I hate missing out on great trades.

But with thousands of stocks, I can’t go through every chart.

That’s why I created my proprietary High Octane scanner.

Today, I want to give you a peek behind the curtain…

So you can see how it works!

My goal – give you a starting point to developing your own scanner.

Because let’s face it, we all want to grab every opportunity we can.

But we’re only human.

That is, until now…

The High Octane Options Scanner

Let’s start with why I bothered even creating a scanner for members.

Quite simply – generate concrete trade ideas.

Everyone is at different stages in their trading. Some folks need to trade less, others more.

The scanner helps me find similar setups over and over using the criteria I feed it.

Any scanner worth its salt should cut through the noise and deliver a good selection of stocks.

You can loosen or tighten the parameters to increase or reduce the results.

For my High Octane scanner, I narrow it down to only hourly timeframes since that’s where I trade primarily.

That’s also why I have it scheduled to refresh every hour at the bottom of the hour.

How often you need to run new results depends on your setup.

The simpler, the better

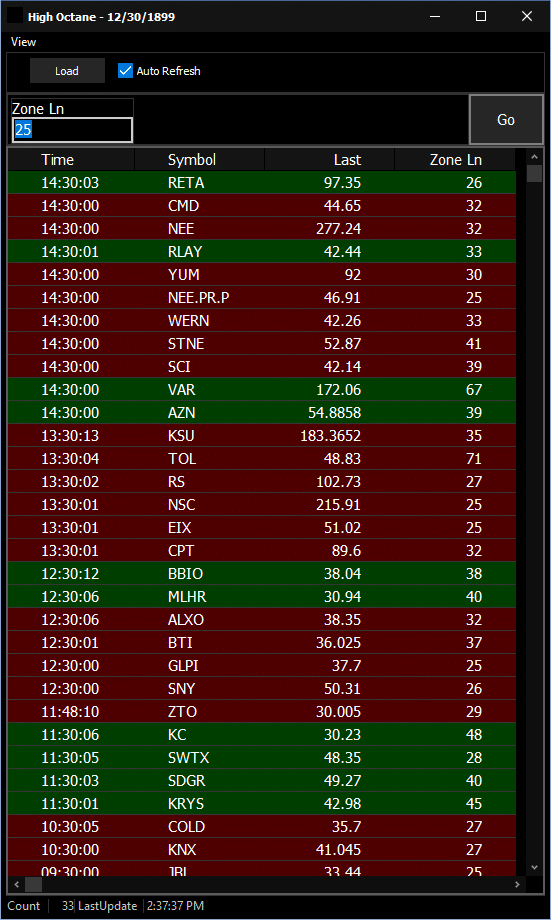

Here’s a quick look at some recent results:

You’ll quickly notice how it’s pretty cut and dry.

When I use a scanner – simpler is better.

The more calculations and restrictions I put onto a scanner, the longer it takes to calculate and narrow my results.

Adding too many constraints creates the scanning equivalent of analysis paralysis.

Remember, the goal of the scanner is to provide YOU with good trade ideas.

If you end up with 1,000 results, chances are it’s not doing enough.

On the other hand, if you get five all week, it’s probably too restrictive.

Turning scans into trades

Here’s where the rubber meets the road.

Let’s say you build a scanner that gives you good results about 80%-90% of the time.

From there, you still need to do your due diligence on the setup.

Some things are too difficult to program but easy for humans to understand.

For example, how do you tell a scanner that you don’t want to trade Facebook (FB) because Apple’s stock is about to split after an epic run?

Or you aren’t interested in banking stocks before a Fed announcement?

True, you could put each of these individually, but it would quickly get cumbersome.

Here’s a perfect example.

