All eyes focused on the Fed last week, and rightfully so.

No one expected them to adjust rates.

But they failed to offer additional support for the markets, even verbally.

That left bulls running for the exits.

Tech stocks from Advanced Micro Devices (AMD) to Apple (AAPL) crumbled more than 20% from their highs.

And that’s bear market territory, folks.

So, where does that leave us this week?

Three main themes will drive stocks this week.

- Jerome Powell delivers testimony to Congress on Thursday. Traders want to know what steps the Fed will or won’t take to juice the economy.

- Second, Treasury auctions matter a lot more these days. Ben Sturgill pointed out in his Daily Deposits how stocks now take their cue from bond auctions.

- Last, and certainly not least, the political tension sits in the air like the eye of a hurricane.

Here’s how analyzing Fed led me to a superb trade in FCX this last week in my High Octane Options.

A rock and infinity

Jerome Powell made it clear the Fed will tolerate excess inflation for a while.

Pushing aside economic academia that guided the Fed for the last century, he noted the relationship between unemployment and inflation no longer exists.

Therefore, he sees the Fed’s role and duty to drive down unemployment until inflation becomes an issue.

To the dismay of permabulls, this doesn’t mean an ever-expanding balance sheet.

The Fed saw no reason to continue asset purchases at the previous rate.

Hence the selloff in big tech benefited from the low-interest rate debt.

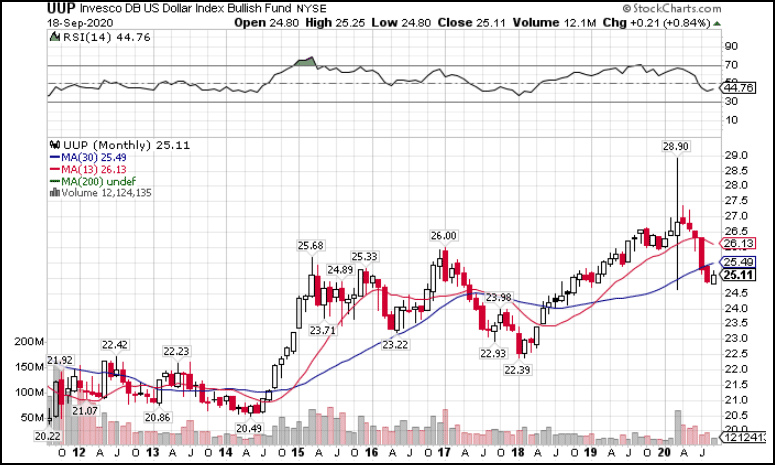

Yet, the dollar remains stubbornly cheap…and looking like it will get cheaper.

UUP Monthly Chart

Cheap dollars benefit multi-national companies, especially exporters.

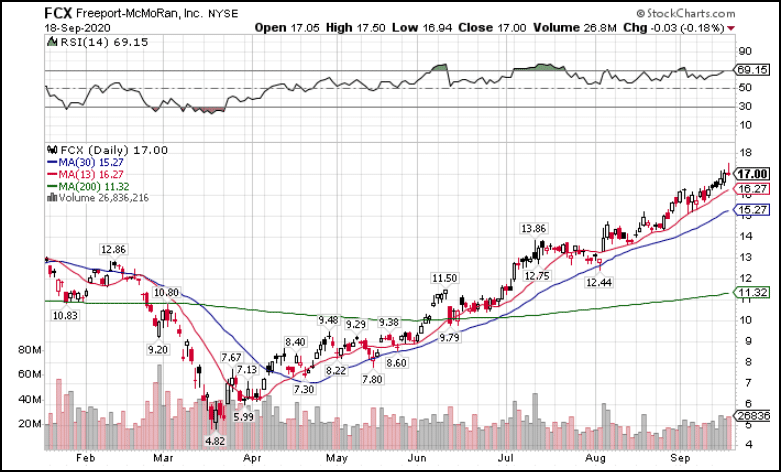

And, as copper prices rose steadily, Freeport MacMoran (FCX) reaped big benefits.

