Tech continues to sell off as quickly as it rose.

And the VIX can’t be trusted to offer up reliable signals.

So, where do we look for market clues?

A place most of us ignore – the currency markets.

I know they’re pretty lame.

But the US Dollar and Japanese Yen proved surprisingly accurate last week.

They forecasted the move out of big tech.

And things may just be getting started.

Because there is one sector primed to drive towards new all-time highs…

While several others should continue their rapid ascent.

It all starts with one of the hottest markets out there…

It’s gold, technically speaking

All things being equal, a cheaper dollar makes gold more attractive since gold is priced in US dollars.

That’s why many investors use it as an inflation hedge.

And if we learned anything from the Fed last week, it’s that they’ll stomp all over your children’s future to drive inflation.

Despite their clearly stated desire, gold hasn’t reacted much.

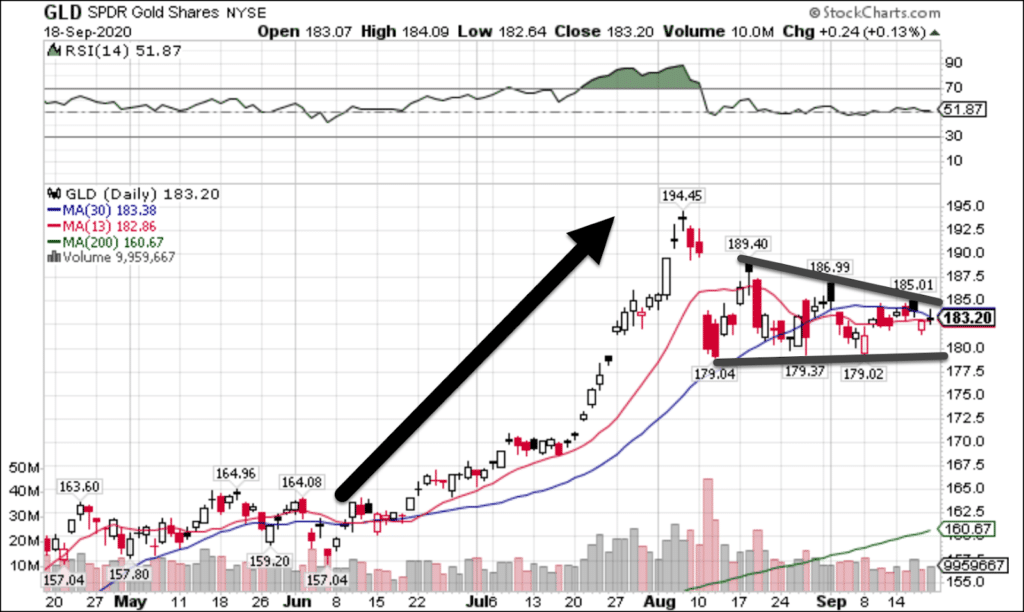

On the hourly chart, you can see the wide range gold traded in the last few weeks.

GLD Hourly Chart

But take a step back to the daily chart and you start to see a drawn-out consolidation taking place.

GLD Daily Chart

Chart analysis textbooks use examples like this to illustrate continuation patterns.

After a steep move higher on growing, but still mild volume, gold petered out in an exhaustion move.

On its pullback, buyers stepped in again and again around $179 in the GLD ETF.

Each time it bounced, sellers and profit takers would come in earlier and earlier.

Yet, the buyers always stepped in at the same level.

So what happens when the two trendlines finally meet?

That’s when we get a test of wills.

And typically, the buyers win out.

This may take more than this week to play out.

But I’ve got this on my watch list, looking for opportunities to start entering this trade.

If I go with long call options in the GLD, I would look at expiration dates out a month or two. This trade comes off the daily chart, so I need to give it enough time to play out.

Another strategy would be to sell a put credit spread below the $179 level and play for GLD to close above that price by expiration.

You can learn more about credit spreads in my previous blog article here.

As I mentioned before, gold isn’t the only sector set to benefit from the cheaper dollar.

Materials, industrials, and….transports

Last week, I alerted Bullseye Members to a trade idea in Dupont Chemicals (DD).

