Your jump on the week looks at the themes driving this market…

Starting with options expiration.

Normally, traders expect increases in volume and chop during OPEX.

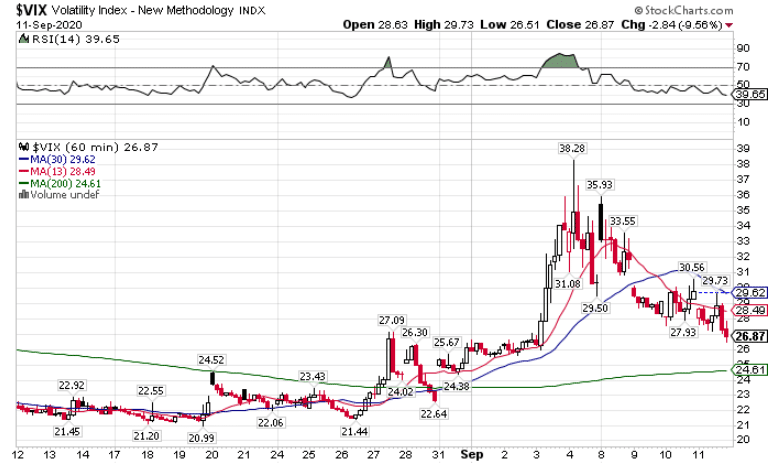

So why isn’t the VIX agreeing with this assessment?

VIX Hourly Chart

How is it that the SPY finished flat on Friday, yet the VIX dropped by nearly 10%?

Typically, the two move in opposite directions.

Except the market didn’t rise to end last week.

And that leads me to one inevitable conclusion…

Honeybadger don’t care

Let me ask a simple question – why do traders buy call options on the VIX?

Two reasons: speculation and protection.

If we all expect stocks to drop and the VIX isn’t climbing, that means traders don’t care.

And that shouldn’t come as a shock to any of us.

Retail traders (and let’s throw SoftBank in there for good measure) speculated in this market with options.

But most of them don’t hold actual investments.

A great example – retail bought call options on high fliers like Apple to the point that Apple’s VIX rose alongside the stock.

These traders aren’t savvy enough or engaged enough to buy VIX protection.

Which means the VIX reads as follows – investors are complacent.

They don’t care if the market drops…at least not yet.

Here’s where things might get interesting.

Those same option traders may decide to start buying puts on stocks to ride the market lower.

That forces market makers to sell stocks to hedge their positions.

See enough of this happen and it can create a cascade of selling.

I wouldn’t be surprised to see markets get vicious this week in both directions as big money tries to knock retail option holders out of position.

Campaign headlines take center stage

As we get into the final stretch of election season, markets will start to price in presidential policy.

Each poll that comes out provides another clue as to who might run the country next year and their subsequent policies.

And if it’s anything like 2016, we could see some fireworks.

Across all the issues, I expect COVID and the economy to drive the majority of the debate.

As cases decline in major hotspots they began springing up in rural areas like the Dakotas.

AstraZeneca’s pause on trials last week threw cold water on the hope for a quick vaccine.

President Trump would greatly benefit from a breakthrough before the election, while any major resurgence puts him in a bind.

All three – the election, COVID, and the economy – are linked to one another.

And much like an option approaching expiration, the closer we get to election day, the more each news story can move the markets.

Use the chop to your advantage

Rather than run from the volatility, flip the script.

Here’s how I did it just last week.

You see, while retail traders had been trained to buy-the-dip, I knew better.

