Rules, structure, and discipline.

All essential ingredients that make a top performing trader.

However, top traders are also flexible, and understand when it’s OKAY to go against the rules.

Today I want to share with you a story about how I did it…

At the worst point, my options lost 74% of their value!

Did I cut my losses and walk away?

I added to the trade!

The next day, I was staring down the barrel of a nearly 100% Winner.

A High Octane Options trade that certainly tested my patience*

*See disclaimer below

It’s not easy to hold onto a losing trade, let alone add to it.

Most of us have a horror story where we got burned doing that.

But, this one was different and I want to explain why.

Because you need to understand when a trade is broken or whether it’s still valid.

From start to finish, I managed my risk appropriately.

I was comfortable with losing, knowing I made the best decisions.

My stop losses were never hit, even though the trade took forever.

Let’s break down the trade from start to finish so you can get a clearer picture.

By the end of this, I want you to look at your trades and know whether you should add or cut it loose.

Define the setup

It doesn’t matter what you trading style is, or which market you play in, EVERY trader should have a clearly defined setup.

We throw that term around a lot, but what is a setup?

A setup is a situation that falls within a common framework that a person uses to execute a trade.

Any setup you have should include the following:

- Identifiable parameters such as a chart pattern, candlesticks, or even a type of news story that is repeated

- Profit target

- Stop loss

Now, some traders may use trailing stops, a percentage lost or gained as their stops and targets – all of these are fine.

The key point is that you have these identified PRIOR to making the trade.

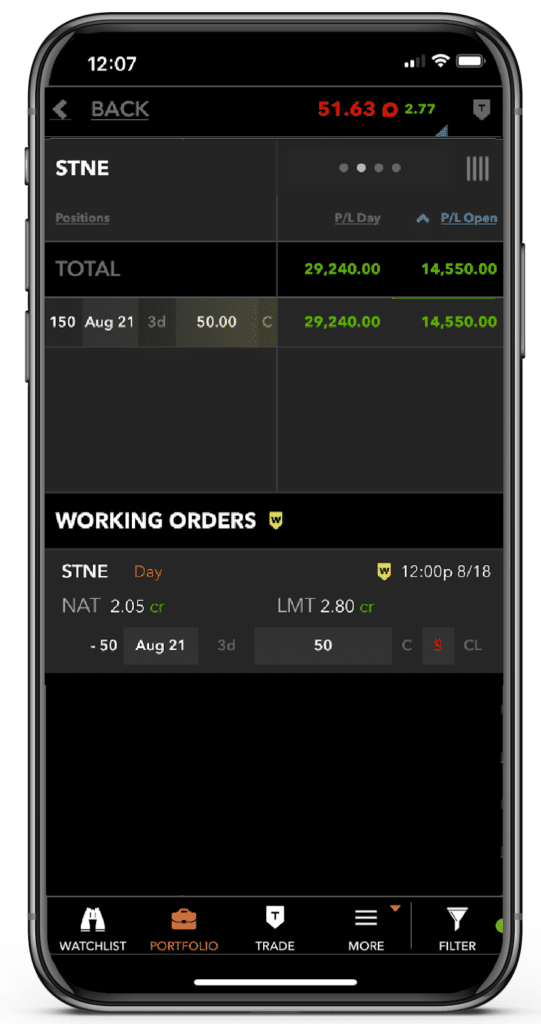

Let’s take a look at the STNE setup.

STNE Hourly Chart

Here’s how this particular setup works.

- You get a sharp move higher on a significant increase in volume.

- Price retraces back to near the breakout, preferably with the moving averages.

- I enter the trade at that point with a target about halfway up the first move

- My stop is a close below the recent low.

In this case, my stop would be that little swing point at $46.23. My target was around $52, where you can see a little gap window that formed when price fell back.

My preferred method of trading is to use options. They provide me additional leverage for the capital.

However, they lose value over time.

Since this trade came off the hourly chart, I went out to the Friday expiration roughly two weeks into the future.

Because I was so close to the stop out area, there wasn’t a price that I wanted to add.

Instead, I noted that if time decay ate away enough of the option premium (price), that I would add closer to expiration.

You can see how the stock barely moved for days on end. Each day that passed by, my options were worth less and less.

Eventually, they got down to half of what I paid for them. That was when I decided to add to the trade.

Once I did that, I only had a few days left until expiration. If the stock didn’t show promise within 72 hours of expiry, I would have cut the trade loose.

Why I stayed in the trade

As you can see on the chart, at no point did my chart pattern break down. The idea itself still worked.

I was losing because of option time decay.

If I had sold a put credit spread, then I wouldn’t have needed to worry as that just required the stock to finish at or above the upper strike price at expiration.

Another choice I had would be to roll out the trade to a later expiration date, cutting down on the time decay.

In this case, I added to the trade when it was worth half of the original price. I made this decision when I first entered the trade.

Doing that let me define my losses from the outset. That way, I wouldn’t be surprised if I got smoked.

Understanding risk management

I can’t stress enough how important risk management is.

No other skillset makes or breaks a trader.

Which is why option fundamentals are a crucial part of every traders’ toolkit.

You can learn all about options, portfolio allocation, choosing the right option contract, and more in my Total Alpha Options Masterclass.

And it’s starting soon.

Click here to register for my Total Alpha Options Masterclass.