While my Bullseye trade of the week had a REALLY GOOD run lately, sometimes the market feels the need to rain on my parade.

I know the past week’s loss in TAN frustrated subscribers – it certainly bothered me.

I believe I took it well…

But rather than second-guessing myself, I want to dissect this trade.

You see, trading comes with losses. That’s inevitable.

What we control is how we analyze the setup and execute the trade.

The rest is up to the market.

So the question is did I make any bad decisions?

And what could I do differently that would deliver better results?

Let’s dive in!

Working through the setup

Before the market opened Monday morning, I sent the following email out to Bullseye Members at 8:30 AM.

One of the pieces I left out of this was how the election might impact this trade.

You see, there was an underlying assumption that if Joe Biden won the presidency it would create a favorable environment for solar stocks.

Funny thing is, that may or may not be true. But if enough people in the market believe it, it becomes a self-fulfilling prophecy.

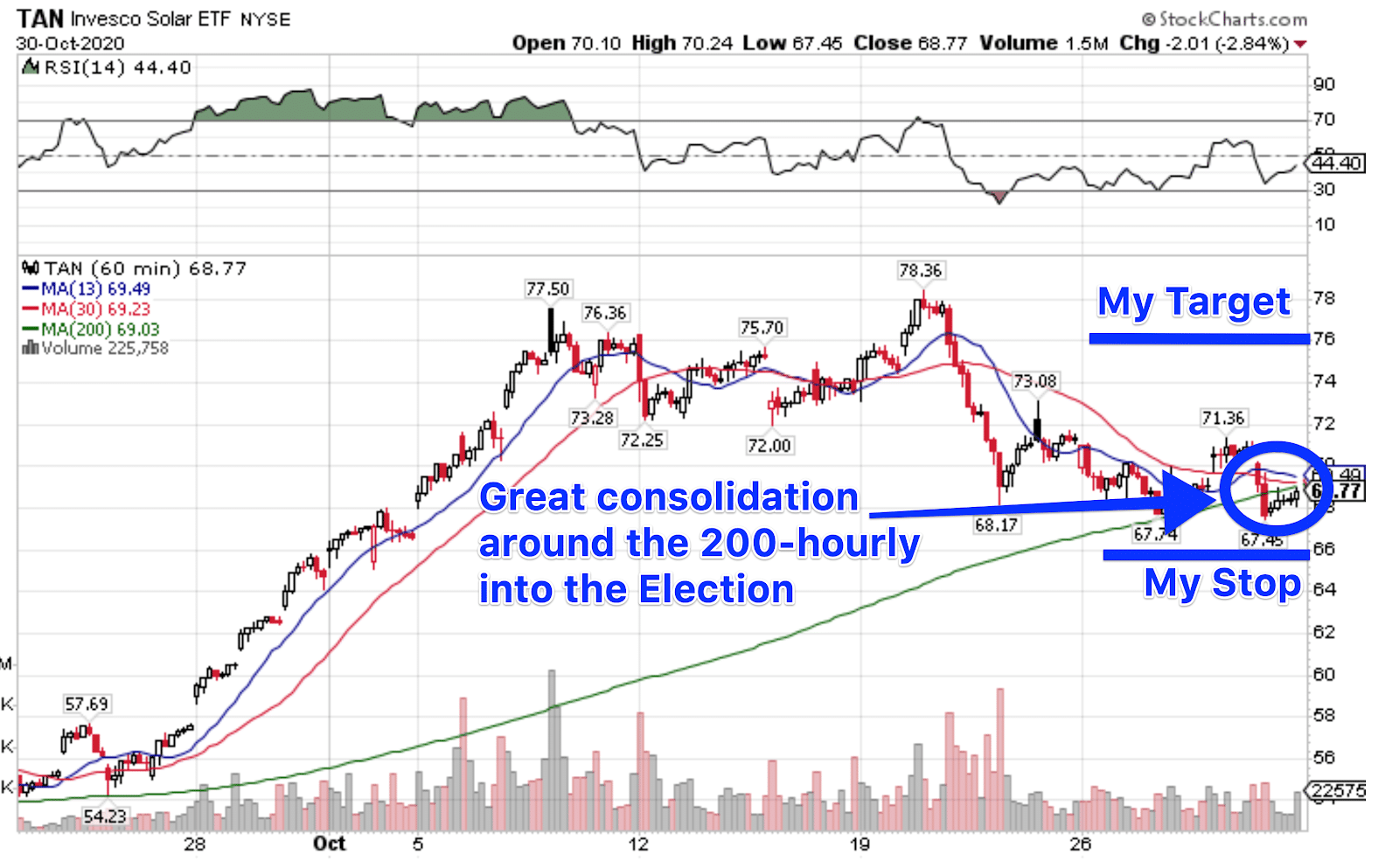

Now, here’s what the chart I used looked like.

TAN Hourly Chart

I dropped the orange line on the $66 level.

Early in the morning, shares cratered and closed the hour below that price.

Yet, as the day went on, the stock slowly crawled back to finish the day just below $68.

That is not a daily close below $66.

But, fear got the better of me and I exited the trade early.

So what happened the very next day?

The ETF took off like a rocket ship, blasting right through my target.

I sold my $4.20 call options for $1.85 at 9:35 AM on November 4th – about as close to the low as you could get.

To be fair, I thought I did the right thing because those same options traded well below $1.00 in the first minutes of the day.

Except….

That same option closed the week a bit over $6.00, a nearly 50% increase.

At its peak that week, the options sold for $8.00

The next steps

I want to point out what should be obvious but bears stating.

The trade idea worked perfectly.

If I stuck to my plan, I’d have turned a profit.

Instead, even after decades of trading, I let fear guide my decision making, pushing me out of a trade early.

It’s the very reason I use daily closes. Intraday swings are often violent and designed to take traders out of the positions.

Daily closes give me a better sense of where the actual trend is longer-term.

So, how do I stop this from happening again?

There are a couple of methods I found that help me.

First, the #1 tool to help is a trading journal. Logging your trades honestly helps you identify problems and opportunities, whether it’s in your trade execution or setups themselves.

More importantly, it cuts through the clutter of emotion that clouds your judgment to provide an objective look at the current price action.

Second, these trades don’t need to be managed obsessively. In fact, one of the best things to do is to place the entry order and walk away.

It either fills or it doesn’t.

If it fills, then I set alerts on my phone or computer when price hits my target. Otherwise, I log in 10 minutes before the close and see if I will stop out.

This keeps me away from the screens and gives the trade space to play out.

So here’s my challenge to you.

Do better than I did.

Take my Bullseye trade idea and turn it into your own.

See if you can turn a profit where I failed to.