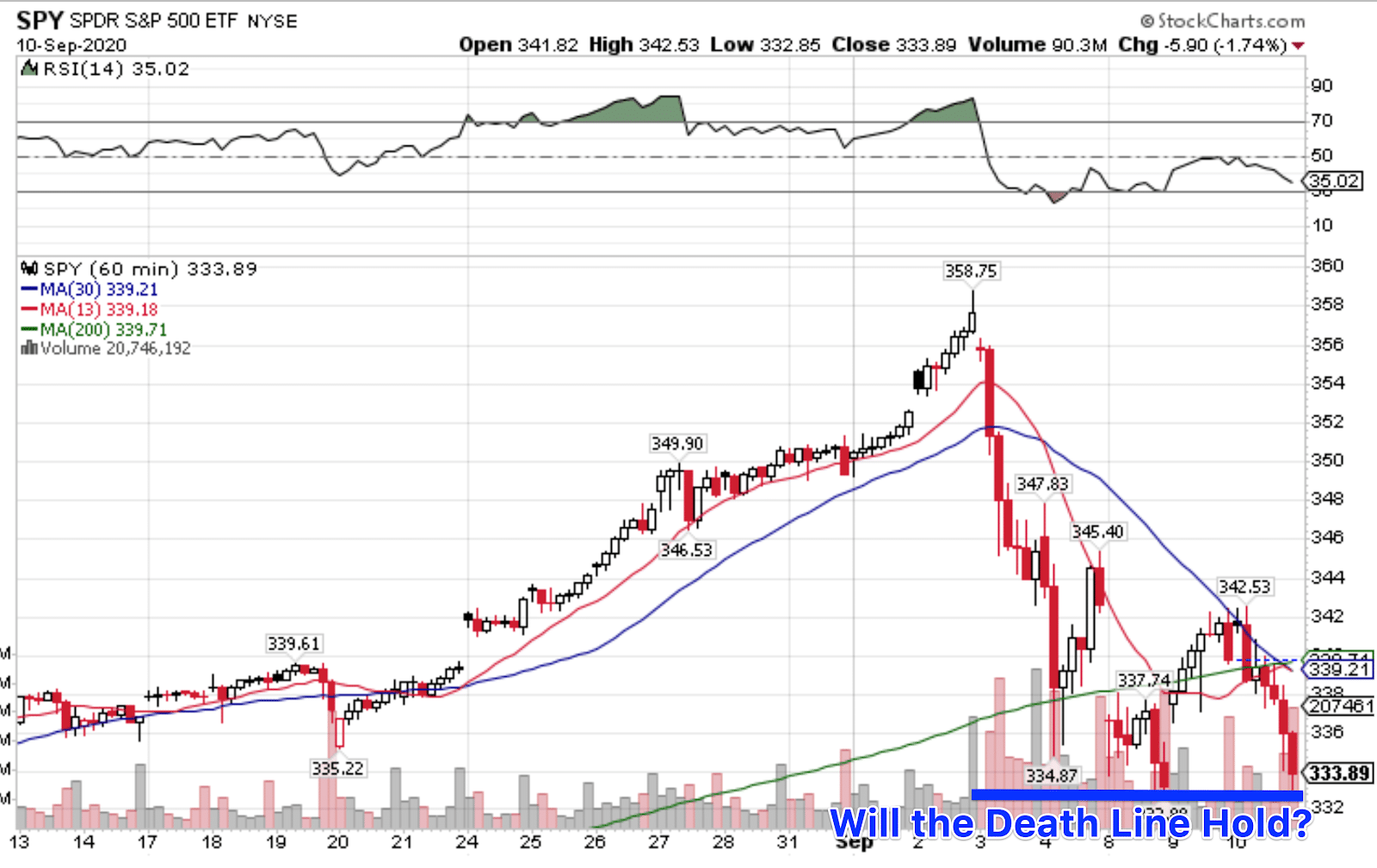

SPY Hourly Chart

When markets failed at a key level – THE DEATH LINE – I saw a chance to hop on the short side.

