A couple of days ago, I got into call options in Zscaler (ZS) expecting to hold them for at least a few days.

But as the stock ripped higher, I decided to cut half my position the same day.

Why would I lock in some profits early instead of letting the trade run?

Quite simply, this market doesn’t favor swing traders.

Volatility is at an extreme.

While it won’t last forever, there’s a way to turn a day-trade into a swing trade.

And this cool trick can help you manage your risk and keep yourself open to runners.

You see, day trades are all well and good.

But look at how much some of these indexes moved in the last few weeks.

Wouldn’t it be awesome to catch a runner on even a portion of these?

That’s what I want to help you learn.

Crafting a day trade

Like the name implies, it’s a short-term trade where you are meant to enter and exit in the same day.

A lot of individuals prefer this method since it doesn’t carry any overnight risk.

For those who can’t spend every waking moment in front of the computer, this isn’t exactly practical.

However, the same basic principals for swing trading apply, with a few adjustments.

First, I go down to a smaller timeframe.

Personally, I like trading the hourly chart. It offers me a perspective that works for day trades and swing trades.

Going down to 5, 10, 15, or even 30-minute timeframes also work.

What you want to do is apply the same setup you might for a swing trade, except shrunken down for a daytrade.

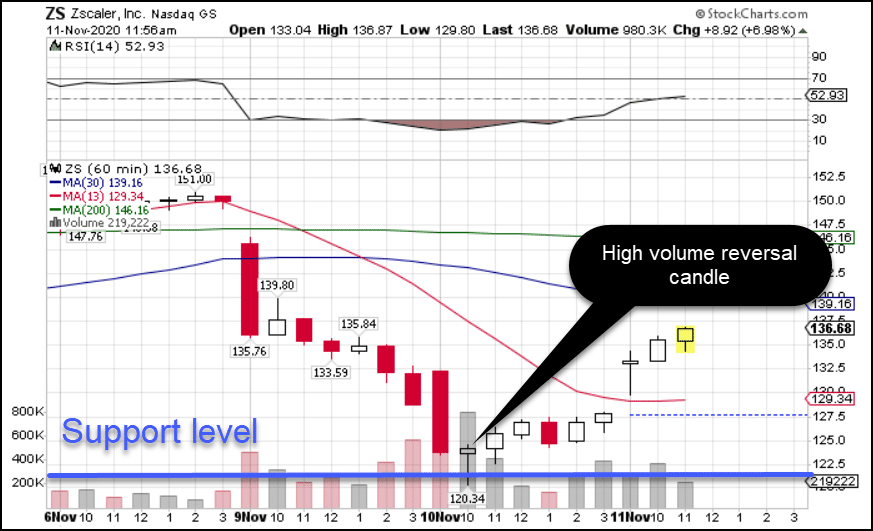

Let’s use my Zscaler trade as an example.

ZS Hourly Chart

I want to show you how I would structure the same setup as a daytrade and a swing trade.

As a swing trade, here’s how I would manage the position.

- Any DAILY close below the recent low at $120.34 and I would stop out of the trade.

- This can mean that the actual price I get is $119, $118, or even lower.

- My target would be up near the breakdown area around $150

- I would enter the trade at the close of the candle.

- Using options, I would go out about 2-3 weeks to give the trade enough time.

For a daytrade, it would be a little different.

- Any HOURLY close below the recent low at $120.34 and I would stop out of the trade.

- This tightens the stop window down to be much closer to $120.34

- My target would be about half the height of the candle, or $127.50

- While I might take the trade at the close of the candle, I would prefer a slight retracement to give me a lower entry.

- Using options, I might go out 1-2 weeks, depending on what day I actually take the trade.

You see, most of the dynamics are the same. It’s just a slight shift in how I enter and exit the trade.

Turning a day trade into a swing trade

This part is actually quite easy, and something I executed perfectly.

When I get to my daytrade target, instead of taking the entire trade-off, I take off half or slightly more.

The rest I set to breakeven and see how far it can go.

Do I risk a gap down that crashes the price of the options on me?

Absolutely.

In fact, this happened to me recently in a High Octane trade I took in Freeport Macmoran (FCX).

Locking in profits, I took off 25% pf my position. The next day, the stock crashed out and turned the trade into a loss.

However, the loss wasn’t as bad as it could have been had I not locked in those profits.

The more you lock-in, the lower your risk.

It’s the very reason I advocate for scaling in and out of trades.

Now, if you’re struggling to find trade ideas, I’ve got just the thing – my favorite trading pattern.

Join me for my upcoming seminar where you learn what this pattern is and how I apply it to my trading.