Sometimes we set the bar so low, it’s hard not to achieve success.

Using the Coronavirus as cover, analysts slashed expectations, making them and the companies they cover look like rock stars.

Newsflash to all the analysts out there…

Frankly, I’ve got better things to do with my time.

While they’re blabbing about a non-existent recovery, I’m actually digging through charts to find real trade setups for High Octane Option Members that don’t rely on fake earnings.

I explain to High Octane Options members why and how I took these trades *

*Please see disclaimer below

And this upcoming week isn’t any different.

That’s why this week’s Jump takes a slightly different take.

Earnings themselves won’t matter – all that happened in the past.

What the market cares about is GUIDANCE!

While most companies won’t have much to say, there are a few earnings that are worth watching.

And I’m going to show you a strategy to take advantage of the non-events…

Plus, there’s a looming deadline for politicians to stave off potential calamity…and we all know how well they do with those…

Earnings are like garbage bins…they all stink!

Few companies are providing guidance for the upcoming year. Notably, Netflix gave subscriber forecasts, which happened to be lower than Wall-Street’s expectations.

Realistically, the lack of information creates a big question mark around these events.

And traders will struggle to figure out how to play them.

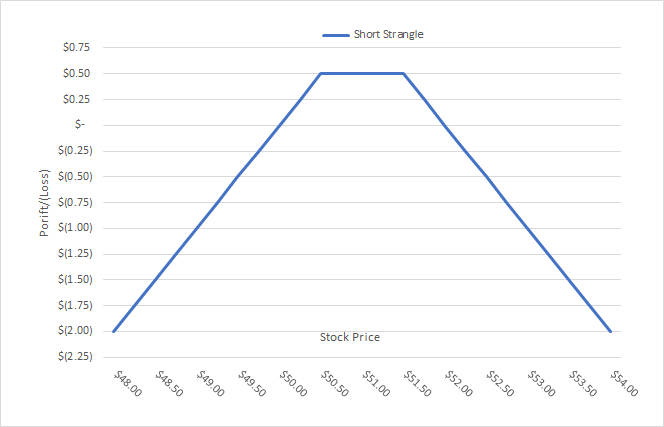

But one interesting way to play them is by using a strategy known as the ‘strangle.’

A strangle can be a risky strategy if you’re not careful.

It involves selling an out-of-the-money call and put simultaneously, with a payout graph looking something like this:

Strangles benefit from implied volatility decay much faster than a typical iron condor.

And since implied volatility is extremely high right before earnings and drops right after, it creates an ideal setup to execute this trade.

The trick to using these for earnings is to find stocks where the implied volatility overstates the historical moves.

For example, say that implied volatility says the stock will move by 5% by the end of the week. However, when you look at the historical post-earnings moves, the stock only moves 3% most of the time.

You can sell a strangle out-of-the-money strangles at 5% from the stock’s current price (or further).

So, if history and probabilities hold, the stock should stick to its historical trends and land inside the strikes.

Even if it doesn’t, the IV decay immediately after earnings can be enough to turn a profit all on its own.

If all this sounds Greek to you, then don’t worry. I’ve got just the thing.

Here is a link to my Ultimate Beginners Guide to Options.

This will start you on the path to learning how to understand and create strategies like these.

Let’s all go jump off a cliff

For weeks, we’ve heard about the economic stimulus coming to an end. Congress and the President know they need to continue pumping money or risk economic calamity.

So we’re all in agreement right?

Yeah, I thought not…

I mean, why should things actually happen for once?

Current negotiations center on the size and implementation of the next stimulus.

Republicans and the President want $1 trillion max and Democrats want more.

There’s also wide disagreement on how the money should be spent.

So we’re headed towards another fiscal cliff that is only exacerbated by campaign season kicking off.

My sense is President Trump needs the economy and stock market moving in the right direction more than Democrats do, and Democrats know this.

I’m not being callous, just saying how I objectively see it.

Democrats will likely put the screws to the President knowing that he needs the win to get what they want, or at least the size and implementation.

In the end, it won’t be something either is happy with but both will claim victory.

Where that leaves traders

At the moment, markets don’t care one lick about what’s going on. The Fed’s funny money continues to push equities higher.

To that end, I’ve been keeping my High Octane trades short and sweet, trying to capture quick hits here and there.

