During periods of fear and uncertainty, option volatility (better known as implied volatility) will rise.

When the overall market establishes a bullish trend and complacency replaces fear—implied volatility contracts.

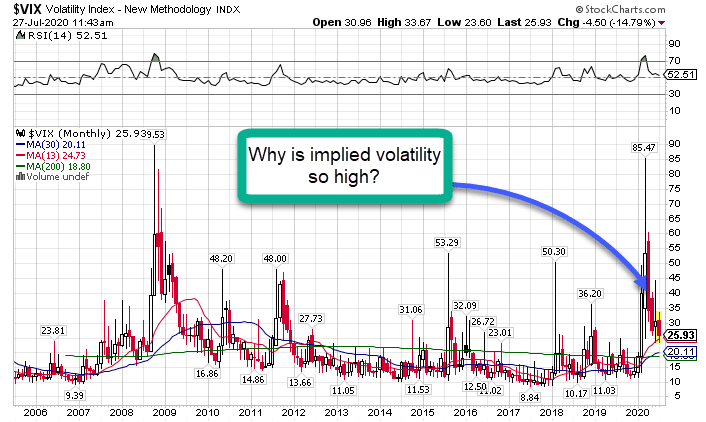

Traders rely on the VIX to gain a pulse on the market’s volatility.

During the peak of the COVID crisis in March, the VIX exploded to a high of 85.47.

It has since dropped below 26.

Rarely does it stay elevated for long.

VIX Monthly Chart

And despite the massive rally we’ve seen in the stock market…

…implied volatility is relatively high.

Why should you care?

Simple.

You can actually devise strategies that take advantage of high implied volatility.

I want to show you how they work.

But most importantly, how you can make meaningful profits from adapting these strategies.

Implied volatility and option prices

Three things comprise option prices: distance between the strike price and current price, time until expiration, and implied volatility.

We can control the first two with the option contract we select. The third one implied volatility, we cannot.

Instead, we choose when we want to sell options.

Think of implied volatility as demand for insurance. Wouldn’t you rather sell home insurance policies after a natural disaster than before, maximizing the price you get?

That’s what we’re talking about with high implied volatility.

By selling when IV is higher than usual, we get one of two benefits: receiving a bigger premium or wider strikes.

Here’s an example.

Say I want to sell a put credit spread on the SPY going out two weeks. The SPY currently trades at $320.

I would do the following:

- Sell the $315 puts for $15

- Buy the $310 puts for $13

- Receive a credit of $2

If implied volatility was at normal levels, I might only receive $1 for that trade. Similarly, if I moved the strikes up to $312 and $317 I would $2 in normal times but $3 now with high IV.

All of this assumes that implied volatility does what it historically has – moves towards the average.

Turning this to an advantage

Over time, implied volatility will go back to its historical average.

The broad market volatility measure known as the VIX typically sits between $15-$18.

Right now, it’s trading around $25.

What we can do is WAIT until we get a spike in volatility. That’s when we strike!

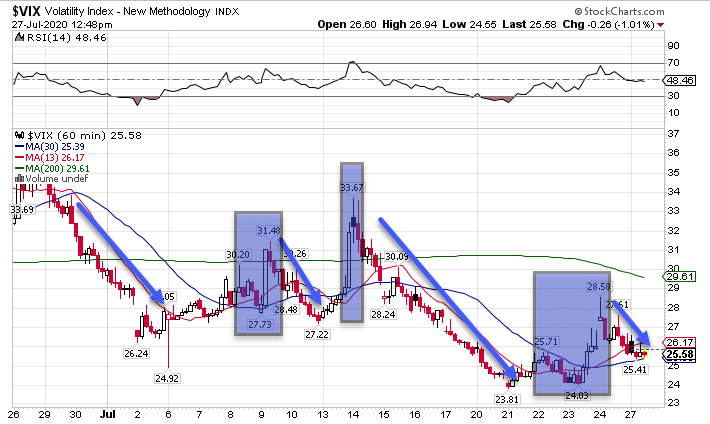

Look at the VIX over the last month.

VIX Hourly Chart

Every time the VIX runs higher, it eventually sells off.

So, if we sell premium (options) into those spikes, not only do we get time decay working for us, but implied volatility contraction.

How much is this worth?

That depends on the magnitude of the move in volatility as well as the time left until expiration.

The way I trade these in my Total Alpha Portfolio, it often accounts for about 20% of the total profits I’m looking to collect.

And that’s just with defined risk trades such as iron condors and credit spreads.

Wide iron condors or strangles (undefined risk trades), receive a much greater benefit sooner from implied volatility contraction.

The only problem is they aren’t as capital efficient (requires a lot of money to trade) and carry higher potential losses.

What happens if implied volatility increases?

This is the one risk you can’t avoid. There’s always a chance it can go the other way.

We saw in early March how implied volatility can keep expanding well beyond what most of us think.

That’s why risk management is important.

It’s not enough to limit the capital you commit to one trade, but also the total capital at play at one time and per expiration cycle.

I like to carry a basket of trades that expire at different times to hedge this risk.

By picking my spots when I sell premium, I increase the odds of success. Spreading out my trades to different expirations further reduces my risk of getting the timing wrong.

Think of it as another form of diversification.

Which setups work best

Every trade I take starts with a setup. Great setups identify entries as well as profit targets and stop areas.

One way to cut through the clutter is with my High Octane Options Scanner.

This proprietary scanner identifies potential ‘money-pattern’ setups that I want to trade.

Along with my other handpicked option trades, members get to see my orders in a live stream broadcast during market hours.

You don’t want to miss this.