Stop-market orders do not belong in options trading.

If you use them right now, toss that notion out the window.

I’m going to show you how I stop out of option trades.

This is one of the first things High Octane Option members ask me.

You see, most people assume that options work just like stocks…

I mean they have the same order types right?

Look I’ve taught thousands of people about the ins and outs of trading.

And the simple truth is most of them lose money the way they trade options.

So I want to explain not just how but WHY I stop out of trades correctly.

Options are not stocks

Let me start with something that might sound obvious but options and stocks are not the same thing.

Each option contract controls 100 shares of stock, known as a lot.

They’re what’s known as a derivative product – the price of an option is derived from the stock.

The two move together, but they trade in different markets.

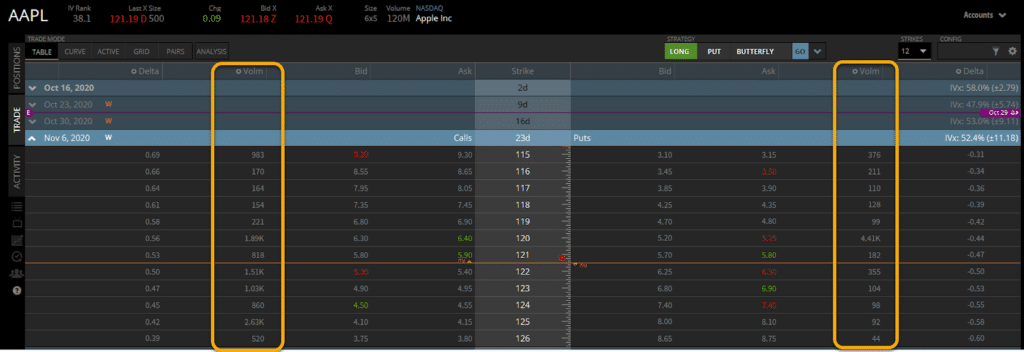

Take a look at this options chain for the popular stock Apple (AAPL).

I circled the option volume on the day I took the screenshot.

The volume on some of the best strikes traded a couple thousand.

Even the most popular SPY ETF options expiring might trade 40,000 contracts.

Apple trades around 150 million shares a day!

This is what’s known as liquidity.

The problem with stop loss orders

Stop loss or stop market orders work just fine when you have a stock that trades more than a few hundred thousand shares each day.

It doesn’t do well with small caps that trade maybe 40,000 shares a day.

Ever noticed what happens when you do?

The bid (price you sell to the market maker at) compared to the ask (price you buy from the market maker at) is wide enough to drive a semi-truck through.

You can lose huge amounts of money because of this spread.

With options, this same thing goes.

Take another glance at the option chain above.

The bid/ask spreads are $0.05, not the usual $0.01 we see with liquid stocks.

But what really becomes problematic is how stop loss orders work.

You see, stop loss orders activate only once a stock trades at the stop loss price or lower.

With millions of shares changing hands each day, that’s not a problem when you trade the stock.

But with options that could go minutes without a contract changing hands, you could see the option fall by a significant amount past your stop level before a contract trades.

It’s only then that your stop loss order converts to a market order.

That means you get the best price at that time.

Let me give you an example.

Using the option chain above, I bought Apple $119 puts for $4.80. I put in a stop loss order for the option contract at $4.00.

That specific option contract only traded 99 times that day.

If you imagine that spread out over 6.5 hours, that’s about one contract every four minutes.

Think about how much Apple could move in just four seconds let alone four minutes.

The stock could have spiked on news, putting the bid/ask on your contract down at $3.00/$3.10 before your stop loss triggered.

Now you see the potential problem.

A better way to stop out of option trades

My preferred method of stopping out of option trades – wait for the candle to close.

A candle is one period on the timeframe you’re looking at for the trade.

If I’m using an hourly chart, each candle is 60 minutes.

I pick out a price that I use as my stop level.

Then, I wait for the candle to close below that level (sometimes I wait for the whole day to close).

Once that happens, I manually exit the trade using limit orders.

This does two things.

First, it prevents me from getting whipped out of a trade prematurely intraday. And trust me, markets will take advantage of stop-loss orders.

Second, I adjust my risk to accept this wider variance.

My stop loss could be at $110 on Apple, but by the time it closes a candle, it might be down at $108.

That’s ok.

I simply lower the size of my trade to account for the extra wiggle room.

Options provide great profit potential, so I’m fine using a bit smaller position and giving it the space it needs to work.

Watch and learn

One of the best ways to see how this is done is by following an experienced trader.

That’s why I created High Octane Options.

This service is designed to teach you option trading skills through some of my best trade ideas.

You get a blueprint to my trade idea from why I’m looking at it all the way down to the contract I plan to play.

See what you could learn from High Octane Options.