I’m calling a bull run into the election.

But Facebook and Google aren’t my favorites.

I’m looking at Tesla, Carvana, and TAN, the Invesco Solar ETF.

And I want to walk you through these juicy setups.

Each of these contains catalysts that could propel stocks through their all-time highs…

Plus incredible charts that exhibit lots of bullish behavior.

So make sure you brush up on your option basics.

Because you’ll need them for some of the option strategies I’m about to throw at you.

Now, let’s get cracking.

Tesla (TSLA) – 7.7% Short Float

It amazes me how many people keep betting against Tesla as it melts their faces.

Elon drops his results Wednesday after the markets close.

And if history is any indicator, we’re likely to see a run up into the event.

The company is set to report its fifth consecutive quarter of positive earnings.

I remember not that long ago when folks worried the company would run out of cash.

Investors are watching to see whether the company will meet the half-million deliveries this year as well as progress on their factory construction.

But to me, I want to know more about their automated driving as well as their $25,000 vehicle.

One directly addresses a huge concern during the pandemic, and the other breaks an electronic vehicle barrier.

Right now, the chart sets up for a potential breakout above the all-time highs.

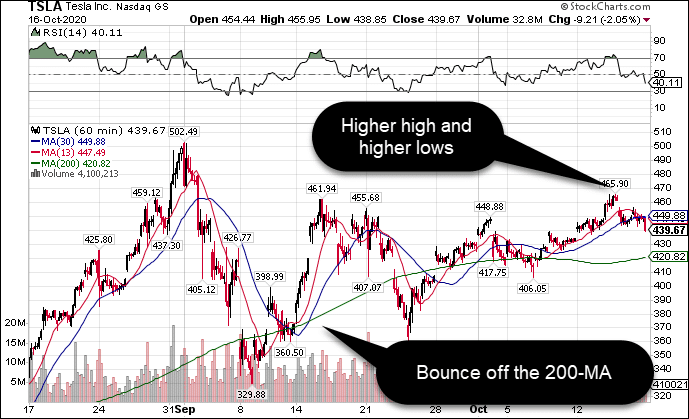

TSLA Hourly Chart

TSLA Hourly Chart

I love how shares made a series of higher highs and higher lows after bouncing off the gravitational line.

That demonstrates bullish behavior to me.

And the huge short-interest could easily create a short squeeze that pushes shares higher quickly.

There are two potential areas I see as support: the gap fill at $433, and the gravitational line at $420.

A pullback to these spots creates a great opportunity to sell a put credit spread.

This is where I sell a put option at or below the current price and buy another at a lower strike, creating a defined risk trade. Initiating the trade pays me a credit.

As long as shares remain above the strikes by expiration, I keep the credit as my maximum potential profit.

If shares do what I expect and shoot higher, the implosion in implied combined with the directional movement should make this a quick trade to take profits.

Caravana (CVNA) – 31.65% Short Float

The pandemic changed the way people shop.

While Carvana did well before the pandemic, they’ve seen accelerating interest lately.

The company doesn’t report earnings until October 29th.

But the high short float and bullish chart should propel shares higher.

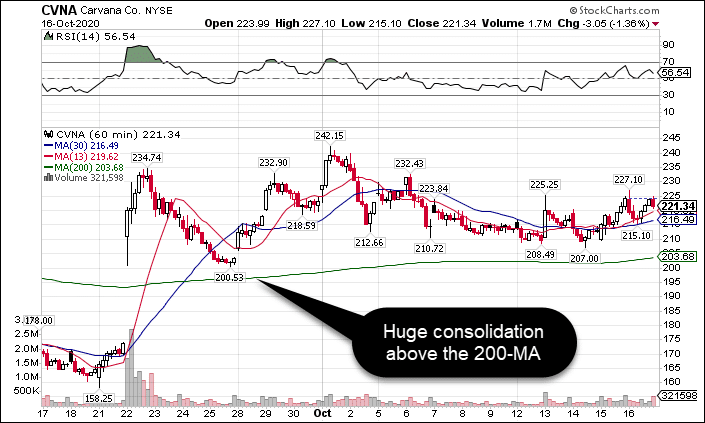

CVNA Hourly Chart

CVNA Hourly Chart

Shares soared in late September making a high of $240 before backing down to $200.

Since then, it’s traded in a narrowing range.

What I love about the recent price action is how it’s shown relative strength compared to the rest of the market.

$210 acted as strong support, and with shares trading at ~$220 and a high up at $240, I like the risk-reward here.

While earnings are coming up, I like the idea of buying call options that run up into earnings.

This involves buying calls that expire after earnings and selling them before the announcement.

That way I take advantage of the natural increase in option premium due to the expansion of implied volatility that occurs before earnings.

Invesco Solar ETF (TAN)

I love the green energy story and where it’s headed.

Even with a glut of oil, there’s still a huge push for low-cost renewable alternatives.

As Elon Musk showed, it’s possible to take a current technology and find cheaper ways to produce them.

We’ve seen that over the past decade as solar panel prices plummeted while efficiency increased.

The difficulty is picking one particular stock to trade in this sector.

That’s why I like this ETF.

I don’t have to worry about earnings, which is a huge boon for me as an options trader.

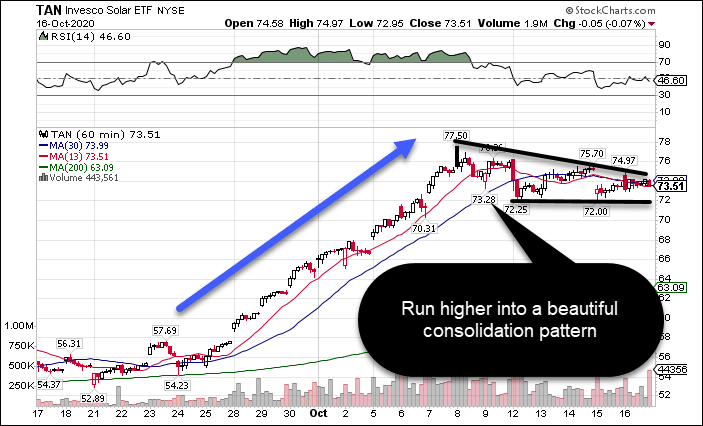

TAN Hourly Chart

TAN Hourly Chart

Despite a huge run in the last month, shares haven’t fallen back.

In fact, they continue to consolidate sideways. This likely means investors are accumulating shares, which can precede another leg higher.

With historically high implied volatility, I want to be an option seller here.

My favorite trade for this is a put credit spread, the same I spoke about earlier.

It lets declines in implied volatility work for me, which is statistically what happens when implied volatility is stretched.

Cut your learning curve

I spent years learning how to trade markets, spending countless hours and dollars along the way.

My High Octane Options service aims to teach you how to trade the market.

You learn many of the same skills and techniques I use to trade the market every day.

Plus, you get real-time access to my proprietary scanner that delivers loads of trading ideas.

That’s not to mention trade alerts and more.