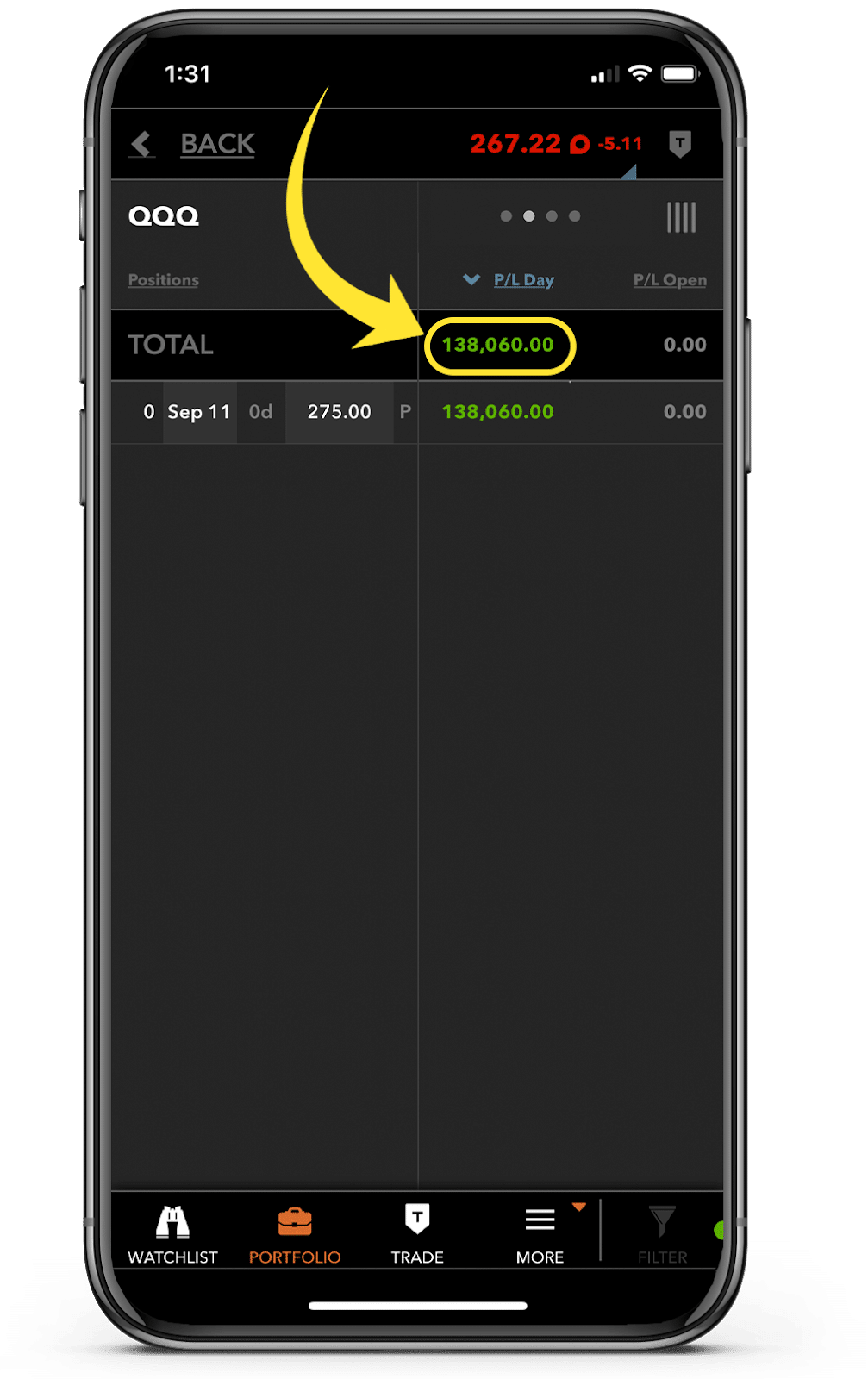

And man did it create one heck of a payday in my Total Alpha Portfolio*

*See disclaimer below

And look, I had plenty of other trades that went against me.

But this winner outstripped them all.

So, why bring this up?

Because this week could see that same dynamic play in reverse.

With traders primed to bet on a crashing market, I see an opportunity for a massive head fake.

With little news and earnings to drive investment decisions, algos could easily manipulate stocks.

The obvious move – get as many people out of their call options before ripping the market higher.

Now, my best idea will be reserved for members of Bullseye Trades.

They get the complete blueprints for my top trade idea coming into the week.

That includes my setup, entries, targets, a specific option contracts I’m looking at.

Click here to learn more about my Bullseye Trades

Expected earnings dates listed in (…)

Stocks I want to bet against this week…

SC, DFS, PENN, IWM, SNAP, ROKU, SPOT, WK, ECL, TWLO

Stocks I want to buy this week…

MJ (none), DKNG (Nov 13), ZM (Sept 3), CVNA (Nov 4), CARR (July 30), GDX (none), RNG (Nov 2), NEM (Nov 3), CLX (Oct 29), RH (Sep 8), SHOP (Nov 3), JNJ (Oct 20), MSFT (Oct 28), TTD (Nov 5), GOOGL (Oct 26), FSLY (Nov 5), WMT (Aug 18), WORK (Sept 2), TWTR (Oct 27), AVLR (Aug 5), SQ (Aug 5), JD (Aug 11), NET (Nov 5), ADBE (Sept 25), MCD (Oct 27), COST (Oct 1), FB (Nov 4), PYPL (Oct 28), MTCH (Nov 4), ZEN (Nov 3)

This Week’s Calendar

Monday, September 14th

- Major earnings: Lennar Corp (LEN)

Tuesday, September 15th

- 6:00 AM EST – NFIB Small Business Optimism August

- 7:45 AM EST – ICSC Weekly Retail Sales

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Adobe (ADBE), FedEx (FDX)

Wednesday, September 16th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Retail Sales August

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Herman Miller (MLHR)

Thursday, September 17th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Housing Starts & Building Permits August

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: None of note

Friday, September 18th

- 10:0 AM EST – University of Michigan Consumer Confidence September

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: None of note