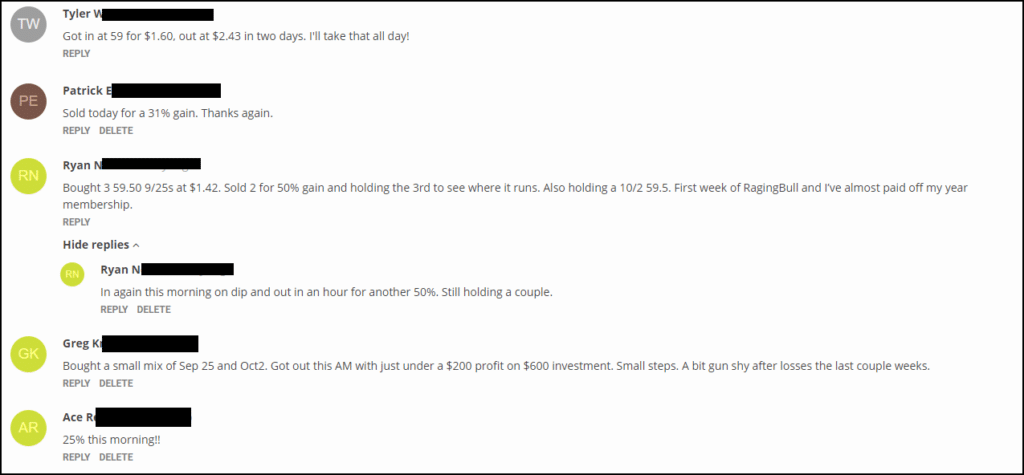

While I wasn’t able to get into the trade, a few members noted their success.

To be sure, it didn’t work out for everyone. Heck, I couldn’t get a fill on my order.

But, the idea came from my insights on the dollar.

You see, with a cheaper dollar, exports and multinational companies benefit.

Exporters’ products become relatively cheaper and multinationals oversees sales translate to more dollars.

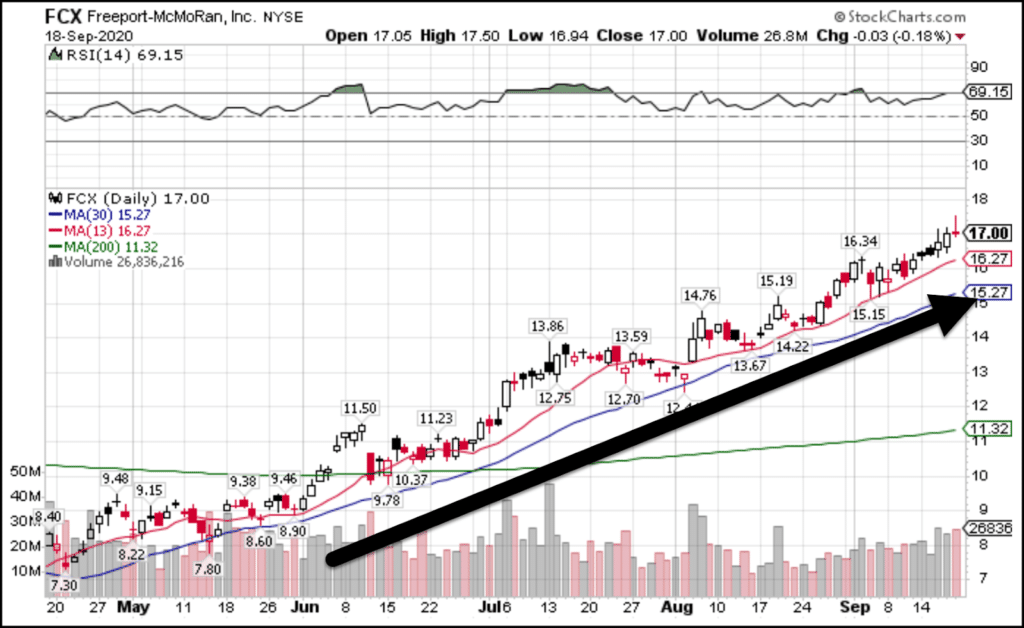

That’s why I picked up Freeport Macmoran (FCX) this past week.

The company benefited from the cheaper dollar as well as skyrocketing copper prices.

FCX Daily Chart

That’s about as bullish a chart as you get.

