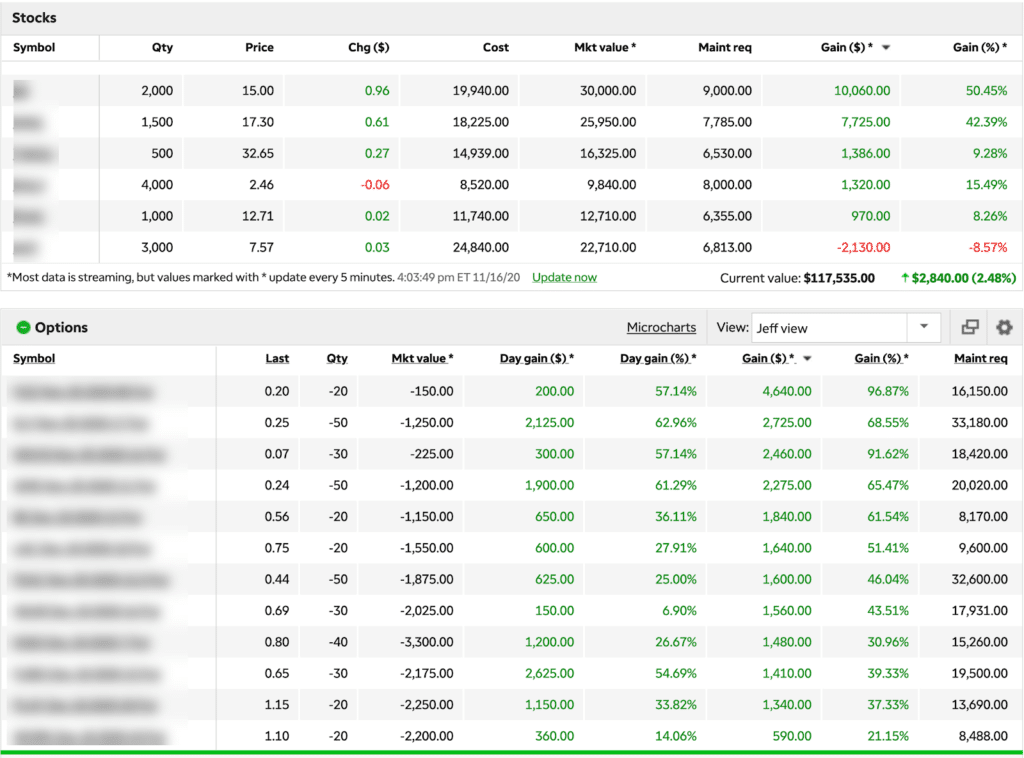

My last set of trades in my Portfolio Accelerator went 12 for 12 using one strategy…*

Cash Covered Puts

Now, you’re probably wondering, “Jeff, what the heck is that? What happened to good ol’ fashioned buy and hold?”

Before you think this is too complicated and it doesn’t suit your style, let me explain why that thinking can cost you money.

A great way for my Portfolio Accelerator to close out the month*

A great way for my Portfolio Accelerator to close out the month*

*See disclaimer below

If this is such a great strategy, why doesn’t everyone use it?

Quite honestly, many folks don’t understand it.

Some don’t realize it’s available in eligible retirement accounts.

And there are some traders that lack patience who just want to make a quick buck.

That’s pretty crazy considering that this strategy PAYS TRADERS TO WAIT!

Sure, I could place a limit order and hope it gets filled.

But I prefer to collect some cash for tying up my money.

Here’s how it works.

Cash Covered Pays You To Wait

When you sell a put option, you get paid a credit that you keep NO MATTER WHAT (unless you close the trade early).

Each put option has a specific strike price and expiration date associated with it.

That price is like your limit-order.

If the stock falls below that price by expiration, you purchase (are assigned) 100 shares of stock for each put you sold. That purchase price is the strike price, even if the stock is below that.

But you ALSO keep that original credit.

You see where I’m going here?

You can get paid to buy a stock you already want to make an investment.

