Can our economy recover if more than 10% of the population is unemployed?

And shouldn’t we be getting back to normal by now?

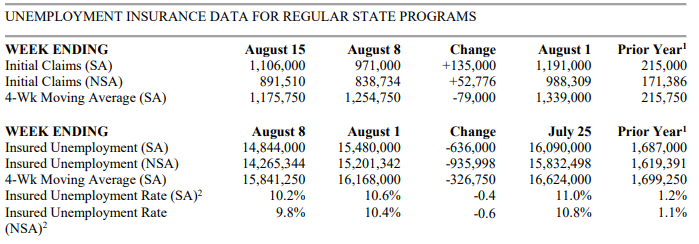

Last week’s jobless data reversed recent trends with week over week initial claims rising.

Department of Labor Weekly Unemployment Data

Our Jump on the Week unpacks the diverging narratives hitting the wires.

Every other data point we’ve received tells a completely different story.

Home sales sizzle while retail continues its recovery.

Even airline traffic is slowly returning despite travel restrictions.

So what’s the real story?

Does the market even care?

The balloon waiting to burst

It’s a weird dynamic.

Tens of millions of folks out of work.

Yet, none of the data shows the economy falling apart.

Even credit card debt remains low.

For all this – you can thank Congress.

Yes, despite their constant ineptitude, the stimulus bill did what it was supposed to – stimulate the economy.

Or more appropriately said, it kept it from falling apart.

Generous unemployment benefits, direct consumer payments, as well as other initiatives helped stem the bleeding.

Couple that with years of solid economic growth and there’s a nice cushion to catch the fall.

Here’s the problem.

That only lasts as long as the money does.

And right now, none of our politicians seem to care about continuing the support.

Chances are they won’t bother until things get bad enough like during the last government shutdown.

How long can folks continue like this before things get really bad?

That’s tough to say.

Eviction moratoriums keep many residents in their apartments and homes…for now.

Eventually, that kick-the-can-down-the-road strategy will rear its ugly head.

Here’s the order of data decline I expect to see:

- Increased credit card debt

- Lower retail spending

- Falling consumer sentiment

It may not occur in that exact order, but these should give us a clue of things to come.

But one major theme will dominate the coming week.

Back to school

We end August and start our swing into September – AKA school season.

Around the country, districts balance in-person and virtual learning.

We’ve heard a few stories about the spread of COVID, but they’ve been anecdotal for now.

Major hotspots like Florida, Texas, and California have seen caseloads decline, as well as the U.S. overall.

In a strange turn of events, European countries are contending with a resurgence.

The next few weeks are do or die for the school year.

We’ll find out very quickly whether fears of Coronavirus spreading through children at school are real – or whether the fears are overblown.

Most of that depends on the vaccines and treatment which are chugging along but running into a few snags.

Vaccine update

Last week, Johnson & Johnson (JNJ) announced one of the largest phase 3 vaccine trials to date with over 30,000 volunteers.

That’s going to be interesting considering a major problem affecting current studies – volunteers.

Current phase 3 trials have struggled to get enough minority participants for their studies. That’s particularly troublesome considering how disproportionately they’ve been hit with infections.

Keep in mind that many vaccine treatments only are 40%-60% effective. That leaves a lot of room for error.

While there hasn’t been as much focus on it, Coronavirus treatments will be a vital tool in fighting the disease and returning to normalcy.

Turning information into trades

This week, I’ve got my eye on Moderna (MRNA). The company’s at the forefront of the Coronavirus fight and shares could move in a big way on the slightest news story.

But my best trade idea of the week is reserved for Bullseye Members.

They get my top trade idea for the week delivered to their inbox Monday morning.

A trade idea aimed at hitting+100% on my options contract selection.

Are you ready?

Click here to learn more about my Bullseye Trade of the Week.

Expected earnings dates listed in (…)

Stocks I want to bet against this week…

SC, DFS, PENN, IWM, SNAP, ROKU, SPOT, WK, ECL, TWLO

Stocks I want to buy this week…

MJ (none), DKNG (Nov 13), ZM (Sept 3), CVNA (Nov 4), CARR (July 30), GDX (none), RNG (Nov 2), NEM (Nov 3), CLX (Oct 29), RH (Sep 8), SHOP (Nov 3), JNJ (Oct 20), MSFT (Oct 28), TTD (Nov 5), GOOGL (Oct 26), FSLY (Nov 5), WMT (Aug 18), WORK (Sept 2), TWTR (Oct 27), AVLR (Aug 5), SQ (Aug 5), JD (Aug 11), NET (Nov 5), ADBE (Sept 25), MCD (Oct 27), COST (Oct 1), FB (Nov 4), PYPL (Oct 28), MTCH (Nov 4), ZEN (Nov 3)

This Week’s Calendar

Monday, August 24th

- 8:30 AM EST – Chicago Fed National Activity Index July

- Major earnings: Palo Alto Networks (PANW)

Tuesday, August 25th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 9:00 AM EST – Case Shiller Home Price Index June

- 10:00 AM EST – Consumer Confidence Index August

- 10:00 AM EST – New Home Sales August

- 10:00 AM EST – Richmond Fed Manufacturing Index August

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Autodesk (ADSK), Autohome (ATHM), Bank of Montreal (BMO), Best Buy (BBY), Children’s Place (PLCE), Hain Celestial Group (HAIN), Hewlett Packard Enterprise (HPE), Hormel Foods (HRL), Intuit (INTU), J.M. Smucker (SJM), Medtronic (MDT), Salesforce (CRM), Toll Brothers (TOL), Urban Outfitters (URBN)

Wednesday, August 26th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Durable Goods Orders June

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Box (BOX), Dick’s Sporting Goods (DKS), NetApp (NTAP), Splunk (SPLK)

Thursday, August 27th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – GDP Q2 Revisions

- 10:00 AM EST – Pending Home Sales Index July

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Abercrombie & Fitch (ANF), Burlington Stores (NURL), Dollar Tree (DLTR) Gap (GPS), HP (HPQ), Marvell Technology (MRVL), Veeva Systems (VEEV), Workday (WDAY)

Friday, August 28th

- 8:30 AM EST – Personal Income, Consumer Spending, & Inflations July

- 9:45 AM EST – Chicago PMI August

- 10:00 AM EST – Consumer Sentiment August

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: HIbbett Sports (HIBB)