But the one sector that I have yet to dip my toe in is the transports.

IYT Daily Chart

I missed my opportunity to go long the IYT when it made a slightly pullback and consolidated at the end of August.

Now, I’m hoping that the broader market drags this ETF down to the 30-period moving average (blue line). That would be a great spot to get long the sector or even pick up some specific stocks.

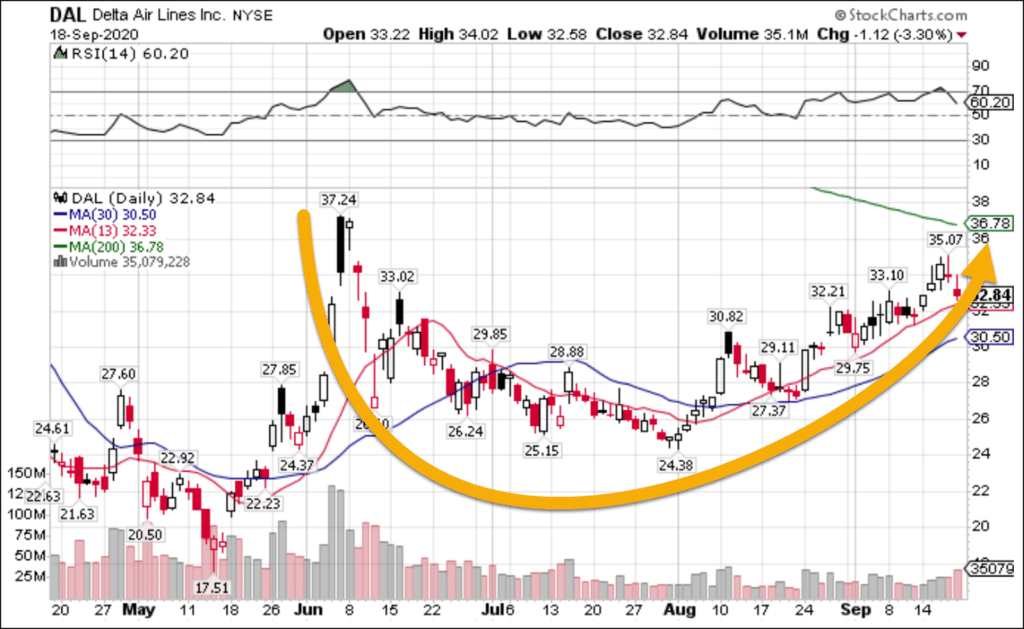

One stock, in particular, is quite interesting – Delta Airlines (DAL).

DAL Daily Chart

After peaking in eary June, shares traded lower to create this nice round base.

As it gets near the 200-period moving average on the daily chart, I expect it might start to move sideways, building energy to make a jump over that indicator.

During that sideways consolidation, I would look for a chance to get into the stock, especially if the broader transport sector is doing well.

But I know you want to ask me about the technology sector because – hey, that’s all anyone cares about these days.

So let me give you my thoughts.

To tech or not to tech

Volatility is the name of the game here.

We already saw Apple (AAPL) hit bear market territory.

I suspect that many other stocks will join it shortly.

In reality, none of these companies are broken. They just suffered from over-exuberance.

Only once that sentiment is let out will they resume their ascent.

And that may take until next year.

Think of it this way.

They dominated the headlines for the last six months.

So even a cooling off period of half that time takes us near 2021.

I will certainly look for opportunities here and there, especially with uncorrelated momentum stocks.

But otherwise, I have a solid trading plan based on my outlook to work with.

Speaking of a trading plan

Do you know what one looks like?

If not, let me help you.

My Bullseye Trade of the week is delivered to members with my full trading plan.

That’s right.

I lay out everything that a pro-trader puts in their blueprints including:

- The stock and my thesis

- Entry, exit, and add-on levels

- Which contracts I’m looking at

- A full chart analysis of the setup

If you lack any of these in your plans, you don’t have all the tools in your bag.

See what you’ve been missing.

Click here to learn more about my Bullseye Trade of The Week.

*RagingBull does NOT track or verify subscribers’ individual trading results and these individual experiences should NOT be understood as typical as or representative. Please see our Testimonials Disclaimer here: https://ragingbull.com/disclaimer