I could not talk about the biggest news event set to drive markets this week.

But that’s not fair to you.

We can’t ignore the fact President Trump contracted Coronavirus.

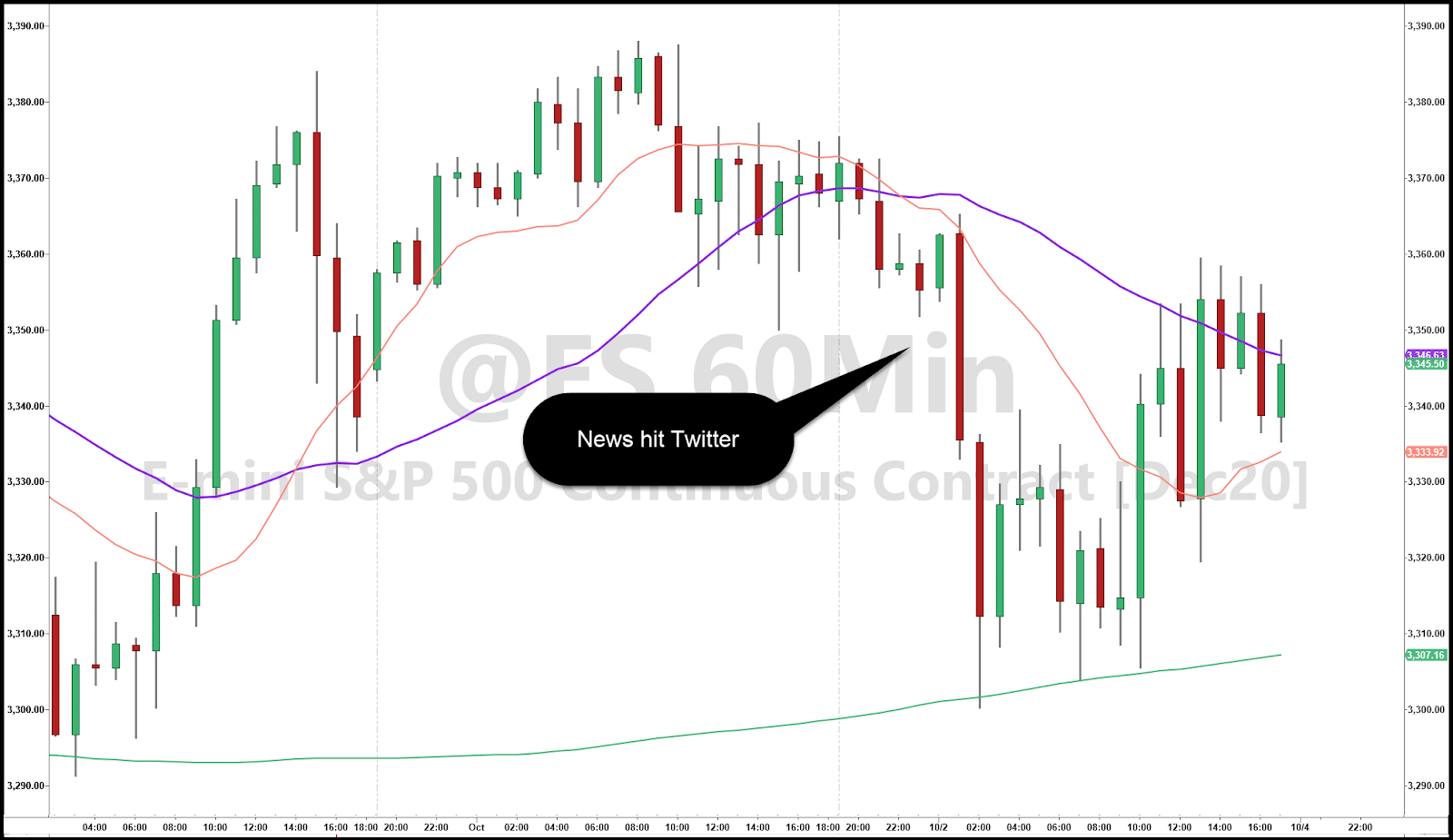

Markets didn’t.

As soon as the news hit the wire, futures nosedived.

There are two important technical patterns in this chart as well.

So, I’m going to offer as objective a view as I can about the market impact.

That includes focusing on how large money investors and traders view things.

At the end of the day, markets do not care about my political opinion or yours.

All they care about is price discovery.

Markets aren’t concerned yet

When news that President Trump contracted COVID, futures immediately sold off.

By the open, markets remained inside recent trading ranges.

This told me a bounce in equities was likely, which took place early in the day.

From there, markets diverged with technology continuing its slide while the S&P 500 stayed off its lows.

Here’s how I believe investors view this situation.

At the moment, markets expect the president to recover. Any talk about the 25th amendment and such is meant for politicos, not traders.

I suspect market participants are weighing the impact on economic recovery.

They want to know whether this derails any reopening plans, curtails consumer activity, and anything else along those lines.

