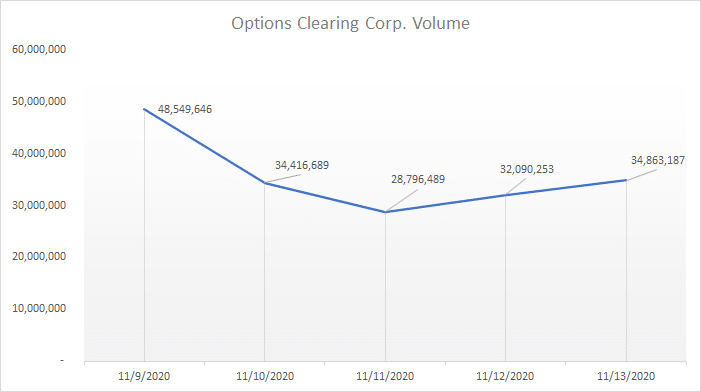

In 2020, the average daily option contract volume is ~29M.

November’s average so far is 33.17M.

Last Monday, when the vaccine news hit the wire, 48.5M contracts traded.

To be fair, that’s a whisker under the all-time high of 48.96M.

Options Clearing Corp. Contract Volume

Oh, and I almost forgot…THIS WEEK IS OPTIONS EXPIRATION WEEK!

That’s why I’m excited to show you my trading plan for this week.

The market volatility is creating so many opportunities, picking just one stock for my Bullseye Trade of the week is gonna be tough (but if you don’t click here you’ll never know).

And things get jump started first thing on Monday with the one and only…Fed speak.

A silent Fed is the best Fed

There’s no denying that Fed speakers have an innate ability to tank the markets.

Sure, you can blame the midweek decline on something other than Jerome Powell.

But, his ability to send stocks into a tailspin is so predictable, I used it to take a quick trade with some SPY put options for a quick $4,900* profit in Total Alpha.

Monday we get the Fed’s Clarida speaking at 2 pm EST.

That gives markets a little reprieve to rally for at least half the day, continuing their trend from the end of last week.

But by Wednesday, we get slammed with Fed speakers fast and furious, setting us up for a doozy Thursday and Friday.

You may not know this, but statistically speaking, Thursdays and Fridays of options expiration week are horrible trading days for the bulls.

How bad you ask?

Let me throw you some stats.

If you bought the following ETFs and at the open on Friday and sold them at the close, here’s how you would have performed in the last 20 years.

- QQQ: Won 42.49% of your trades and lost nearly twice what you gained

- SPY: Won 45.06% of your trades and lost slightly less than twice your gains

- IWM: Won 48.50% of your trades and lost, but come closer to breakeven

For reference, the major indexes win about 53%-54% on an average day.

Statistically speaking, Friday’s of options expiration weeks are losers.

Throw in some Fed speakers, and you’ve got yourself a potential bear mauling.

I do want to point out that Thursday of OPEX is fairly normal. It’s just that whatever happens after the close Thursday through Friday’s close is when things get nasty.

And with the huge amount of trading volume in options, things could get a bit dicey.

Increased options = increased volatility?

Back in March, when markets plummeted, traders bought more and more put options to bet against ETFs and stocks.

This created a feedback loop.

You see, a trader buys a put contract from a market maker. That market maker then sells the stock to hedge the contract they just sold.

Normally, that doesn’t do much.

However, when markets are trending hard, it forces the market maker to sell more and more shares, sending price lower, forcing them to sell more shares, etc, etc.

Right now, markets are caught in a trading range, so market makers and option sellers are making a killing.

All those out-of-the-money options traders keep buying are expiring worthless.

Eventually, the market will break out, higher or lower.

Once it does, we will see a self-fulfilling prophecy as I described earlier, simply because there are so many open options contracts out there.

I take advantage of this by becoming the option seller

Right now, my favorite trades are credit spreads.

These are defined risk trades that let me become the option seller and take advantage of this range-based price action.

In fact, it’s the most common strategy that I teach to Total Alpha members and one that I recommend you learn.

That’s why I created this training video that you need to watch right now.

Otherwise, you’re missing out on one of the best strategies for the current market.

Click here to discover credit spreads

Stocks I’m watching this week

GOOS, RNG, COST, ZEN, CRSP, NVDA, YETI, SPOT, DPZ, ADBE, EXPE, FB, MSFT, ECL, FSLY, SHOP, TAN, SPCE, RTX, PETS, IWM, RUN, TWTR, MTCH, TDOC, TSCO, ESTC, OSTK, GSX, CHWY, RKT, LULU, ZS, WKHS, SNOW, WMT, DG, FIVE, NDAQ, XOP, CHTR, MJ, CGC, DOCU, NFLX, LVGO, IAC, BNTX, ENPH, PTON, ROKU, LMND, BNTX, ENPH, ADBE, SHOP, ETSY, NOW, DOCU, JKS, AVLR, XPEV, GSX

This Week’s Calendar

Monday, November 16th

- 8:30 AM EST – Empire Manufacturing Index November

- 2:00 PM EST – Fed’s Clarida Speaks

- Major Earnings: AECOM (ACM), Celsion Corp (CLSN), Jaguar Health Inc (JAGX), Palo Alto Networks Inc (PANW), Tyson Foods ‘A’ (TSN), Boxlight Corp Cl A (BOXL), Cinedigm Corp Cl A (CIDM), Co-Diagnostics Inc (CODX), iBio, Inc. (IBIO), LiveXLive Media Inc (LIVX), Remark Hldgs Inc (MARK), SmileDirectClub Inc (SDC), AT&T Inc (T), Sunesis Pharmaceuticals, Inc. (SNSS), Widepoint Corporation (WYY).

Tuesday, November 17th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – October Retail Sales

- 8:30 AM EST – October Import/Export Prices

- 9:15 AM EST – October Industrial Production & Capacity Utilization

- 10:00 AM EST – NAHB November Housing Market Index

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Aramark (ARMK), Evoqua Water Technologies Corp (AQUA), Home Depot Inc (HD), Wal-Mart Stores (WMT).

Wednesday, November 18th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – October Housing Starts & Building Permits

- 10:30 AM EST – Weekly DOE Inventory Data

- 12:15 PM EST – Fed’s Williams Speaks

- 1:20 PM EST – Fed’s Bullard Speaks

- 6:00 PM EST – Fed’s Kaplan Speaks

- Major earnings: Avaya Hldg Corp (AVYA), Lowe’s Cos, Inc (LOW), Target Corp (TGT), TJX Companies (TJX), Keysight Tech Inc (KEYS), L Brands, Inc. (LB), Nuance Communications Inc (NUAN), Nvidia Corp (NVDA), Sonos Inc (SONO), UGI Corp (UGI).

Thursday, November 19th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – November Philly Fed Business Index

- 10:00 AM EST – October Existing Home Sales & Leading Index

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – November Kansas City Fed Manufacturing

- Major earnings: Berry Plastics Grp Inc (BERY), BJ’s Wholesale Club Holdings (BJ), Macy’s, Inc. (M), Caleres Inc (CAL), Helmerich & Payne (HP), Intuit Inc (INTU), Ross Stores (ROST), Workday Inc (WDAY).

Friday, November 20th

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: The Buckle Inc (BKE), Destination XL Grp Inc (DXLG), Foot Locker (FL), Hibbett Sporting Goods (HIBB).