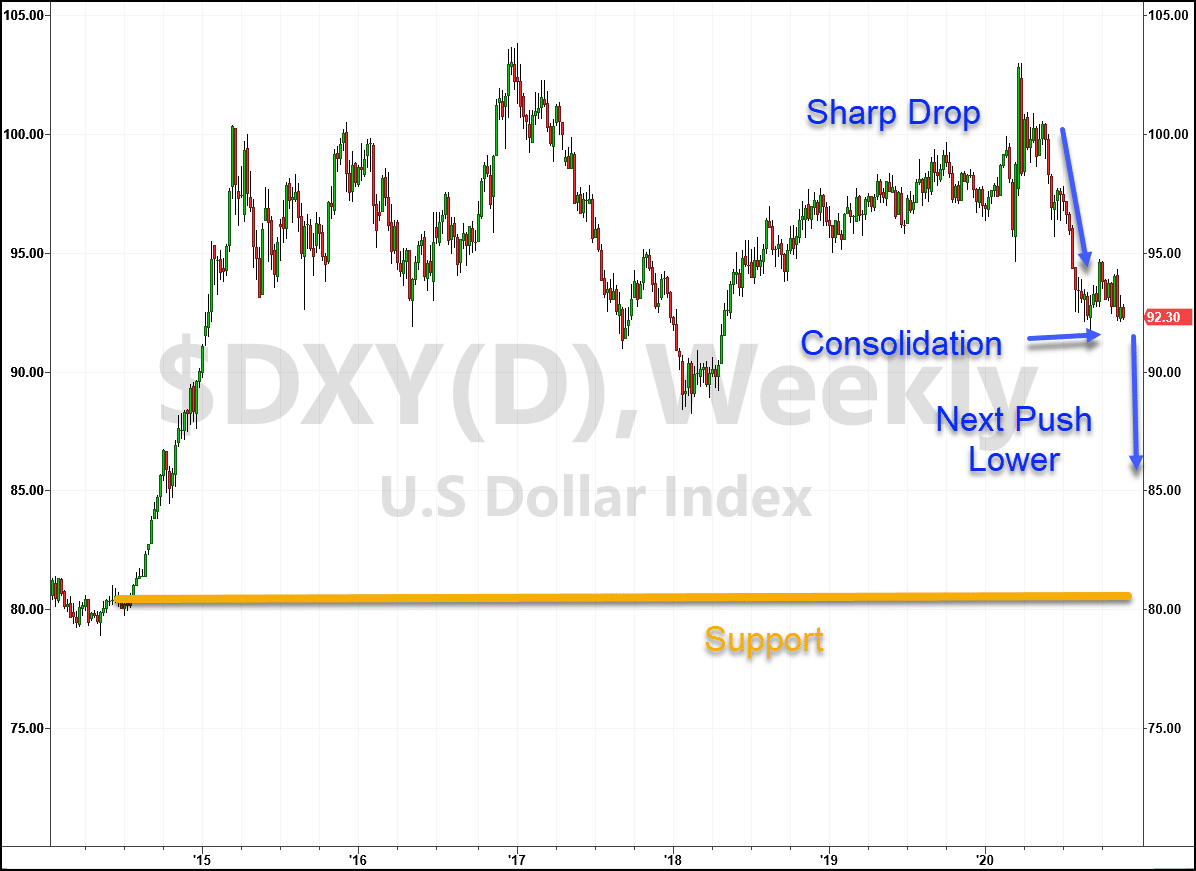

Look at the charts.

Diving for dollars

U.S. dollars might have been the trendy trade last year. But, they’re about to collapse another 5%-10% against a basket of currencies.

Take a look at the U.S. dollar index weekly chart.

US Dollar Index Weekly Chart

How is it possible that the dollar and gold charts look similar if they’re supposed to head in opposite directions?

First, this is a weekly chart. The gold chart was daily. Gold can trade lower and find support long before the dollar breaks lower.

Second, gold is subject to supply and demand like anything else. A big portion of demand comes from Asia, which slowed down with the pandemic. That won’t restart until 2021.

Right now the dollar index is trading around $92. The next stop is $90. But after that, I think we could see it trade as low as $80 – prices we haven’t seen since the Great Recession.

The trade to get paid

Now, that’s not all bad. There are a ton of great investment opportunities that come with higher inflation.

For starters, small-caps tend to do extraordinarily well. These began showing life in the last month, and have been a key focus of my Portfolio Accelerator.

Multinational exporters like Deere (DE), Caterpillar (CAT), and industrial reflation trades do quite well.

That doesn’t mean tech stocks get clobbered.

Rather, it lays out more opportunities for us to trade and invest.

Turning into trades

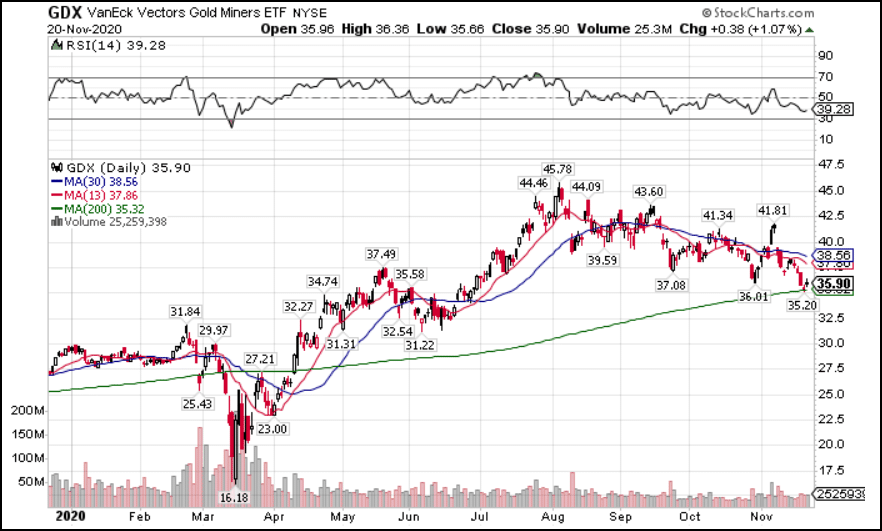

My favorite way to trade gold is through the gold miners ETF the GDX.

I’m not involved enough to pick individual companies, so this ETF works great for me.

It contains most of the major gold miners who benefit from higher gold prices.

The best part – it tends to outperform the GLD ETF when gold is on the move.

GDX Daily Chart

Check out how the GDX more than doubled off the March lows.

To be fair, it also tends to fall faster than gold as well.

That’s why I like to use cash covered puts when I get into these trades.

It’s one of my favorite option investment strategies that enhances my returns.

And it’s why you need to check out my Portfolio Accelerator before this trade takes off without you.

Click here to access my Portfolio Accelerator.