And right now, it does not appear they see that as likely.

I came to this conclusion looking at Friday’s market activity.

We saw technology sell off, but transports (IYT) finished higher on the day as did financials (XLF) and retail (XRT).

IYT Hourly Chart

If smart money expected coronavirus related restrictions to reemerge, these wouldn’t be the names they bought up.

So as far as the markets are concerned, nothing has changed.

What could derail bulls

I know I state the obvious here.

If the president’s situation worsens or the COVID situation around him worsens substantially, that would be where I expect markets to sell off.

At that point, they would start to price uncertainty.

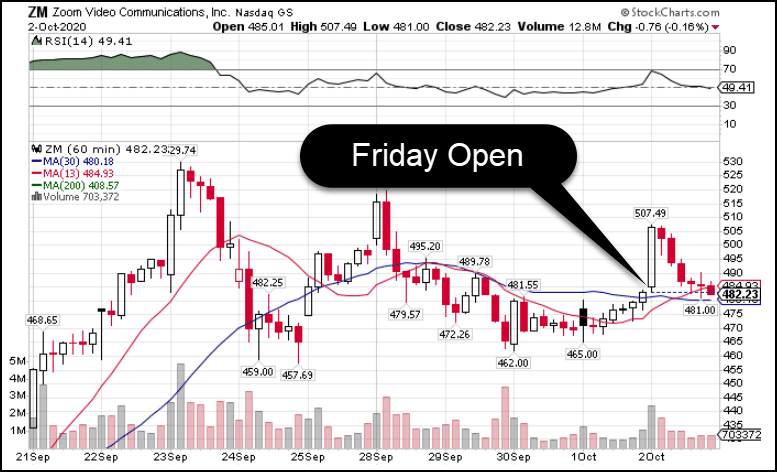

We saw what this looks like at the open on Friday.

Stay-at-home plays like Zoom (ZM) took off while everything else opened lower.

ZM Hourly Chart

Now, there is one other thing worth noting in the week ahead.

Don’t forget about the Fed

We have multiple Fed speakers this week including Chairman Jerome Powell.

On Wednesday, we’ll get a look at the minutes from their September meeting.

Up until now, every time Powell opens his mouth, the market drops.

News surrounding President Trump could eclipse that trend….

But I don’t think so.

Unless things substantially change on that front, markets will be more interested in what Jerome Powell does or doesn’t say.

We also hear from other Fed members, many of which continue their calls for more stimulus.

And with congress unlikely to act, the Fed may take it upon themselves to do so.

We already saw the recovery in the job market wane along with consumer income.

As more data becomes available, the Fed may decide additional stimulus may be necessary.

However, they might be reluctant to act if credit markets remain solvent.

The Fed is willing to juice employment and stabilize lending.

But, there are limits to their generosity (believe it or not).

They worry (as you will hear in their discussions this week) about interfering in the markets.

So, don’t expect them to step in just because stocks start to slide.

Planning for the week ahead.

I can’t tell you ahead of time what tweet or headline would be significant until it happens.

That’s why I lay out everything in my morning newsletter to High Octane Option Members.

I read the market before the open, and relay my daily outlook and trading plan, along with my best trade idea of the day.

Having a gameplan for each day steers you through the headlines.

It keeps you focused on the trades and what matters.

And sometimes, that can mean not trading at all.

Click here to learn more about High Octane Options.

Stocks I want to bet against this week…

XOM, XLE, XOP, PSX, UNG, RUN, CHD

Stocks I want to buy this week…

WMT, ZS, WORK, SPOT, ZM, DKNG, AMZN, AAPL, CHWY, V, RKT, CRM, COUP

This Week’s Calendar

Monday, October 5th

- 10:00 AM EST – ISM Non-Manufacturing PMI September

- 10:45 AM EST – Fed’s Evan Speaks

- 3:45 PM EST – Fed’s Bostic Speaks

- Major Earnings: None of note.

Tuesday, October 6th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 10:40 AM EST – Fed’s Powell Speaks

- 2:00 PM EST – Fed’s Bostic Speaks

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Paychex (PAYX), Levi Strauss (LEVI)

Wednesday, October 7th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:30 AM EST – Weekly DOE Inventory Data

- 1:00 PM EST – Fed’s Rosengren, Bostic, & Kashkari Host Event On The Economy

- 2:00 PM EST – FOMC Minutes

- 3:00 PM EST – Consumer teCredit August

- 4:30 PM EST – Fed’s Evans Speaks

- Major earnings: Lamb Weston (LW)

Thursday, October 8th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Acuity Brands (AYI), Domino’s Pizza (DPZ)

Friday, October 9th

- 8:30 AM EST – September Jobs Numbers

- 10:00 AM EST – Durable Goods & Factory Orders August

- 8:30 AM EST – University of Michigan Consumer Sentiment September Final

- 10:00 AM EST – Wholesale Inventory & Sales August

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Delta Airlines (DAL)