There’s one industry that has been on fire this year, and I want to show you how to identify money-making opportunities in this red-hot area.

While most traders are still trying to figure out what’s next for the market, I’ll be on the hunt for the best money-making opportunities out there.

What better way to start than by looking at some of the leaders in the market?

Electric vehicle (EV) stocks ARE ON FIRE this year — and I don’t think this is a fad, it’s a revolution.

I mean just check out the year to date returns of some EV stocks:

- NIO +575%

- WKHS +569%

- PLUG +375%

- TSLA +402%

If you didn’t take part in any of those moves, that’s okay — I believe opportunity will present itself very soon.

I know what you’re probably wondering, “What’s the best way to get on this lucrative trade?”

For starters, I invested in a startup company that I’m introducing tonight at 8 PM EST.

This company has me pumped because it hits the EV market from a completely different angle — one with untapped potential.

Not only that, but according to this startup’s CEO, “We fully plan on IPOing in Q3 of 2021.”

Who knows, maybe we’ll see this company running come next year.

If you want to find out how you can join in on the action before this company potentially goes public, then you’ll have to be in attendance tonight.

In the meantime, I want to show you how to uncover EV stocks to trade right now.

The easiest way I know how is by selecting the best stocks out there to trade by splitting them into two categories – speculative and established.

Speculative

Speculation stocks remind me a lot of biotech companies. They offer a huge potential in the future without actually having sold a single product.

Companies that fall into this category include Workhorse (WKHS), Nikola (NKLA), and Spartan Energy Acquisition/Fisker (SPAQ).

At this time, none of these companies have sold an electric vehicle.

Most have customers that already placed orders. But they haven’t made any deliveries yet.

Now, that doesn’t mean these can’t be great trading vehicles or speculation plays.

However, they can rise quickly and fall just as fast.

I want to use Nikola (NKLA) as an example.

Take a look at the daily chart.

Nikola’s epic rise caught the attention of everyone.

And for part of June, it looked like shares would hold up.

But then a combination of a secondary and an eventual scandal tanked price.

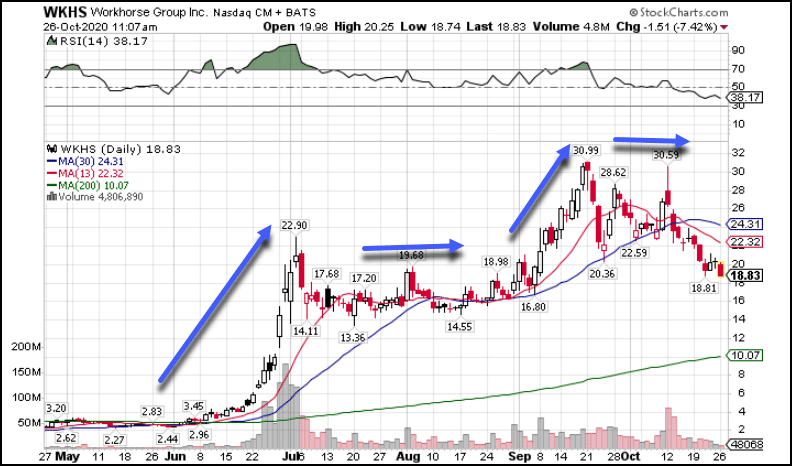

Compare that to the chart of Workhorse (WKHS).

Shares of Workhorse climbed quickly. But unlike Nikola, they traded sideways and then made another leg higher.

That’s the kind of bullish price action that works for both trading and longer-term swings.

Here’s the issue.

In the beginning, no one really knows which is going to do better.

You can do research on the companies themselves, but it’s really a crapshoot.

That’s why risk management becomes key.

Proper risk management with defined entries, targets, and stops defines a structure where I control how much I win and lose.

From there, I’m able to structure trades where my downside loss may be limited, but upside potential is enormous.

One of my favorite ways to do that is with call options.

I know from the outset that I can’t lose more than the cost of the option.

And with their leverage, it offers a huge up-side potential.

Established

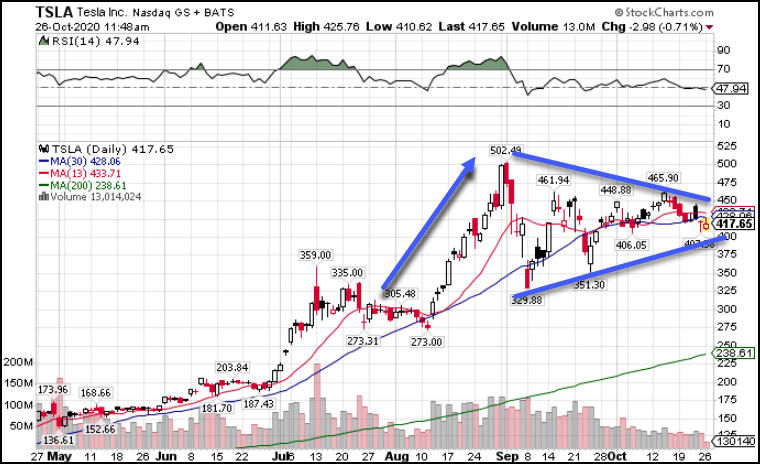

Most of us know that Tesla (TSLA) turned a profit in the last several quarters.

However, there was a time when investors weren’t sure they would survive.

Today, the company garners a nearly $400B market cap.

But they’re not the only player in town making a move.

Chinese company NIO delivered almost 4,000 cars in August, more than double the prior year.

While that doesn’t put them close to Tesla’s 500,000 a year goal, it’s more than the nothing we saw from Nikola or Workhorse.

The difference here is we don’t have to wait for them to show potential, they’ve already crossed that hurdle.

From an investor’s perspective, it’s a slightly safer place than speculative companies.

These fit more into the high-growth category.

Now, with these companies, while I like playing call options, I also enjoy more strategic option plays that I reserve for my Total Alpha portfolio.

That includes credit spreads, covered calls, and even buying the stock outright.

What’s important for me is to make sure I get a good entry.

Take this giant triangle patterns as an example.

Assume shares take off higher and surpass the old high.

If that’s accompanied by good news, I may sell half my position and leave the remainder on with a stop at breakeven, especially if I bought the stock outright.

That way, I lock in profits while giving myself a chance at a longer run in the stock.

In fact, I can use this same idea to build a long-term position over time.

Every time shares pullback I can buy a certain amount. When they rise, I sell a portion.

Over time, as long as the equity continues to rise, I’d end up building a huge position.

Learn to trade options the right way

I know it can be tough figuring out which option contracts to take, how to structure the trade, when to get in…

That’s why I created my Total Alpha Service.

In it, you get access to my entire trading plan, premiere education, and full access to my live-streaming portfolio.

And you can learn all about it in my upcoming webinar.

Don’t miss out.