FCX Daily Chart

The stock has more than quadrupled off the March lows.

Seeing this strong trend, I picked up some quick cash with long call options in the stock, locking in gains, and letting the rest ride higher.

As long as the Fed keeps pushing inflation, industrials and especially material stocks stand to benefit.

But, there is a potential wrinkle in the Fed’s plans…one that could lead to a larger pullback.

Growing debt problems

Despite political posturing, there is little historical evidence that either political party manages debt better.

In fact, the only time I remember our national debt shrinking was in the 1990s, spurred on by a decade of internet growth.

Ahh, the good old days…

I wonder what happened to those acid wash jeans…

Congress passed the largest stimulus in history to soften the blow of the pandemic.

Much of it has been financed by the loose Fed policy.

Yet, the growing debt continues to weigh on investors.

Without the Fed expanding its balance sheet, the remaining bonds must be scooped up by other investors.

However, the exorbitantly low-interest rates and outlook for more supply isn’t that enticing.

We already saw treasury yields slip this week and the subsequent selloff in tech.

As the supply of bonds grows to fund the deficit, the downward pressure on bond prices will drive up yields.

And that would certainly curtail equity market growth.

That’s why I’m watching both the Fed and the auctions closely this week to see whether these trends continue.

Both will set my outlook for the markets for the next 3-9 months.

But in between then, we have a little thing called an election.

In case it wasn’t dirty enough

With the passing of Justice Ruth Bader Ginsburg, a long-awaited vacancy appeared that President Trump itches to fill.

Objectively, the death of one of the more liberal justices and the likely replacement with a conservative one will shift the ideological balance of the high court.

Democrats already hit the airwaves to compare the situation to the Antonin Scalia vacancy, calling on Republicans to hold off on filling the seat.

As expected, Majority Leader Mitch McConnell and President Trump stated that they will move forward with a nomination, most likely Amy Coney Barrett of Indiana, U.S. Court of Appeals for the 7th Circuit who was a finalist behind Justice Brett Kavanaugh.

In reality, there is a marked difference between Judge Merrick Garland’s nomination and now.

Republicans control the Senate and the White House with enough time to confirm the nominee, even if they lose control of the chamber and the White House.

All of this will certainly play into the election rhetoric.

The question is how each side decides to play their cards.

Both Republicans and Democrats will look to leverage the events to increase their voter turnout.

So I wouldn’t be surprised to see the actual nomination drag out right until or even after the election.

Polls currently show Joe Biden closing in on 50% – a key number for a potential win.

As a reference, neither Hillary Clinton nor President Trump garnered numbers in the high 40s simply because many voters, estimated at anywhere from 10%-20%, hadn’t yet made up their minds.

This time around, there appears to be half that amount, hence the higher poll numbers for both candidates.

Markets will begin to respond based on who they perceive the likely victor as well as control of the senate.

At the moment, the House is expected to remain in Democratic control.

The Senate is the big question market.

And if you want to see some real polarization, watch what happens if we get a 50/50 split senate and need the VP to break the tie-breakers.

Translation into trades

Politics will dominate the main news networks this week but should have little impact on the markets.

I laid out my thoughts above as objectively as possible so you aren’t surprised by what happens and can look past it to what really matters.

This week, that’s the Fed and bonds.

I will keep a sharp eye on both including the treasury market ETF TLT.

In fact, my Bullseye Trade of the Week comes directly from these analyses.

