Over the weekend, I received a question from a High Octane Options member.

Some of it dealt with the crude oil price crash from a few months ago…when the futures actually traded negative.

But they weren’t asking about crude oil.

Instead, they wanted to know if a similar dynamic could occur in gold and silver etfs.

Most people wouldn’t be able to draw the connection, but I did.

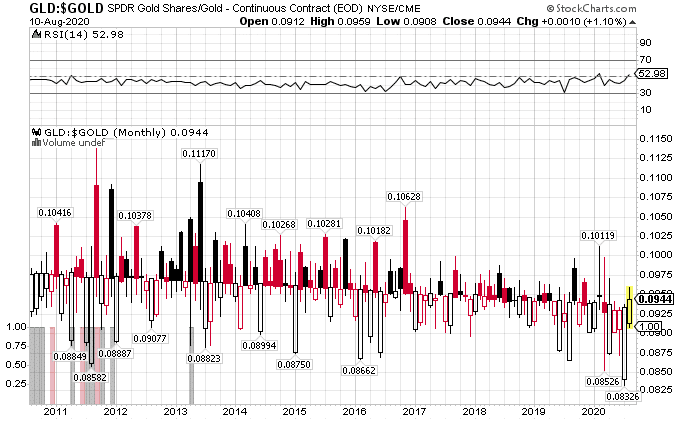

However, before I share my answer, take a look at the chart comparing GLD to Gold over the last decade.

GLD/Gold Ratio Monthly Chart

What it shows is that the GLD loses value over time, more than management fees would imply.

That means the inventory in their warehouse doesn’t cover all their shares and they’re using something like futures or otherwise to achieve the price tracking objectives.

But that’s just the tip of the iceberg.

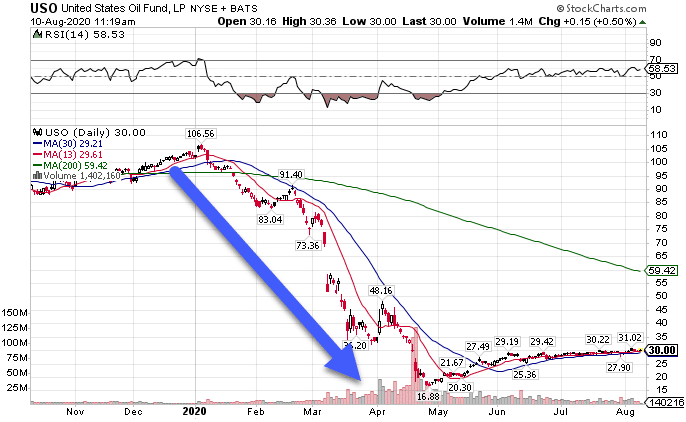

The USO example

Earlier this year, we witnessed something unprecedented with oil.

Futures contracts priced crude oil negative, for the first time ever.

Full storage in Cushing, Oklahoma, meant that traders holding long futures contracts would be forced to take delivery of the physical asset.

That caused selling en-masse, a huge portion of which was driven by the USO ETF.

USO Daily Chart

The critical point here is the problems stemmed from the futures market, also known as a derivative.

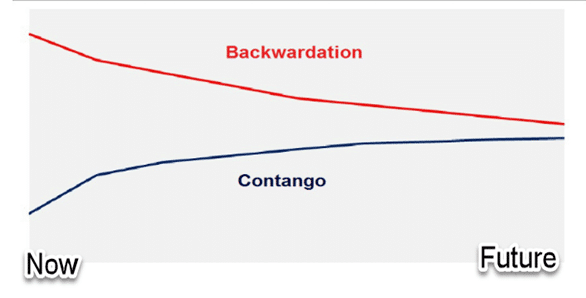

Under normal conditions, non-perishable assets that require storage trade in a futures curve known as contango.

This means futures contracts farther out in time will cost more than shorter-dated ones.

When ETFs use futures contracts for exposure, they need to constantly roll them as each month expires.

That’s why UNG and USO would lose value over time as would the VXX and UVXY which also trade in Contango.

These don’t affect the GLD and SLV ETFs to the same degree, but they are still there, lurking in the background.

GLD & SLV inventory problems

Neither of these ETFs holds enough inventory to cover redemptions if it came to that.

Is that a huge risk?

Not really as you need to own something like 100,000 shares of GLD to make that request.

When you buy shares of GLD or SLV you do so through an ‘Authorized Participant.’

They are the ones that find a custodian bank to source and store the inventory, gold, or silver.

These guys can subcontract that out to smaller banks as well.

So, you go through a giant shell game and still don’t own any actual gold. You rely on these 3rd parties to make sure your investments are preserved.

That’s a difficult pill to swallow given how poorly many of the banks did in 2008.

But, let’s dig into some real possibilities of what this practically means.

I don’t got the goods

Even though it takes a lot to redeem shares for inventory, there’s a real possibility it could happen.

In such an event, the ETF is actually allowed to say, ‘Sorry, we’ll fill your order later or never.’

You heard that right.

If they don’t have the inventory to cover the orders, they can tell the requestor to shove off.

Doesn’t fill any of us with confidence?

Futures deliver problems

Try going online right now and buying gold bullion or silver. It’s nearly impossible.

Finding the physical metal has become a challenge, even for the most seasoned investors.

A while back, I wrote about how there was a potential crisis with gold futures brewing. It was big enough to catch the attention of Congressmen.

Those same issues still exist.

Too many people own outstanding gold and silver futures contracts, without enough inventory to cover the potential redemptions.

Short version – failing on deliveries would throw the whole system into chaos as it would erode trust in the function of the markets.

Cheap ways to play the outcome

You probably already know I’m big into trading options.

They provide me the exposure without the risk of owning some of these ETFs outright.

Because of the liquidity, there’s a wide array of strategies available for me to play.

One that I currently like is buying far out-of-the-money puts or put butterflies.

Both are cheap ways to play an unlikely crash, but one that could pay out big if it happens.

Now, if you’re not familiar with these strategies don’t worry.

The best place to start is with my Ultimate Beginners Guide to Options Trading.

Here you’ll get a crash course on options trading, delivering some quick education on how I play the options markets.

Click here to watch my Ultimate Beginners Guide to Options Trading.