I know it’s hard, but you must try to remain calm and objective during this period of market uncertainty.

It’s easy to get caught up in the news, fear, and hype.

Before you know it, you start making emotional trading decisions.

And let me tell you, those typically don’t end well.

The best way I’ve found to remain mindful and focused has been journaling.

I’m not kidding.

Over the years, I filled out countless steno pads.

So, I speak from experience when I say you need to have one.

And if you don’t, I’m going to show you how I do it.

Before we start, there are some tips I want to share with you to help our discussion.

And given the news cycle, this is timely material.

Click here to watch my training video

Now, let’s take what we just learned and create our own trading journal.

Taming FOMO

Even with a community as large as Raging Bull, trading comes down to you.

As humans, we are quite emotional creatures.

And markets seem to know that.

They have a way of tricking us into trades we don’t want to or have no business being in all the time.

It’s called FOMO – Fear Of Missing Out.

And it’s one of my Top 5 Things to Avoid.

You only loosen its hold by trusting yourself, which is pretty hard to do.

That’s why trading journals are vital to a trader’s success.

You see, data doesn’t care about your feelings. It tells you what’s going on good or bad.

So, if a setup works well, the data will tell you it does.

One of my favorite things about it is when it shows how little trades that we lose here and there that we write off often have huge impacts on our overall performance.

Key elements of a journal

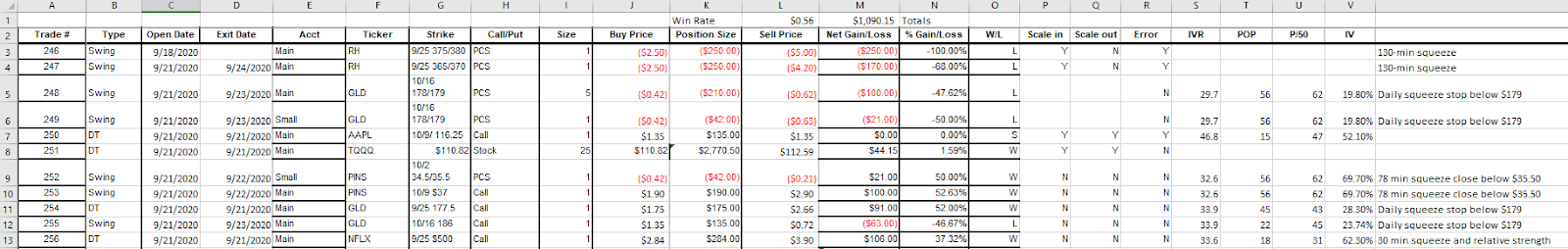

Here’s a quick look at an example journal kept in Excel.

While there is no perfect way to journal your trades, most will include the following.

- Entry & exit time and dates

- Total shares or contracts traded

- Prices for entries and exits

- Type of trade

- Free form notes

This captures every essential element to a trade setup. Consider how an entry might look using the following trading plan for my Bullseye Trade of the Week.

After reading this, see if you can answer the following questions:

- What would my entry be?

- How about my exit?

- If you were trading this, how many contracts would you play?

- How much risk is that?

Analyzing the strategy

So what do you do with the results once you have them?

To start, separate the trades by strategy.

For example, I might look at trades that follow the ‘money-pattern’ or ones that bounce off the gravitational lines.

I want to calculate two major items: win-rate and risk/reward ratio.

Along with position size, these tell me most of what I need to know.

For each strategy, I want to see it’s consistency over time and under various market conditions.

I should be able to answer questions like:

- Does it only perform well in bull markets?

- Am I only good at bullish or bearish trades?

- Do I take a bunch of small losses and hit huge winners?

Once you start to define what works and toss what doesn’t, you can begin calibrating your setups.

I would play around with my targets and stops to see how it affected my win-rate and risk/reward over time – trying to maximize my potential outcome.

Logging these trades let me run various scenarios and then see which performed best.

Analyzing trade management

At the same time, I use the log to review my trade management.

Separate from the strategy analysis, trade journals tell me whether I’m sticking to my rules.

That includes position sizing, sticking to stop and target levels, etc.

One of the easiest things to get caught up in is a winning streak.

You hit a few good trades, build up your bank account and think ‘why not increase my risk?’

A few trades later and you’re staring at what was once a glorious account.

Keeping a trade journal and reviewing it regularly will tell you if you’re getting out of control.

Because the last thing you want is to throw out a winning strategy that took a few large losses only because you let your trade management get out of control.

Expanding on key topics

I’ve mentioned some key topics here such as gravitational lines, the money-pattern, and more.

To help you on your journey, I created a Total Alpha Bootcamp.

This course will help you understand these concepts and how to implement them in your trading.