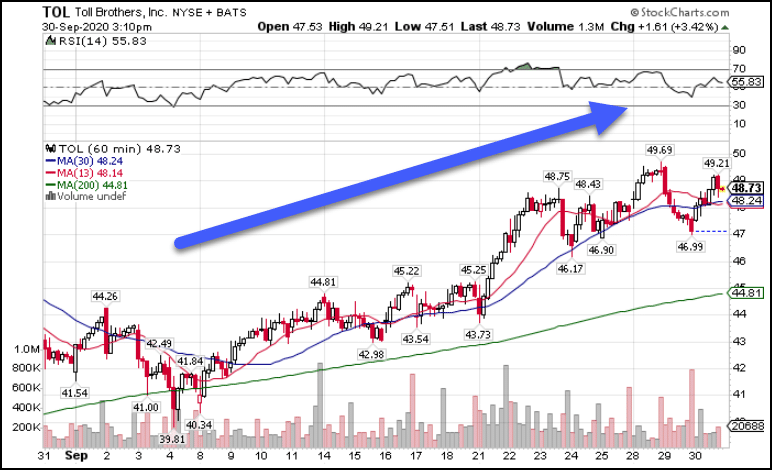

The other day I got a bearish signal from the scanner on Toll Brothers (TOL).

Now take a look at the chart:

TOL Hourly Chart

How would I tell the scanner that shorting a housing stock in this market is a bad idea?

Not to mention I’d be fighting a serious uptrend.

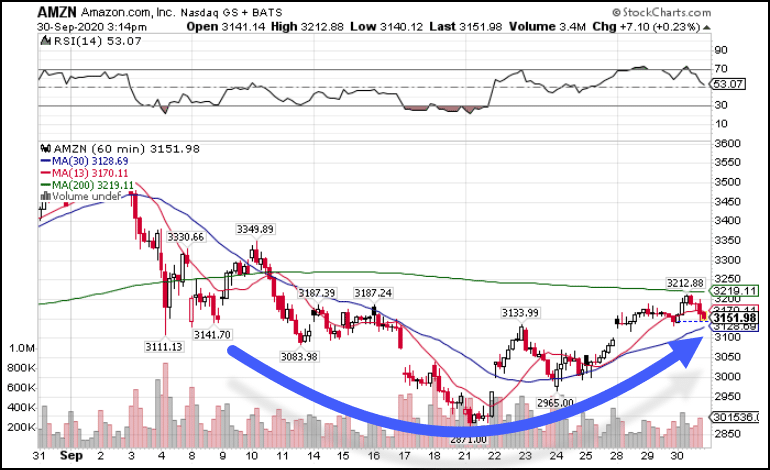

Yet the same scanner dropped me a great setup in Amazon that I took for a long trade.

AMZN Hourly Chart

You see, people mistakenly believe there’s this one magic indicator or scan that will produce trades that a monkey could take and make money.

If something like that exists, I’m not aware of it.

The best we have are tools like scanners that help us cut through the clutter.

Even if the scanner produces 30 results over a day, it may take me all 10 minutes to look through compared to 2 hours every hour!

Start with one area

In this short video I made with 10 Tips for Trading through Covid, I stress the importance of focusing on one area.

The two charts above may seem random, but they aren’t. Both display one simple characteristic that I scan for.

And that’s all I need to generate huge amounts of trade ideas.

New traders often fail because they try to become good at everything.

I can tell you from firsthand experience, the less I trade, the better I trade.

When I first started out, I tried everything from daytrading to swing trading.

After the market beat me up a few times, I found that my bread-and-butter lies on the hourly chart.

It’s where I’m most comfortable reading the market and finding setups.

So, my High Octane Scanner does exactly that.

I don’t need it to look for Bollinger Band squeezes or ADX lines…none of that matters to me.

All that I care about is finding trades that fit my setup criteria.

Now, you have a chance to see how I do this with High Octane Options.

You not only gain access to my proprietary scanner as well as real-time access to my trading portfolio.

I’ll show you how I trade the markets every day with some of the same techniques I gathered over the years.

Click here to learn more about High Octane Options.