California and ride-hailing services aren’t getting along at the moment.

However, this high stakes battle of chicken creates a unique opportunity for the savvy trader…

Opportunities I want to bring into the open.

Of course, it involves trading options.

But not the strategies you’re probably thinking about.

You see, trading a situation like this is all about timing…

…that’s why you have to be very careful with your strategy selection and aware of the role that time decay plays in these types of setups.

Why this case is so important

Uber and Lyft already struggle to turn an operating profit.

Investors like Japan’s Softbank Vision Fund already dumped $7.6 billion into the company….and they’re still underwater.

For the time being, the issue has been kicked to voters.

They’ll decide in November whether delivery and ride-sharing companies should be exempt from California’s gig worker law.

As a state inclined more towards workers, the decision here sets the stage for other places in the U.S., and around the world.

If Uber, Lyft, and other gig companies are forced to reclassify their workers as employees, it adds some major expenses to the equation.

Contractors are typically paid a fee with the expectation that they run their own business and deal with issues such as healthcare, etc.

Depending on the state, employees get sick time, paid time off, healthcare, and other benefits as mandated by law.

For companies that aren’t turning a profit yet, this creates a huge problem for them.

They don’t carry enormous amounts of debt.

But, they claim that such a move would destroy their business models.

The tussle comes at a precarious time where both Lyft and Uber saw ridership fall hard from the pandemic.

Based out of San Francisco, a ruling against the companies could do more than just shut down their California operations.

We’ve already seen Elon Musk threaten to move Tesla operations to other states because of government policies.

Either of these companies might follow suit, especially given the push towards remote work.

The ones who really get hurt are the drivers themselves, many of which rely in part or entirely on the income to sustain themselves.

This is also the same workforce most likely to be hit the hardest from the pandemic layoffs.

So, it’s kind of like a double whammy against them.

All this chaos leads to an environment ripe for profits.

You just have to know where to look…

Option plays

What we know now is that the issue isn’t likely to be resolved until the election.

So, it’s an educated assumption that the stock shouldn’t run up much higher or lower without any other reason.

This happens to be the biggest news impact to them.

That means I want to find strategies that take advantage of a range bound stock.

In comes the iron condor.

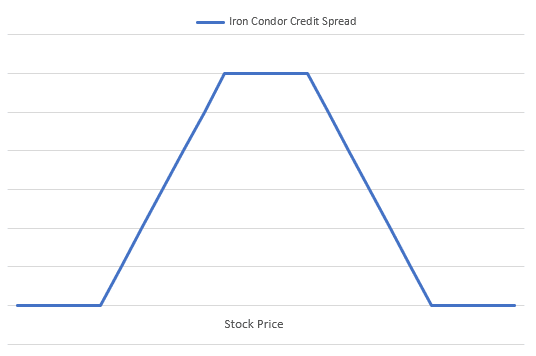

For those of you who aren’t familiar, an iron condor combines a put credit spread and a call credit spread.

The trade is considered ‘neutral’ since the goal is to have the stock get to expiration between the inner strikes of the setup.

Here’s how it might work out.

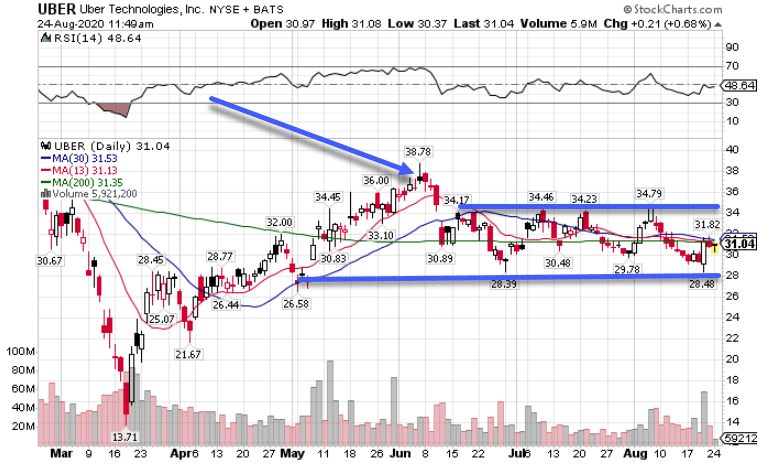

Take a look at the chart of UBER.

UBER Daily Chart

The stock appears to be bound by $28 and $34.

A potential trade setup might look like this:

- I sell the $28 put contract for next month expiration receiving $0.50

- I buy the $27 put contract for the same expiration spending $0.30 to cap my downside risk

- I sell the $34 call contract for the same expiration to receive $0.50.

- Again, I buy the $35 call contract for the same expiration for $0.30 to cap my upside risk.

- In total I receive a credit for this trade: $0.50 + $0.50 – $0.30 – $0.30 = $0.40 x 100 shares = $40

- The maximum I can make for this trade is $40 per spread

- My maximum potential loss is the distance between the strikes minus the credit I receive.

- In this case that’s $1 – $0.40 = $0.60 x 100 = $60 per spread

The payoff graph for the trade looks something like this.

If the stock gets to expiration and is between the inner strikes – $28 – $34 – then I achieve maximum profit.

Because this trade makes money through time decay, each day that passes works in my favor.

And, since I expect the stock to trade sideways, this is a perfect strategy for this situation.

Option basics

Now, if this strategy seems a little intense, don’t worry. I’ve got you covered.

Check out my Ultimate Beginners Guide to Options Trading to learn the basics that build the foundation for trades like these.

Click here to access my exclusive Beginners Guide to Options Trading.