How much do you trust this market?

Do you think it will rise forever?

Or are you waiting to short it… like your life depended on it?

Listening to the talking heads won’t help you find an answer.

But…

Analyzing the major markets will tell you everything you need to know!

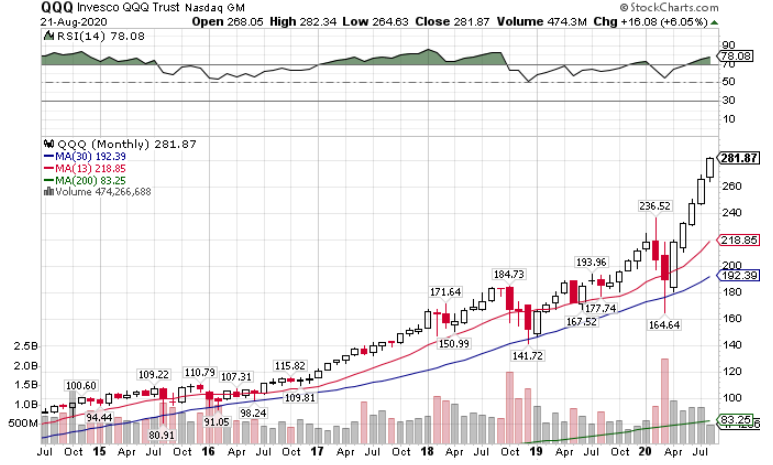

Now if you think a chart like this is sustainable…

QQQ Monthly Chart

You’ve got one thing coming to you.

Here’s my latest on where we go from here.

Concentrated gains

Most of us know by now that the majority of the index gains this year came from a select few stocks.

Tech giants including Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), Facebook (FB), and Google (GOOGL) account for the lions share of gains in the Nasdaq 100 and the S&P 500.

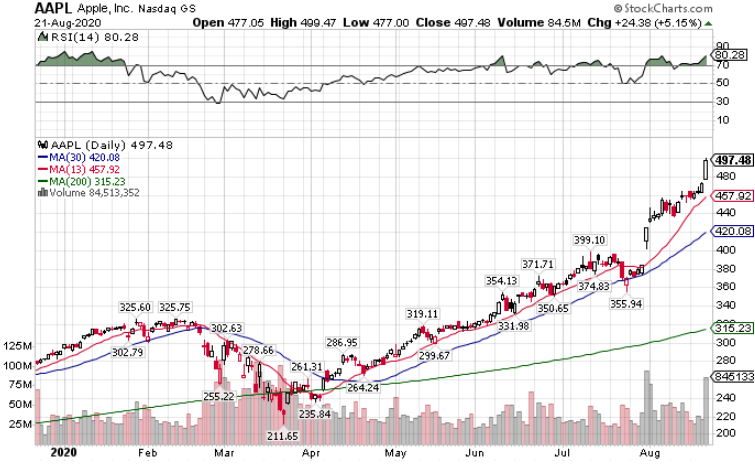

Heck, year-to-date, Apple is up over 60%!

AAPL Daily Chart

With Tesla (TSLA) and Apple (AAPL) announcing stock splits that set off a frenzied buying – the question becomes whether Amazon (AMZN) will be soon to follow.

AMZN Daily Chart

Ohh, and this monolith’s shares are up over 75% year-to-date.

This type of concentration and gains isn’t healthy.

How do I know?

Take a look at the small caps (IWM).

IWM Daily Chart

Year-to-date, this index is down 7.27%.

Talk about a tale of two markets.

For years, investors pointed to the S&P 500 as a broad-based index, something that represented the market and economy better than the Down Jones or the Nasdaq.

Yet, the growth of these giants skews the index so much that it’s beginning to lose its relevance.

A healthy economy needs participation from multiple sectors, especially the financials.

That hasn’t been the case.

In fact, financials are one of the worst performers this year outside of the energy sector.

XLF Daily Chart

For anyone who follows my newsletters, it shouldn’t be a surprise that the 200-period moving average acted

Financials aren’t just companies that you stuff into a retirement portfolio and never look at again.

They’re an integral part of the economy and tell us quite a bit about where the market might be heading.

And that’s much truer now than in the past for the following reasons.

The great debt binge

Amazon raised $10 billion at 0.4% during this pandemic in the debt market – thank you, Jerome Powell.

Large companies gained a huge advantage over smaller ones, allowing them to borrow at near-zero rates.

When this ends…chances are so will their rally.

And that brings me to the financials.

Banks make a good amount of their income based on net interest margin. That’s the difference between the rates they borrow and lend.

When rates are near-zero, they make squat.

Which makes sense considering how high bonds rose since the Fed stepped into the game.

TLT Daily Chart

And also why the bond chart is particularly disturbing.

Normally, I limit my money-pattern crossover to the hourly chart as I teach members of High Octane Options.

However, the rapid decline recently created a bearish crossover and a worrisome problem.

Not that I expect the big guys to issue or roll debt anytime soon.

But all it takes is the tiniest worry to send traders into a frenzy of self-loathing, selling everything in fear.

Protecting myself

One benefit of stocks near all-time highs is options get cheaper!

Take a look at the VIX and how much it’s declined since the peak.

VIX Daily Chart

No, it’s not down to where it was before the crash, but it’s significantly cheaper than it has been.

That’s why I’m using it to my advantage.

In my High Octane Options portfolio, I’m picking up long calls and puts at relative discounts.

That lets me participate in further potential upside, without tying up a ton of capital and putting my butt on the line.

One of my favorite ways to play this market is to buy call options in stocks I like and offset them with puts in the ones that I think will fall first.

It creates a somewhat ‘neutral’ stance that gives me a balanced approach to this market.

Could I potentially make more money putting all my eggs in one basket?

Of course.

But the name of the game is survival, not who can risk the most.

Insights from a professional trader

It’s hard enough turning a profit on your own, sifting through the noise of the financial news.

That’s why I created my High Octane service.

Every day you get my portfolio and proprietary scanner streamed live along with my current plan and outlook on the market.

Cut the learning curve and give yourself a real education.