And that’s why I call it an ‘Accelerator.’

Let me take you through some examples so you can see the mechanics and understand all the risks.

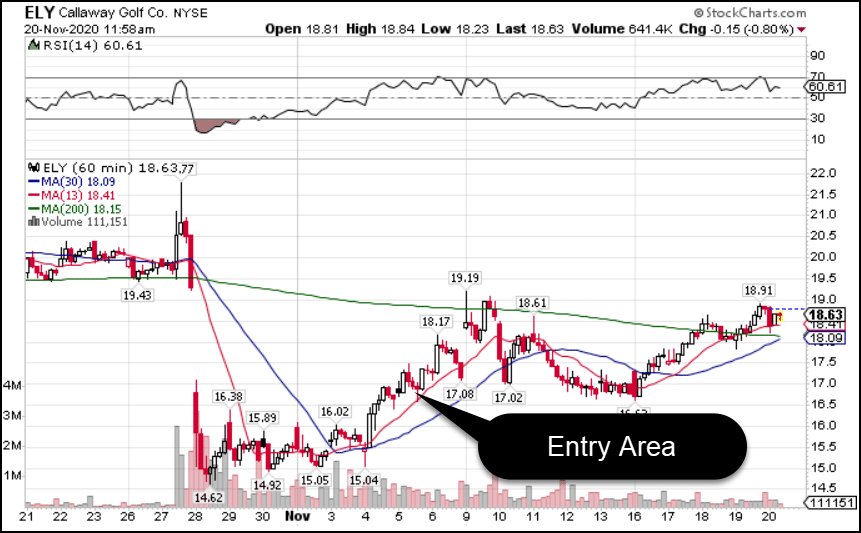

Calloway Golf – $3,300 profit (see disclaimer below)

I’m not a golfer.

The last time I went to a driving range….

I’m no longer allowed back

However, those guys know how to spend a lot of money on their equipment.

During the pandemic, one of the first things to open were golf courses.

It was one of the few activities with low COVID risk that many states allowed.

So, it’s no surprise that I found this quality name brand stock appealing.

The stock pulled back hard in late October, which set up the perfect opportunity to initiate the trade.

With this technical setup on a stock that I liked, I sold at-the-money options on November 7th:

Sold to open (STO) ELY NOV 20 2020, $17 puts for $0.80.

Here’s how the trade worked

- I sold the contract above and received $80 per contract ($0.80 x 100 shares per contract).

- I set aside enough money to purchase 100 shares of stock at $17 ($1700 per contract)

- I keep that $80 unless I close out the trade

- So, if the stock is below $17 at expiration, I get assigned (purchase) 100 shares of stock per contract

Look, I could have set a limit order for 100 shares of stock at $17. But this way, I got paid while I waited.

As you can see in the chart, as the stock climbed far enough, I decided to close out the trade.

So, I bought back those same put options for $0.14, closing out the trade earlier.

That meant I made a profit of $0.80 – $0.14 = $0.66 x 100 shares = $66 per contract.

And I did it in eight days.

Think of it like an investment.

I made $66 on $1700, or 3.88%.

Annualized, that’s 177% return!

Ok, so what’s the downside?

There’s always a catch isn’t there?

Remember, I only got paid $0.80 per contract with a $17 strike.

If the stock moved about $17.80…anything above that price is profit I miss out on.

Another downside – you tie up money.

The farther out-of-the-money you go, the less you get paid (but the higher your chances of success).

And keep in mind, you run the same risks of owning a stock that plummets.

If ELY dropped to $2 overnight, I’d be down $15 x 100 shares per contract. That $80 I received wouldn’t make me feel a whole lot better at that point.

But on the whole, this strategy offers me a way to sell options which, when properly executed, gives me a higher statistical chance of turning a profit.

Learn the right way

Practicing on your own doesn’t make sense.

Why struggle when you can leverage my years of experience?

Join my Portfolio Accelerator today and start taking advantage of these opportunities before they pass you by.

I will guide you through my thought process and teach you how to put together these trades.