Have you ever gotten into a trade, seen it work your way, and then take profits.

Only to watch that trade you just exited, go on, and on, to levels you didn’t even think were possible.

Instead of feeling good about your winner…you’re trying to find a calculator to figure out how much profit YOU COULD HAVE made.

You say to yourself, next this happens, I’ll be ready.

So instead of taking your usual profit target, you sit, and wait for the BIG MOVE.

But you know what happens?

It doesn’t come and you end up turning a winner into a loser.

If You Don’t Take Profits

The Market Will Take

Them From You

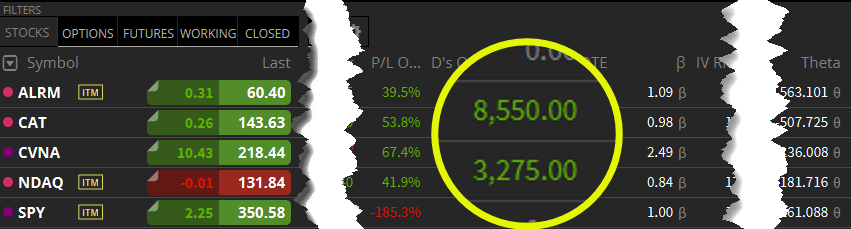

Just this past week I locked in gains in Caterpillar (CAT) and Carvana (CVNA).

That doesn’t include the High Octane Options $4,700 profit I locked in on NDAQ earlier this week*

*See disclaimer below

I know, I know, you’ve been told this 1000 times to LOCK IT IN.

But never like this because…

I’M GOING TO PROVE WHY

I will show you the undeniable logic truth and reveal the answers that no one else has told you…

Pick your friends, not tops or bottoms

I’m going to shatter your world.

The best traders in the world rarely get the maximum possible profit in a trade!

One exception – defined risk profit potential trades like selling options.

Think about how many times you put on a trade only to see it immediately trade against you.

Or how about when you sell a stock only to watch it push on a few more ticks.

If you are a human being, chances are you’ve noticed this just like I have.

I didn’t become a multi-million dollar trader by trying to get in and out at the exact prices.

Heck, I’d venture to say that I get the exact tick less than 0.1% of the time.

That’s the way market movements and statistics work.

So why fight it?

Accept your wrongness and free yourself

Once you realize you aren’t likely to get the top or bottom tick, something clicks.

Why not assume you cannot pick it out and optimize that?

That is where the world of scaling begins.

Scaling into and out of trades isn’t a new concept.

But, it’s one that few of us readily accept.

When you know that trades can run farther, your mind immediately tries to think of ways to find a signal…some indicator that will tell you when it’s maxed out.

Scaling assumes you can’t do this.

Instead, you accept your inability to pick the exact right price and average in and out of trades.

But now I want to take this another step and explain how I lock in profits.

Don’t let a winning trade become a loser

Once I reach my first profit target, I take a portion of the trade off to lock in my profits.

Here’s the twist…

I set a breakeven stop on the remainder.

Doing this ensures that I never lose on the trade.

Now, you can expand this in many different ways.

One option is to set a stop at the last profit target as you scale out of a trade.

Obviously, at the first target, your initial stop will be breakeven. But once you take a second portion of the trade off, you can set the remainder to stop out at your 1st profit target.

Think of it as a modified trailing stop.

Another option is to actually lock in your breakeven.

Say my target on a trade is a 100% return on my options.

Once the options get to a 50% gain, I set a breakeven stop on the entire trade.

Doing this means I can’t lose (slippage aside).

Keep in mind, this can change the possible outcome of the trade as well as the win-rate.

But for a conservative-minded trader, this might make it easier for you to stick with a strategy.

Remember time decay

One last point I want to discuss is related to options trading.

Whenever you buy an option, each day that ticks by works against you.

In other words – your same target price for a trade may yield lower profits later on!

And it’s why I often will lock in profits early on long options trades.

Even if that level isn’t my ultimate target, the profit at that moment may be greater than the potential profit at a higher level if it takes too long to reach it.

That’s exactly why I locked in profits on those High Octane Options trades I spoke about at the beginning.

A few members asked me why I did this.

Everything I told them I laid out for you today.

But they get a leg up in the education department…being that they can view my trades in real-time (not to mention my alerts).

Click here to learn more about High Octane Options.

*Results presented are not typical and may vary from person to person. Please see our Testimonials Disclaimer here: https://ragingbull.com/disclaimer