Many of the markets entered ludicrous territory lately…

Where investors talk about fundamentals like some quaint relic from a bygone era.

No market highlights this better than gold.

As more bulls crowd this trade, the chances it falling off a cliff increase dramatically.

A house of cards ready to fall into the sea!

Betting against this run has been a losing proposition…so far.

Yet, there are signs of an imminent reversal.

Ones you can spot and turn to your advantage.

Most of them hide in plain sight, waiting for you to spot them.

Yet, that’s only half the battle.

From there, you want to select the best trade possible.

Not to worry.

I’m going to highlight what to look for and some options strategies designed for this environment.

Why gold is up

Before we get into the signals around gold, we need to discuss why gold is on this rocket ride.

We aren’t being driven by the traditional demand from Asia. In fact, there’s been a need to move physical gold from Europe to the United States.

What’s taking place is a flight to safety.

During times of economic uncertainty, investors like to buy gold. It’s been a store of value longer than any government on Earth, so it makes sense.

Because gold is priced in U.S. dollars, it can also be a hedge against inflation.

And that brings us to a key discussion topic.

Dollar vs gold

Recently, we’ve seen the U.S. dollar drop over a number of weeks, declining nearly 10%.

With gold denominated in dollars, there’s a direct correlation in its rising prices, all things being equal.

The same goes for any hard assets such as commodities, real estate, and others.

That’s why we can actually use the dollar to predict a potential top in gold.

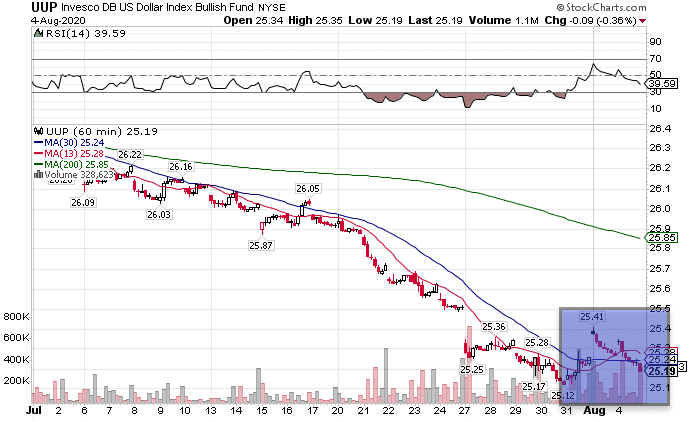

Looking at the daily chart of the dollar, it’s clearly in a downtrend.

However, the last few days show potential signs of a bottom.

UUP Hourly Chart

Compare that to gold which seemed more to pause when it got to $2000 an ounce rather than reverse.

If the dollar keeps rising, it creates a natural headwind on gold, making it harder to keep climbing.

But that’s not the only indication things are about to turn.

Crowded trade

Investors in the gold market like to look at the Commitment of Traders report on gold futures.

This report tells us what the net positions are for various groups of traders such as speculators, commercial, and non-commercial entities.

Commercial traders provide a good gauge as to the extremes in the market.

I look at where they are at relative to their positions over the last year or so.

While they aren’t at their shortest positions ever (usually a sign of a top), they’re very close.

In fact, they’ve started to flatline if not decrease their short positions.

While that may seem bullish to you, that actually means that on the other side of the trade, investors are locking in their gains. As this increases, the chances of gold pulling back grow.

Now, let’s get into the meat of designing a trade.

Choose your weapon

First things first. We need to decide which stock or ETF we want to trade.

The most popular are the GLD ETF, which tracks gold prices, or the GDX ETF, which follows gold miners.

Miners tend to move ahead of gold and have larger price swings. However, they are still stocks of companies and prone to general market declines.

There is also the junior gold miners ETF GDXJ for even larger price swings.

Once you decide in the vehicle, it’s time to figure out how you want to trade.

My preferred method is through options. They allow me to limit my risk while gaining leverage.

Two of my preferred strategies in this situation would be buying puts or selling a call credit spread.

Buying puts gives me the most directional exposure. I’d choose this route if I thought gold would decline hard and fast.

Selling a call credit spread is a defined risk trade where I decide how much I want to risk and win from the outset.

It involves selling a call option at or above the current stock price and buying another above that to cap the trade.

For that transaction, I get paid a credit. If the stock closes below the lower strike price at expiration, I get to keep the credit.

Which I choose depends on two factors.

First is my opinion of the reversal. If I expect it to be sharp and fast, I’m more likely to buy a put options.

Second is implied volatility. This goes into the price of an option. It’s basically trader demand for the options. If implied volatility is high, I would sell a call credit spread and take advantage of the rich option prices.

Open up a world of options

Don’t limit yourself to just buying and selling stocks like everyone else.

Learn the power of trading options.

Sign up for my Total Alpha Options Masterclass kicking off soon.

Here you’ll learn some of my favorite trading techniques and strategies that I use in my trading to this day.

Click here to sign up for my Total Alpha Options Masterclass.