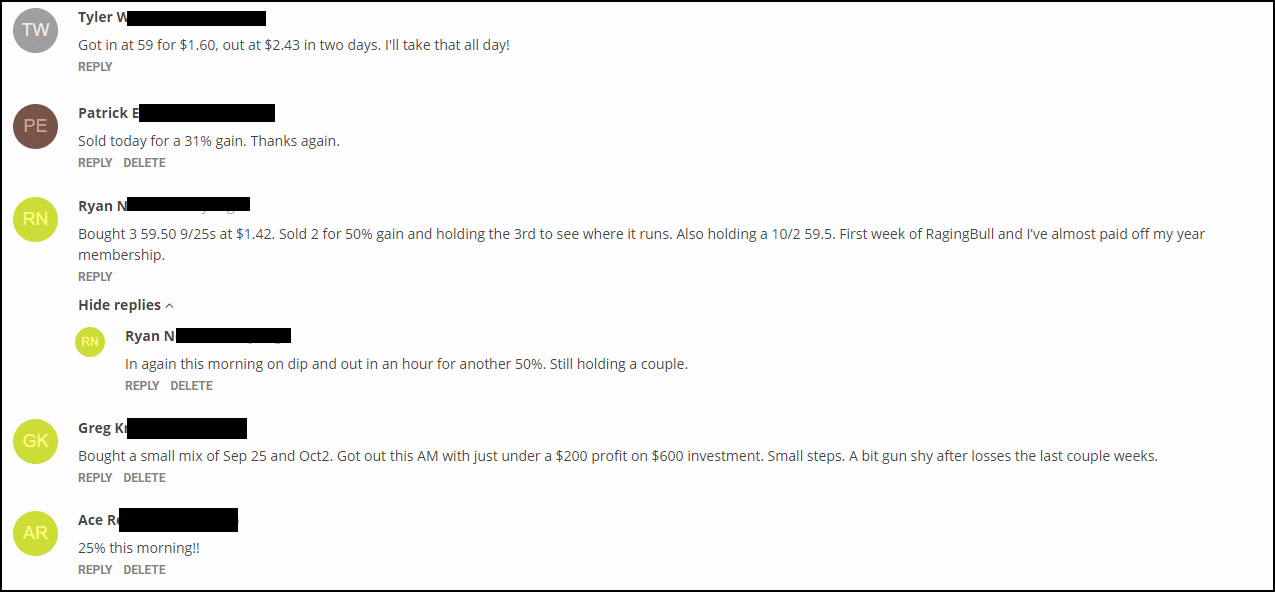

Last week’s call in Dupont (DD) scored some nice wins for a few members.

*See disclaimer below

There’s still time to get Monday’s Bullseye Trade before the opening bell.

Click here to learn more about Bullseye Trades

Stocks I want to bet against this week…

AAPL, YETI, CMG, WY, FEYE, XLRE, XLP

Stocks I want to buy this week…

FCX, CAT, DE, PTON, DKNG, RH, PLUG, DD, FSLY, COF

This Week’s Calendar

Monday, September 21st

- Nothing of note

Tuesday, September 22nd

-

- 7:45 AM EST – ICSC Weekly Retail Sales

- 10:00 AM EST – Existing Home Sales August

- 10:00 AM EST – Richmond Fed Index September

- 1:00 PM EST – U.S. Treasury $52B 2-Year Note Auction

- 4:30 PM EST – API Weekly Inventory Data

- Tesla Battery Day

- Major earnings: Autozone (AZO), KB Homes (KBH), Nike (NKE), StitchFix (SFIX), Steelcase (SCS).

Wednesday, September 23rd

- 7:00 AM EST – MBA Mortgage Applications Data

- 9:00 AM EST – Monthly Home Price Index July

- 10:30 AM EST – Weekly DOE Inventory Data

- 1:00 PM EST – U.S. Treasury $53B 5-Year Note Auction

- Major earnings: General Mills (GIS), Cintas (CTAS).

Thursday, September 24th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:00 AM EST – Jerome Powell Testimony

- 10:00 AM EST – New Home Sales August

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing Index September

- 1:00 PM EST – U.S. Treasury $50B 7-Year Note Auction

- Major earnings: Aytu BioScience Inc (AYTU), Darden Restaurants Inc (DRI), Dynatronics Corp (DYNT), Jabil Inc (JBL), CarMax, Inc (KMX), Rite Aid (RAD), Costco Wholesale Corp (COST).

Friday, September 25th

- 8:30 AM EST – Durable Goods August

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: None of note

*RagingBull does NOT track or verify subscribers’ individual trading results and these individual experiences should NOT be understood as typical as or representative. Please see our Testimonials Disclaimer here: https://ragingbull.com/disclaimer