Markets can and do change on a time. It’s not a question of if…it’s a question of when.

With so many stock choices out there, one way to get started is with my Bullseye Trade of the Week.

Here you get my full plan laid out for you so you can follow along and see exactly what I’m thinking and how I plan to execute the trade.

This is my best options trade idea for the week, delivered to you.

Click here to learn more about Bullseye Trades.

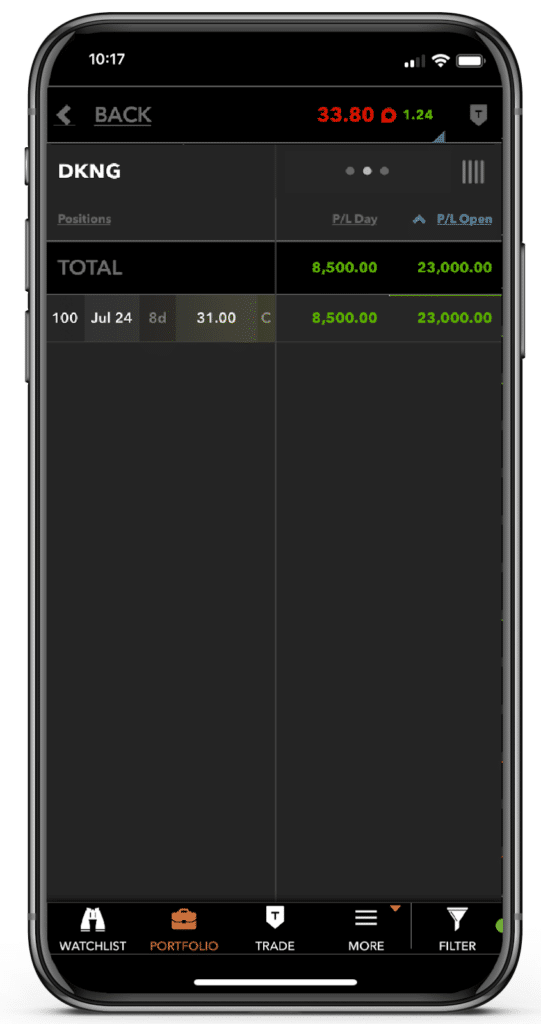

SC, DFS, PENN, IWM, SNAP

Stocks I want to buy this week…

MJ, DKNG, FSLY, PYPL, OKTA, ZM, TWLO, MTCH, NOW, CVNA, ABT, GAN, ECL, CARR, GDX, EXPE, RNG, NEM, CLX, EBAY, VAPO, NKLA, CTXS, COUP, WK, PTON, SHLL, RH, AVLR, SHOP, JNJ, SONO, MSFT, SPOT, TDOC, TTD, GOOGL, ROKU, CRSP

This Week’s Calendar

Expected IPOs for the week: Jamf Holding (JAMF) 16M share IPO pricing between $17-$19 per share.

Monday, July 20th

- Major earnings: Cadence Design Systems (CDNS), Halliburton Co (HAL), ManpowerGroup Inc. (MAN), Old Natl Bancorp(Ind) (ONB), PetMed Express (PETS), American Campus Communities (ACC), BancorpSouth Bank (BXS), Crown Hldg (CCK), Equity Lifestyle Properties (ELS), Limelight Networks Inc (LLNW), Steel Dynamics (STLD), Zions Bancorp (ZION)

Tuesday, July 21st

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Chicago Fed National Activity Index June

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Avangrid Inc (AGR), AAR Corp (AIR), TD Ameritrade Hldg Corp (AMTD), Calix Inc (CALX), Cap One Finl (COF), Carlisle Cos (CSL), Hope Bancorp Inc (HOPE), Interactive Brokers Grp Inc (IBKR), iRobot Corporation (IRBT), Intuitive Surgical (ISRG), Navient Corp (NAVI), Pinnacle Finl Partners (PNFP), Snap Inc (SNAP), Summit Materials Inc (SUM), Teradyne Inc (TER), Texas Instruments (TXN), United Airlines Hldgs Inc (UAL), W R Berkley Corp (WRB), Wintrust Finl (WTFC), Commerce BancShares Inc (CBSH), CIT Grp Inc (CIT), Comerica Inc (CMA), Fulton Finl Corp (FULT), Graphic Packaging Hldg Co (GPK), Coca-Cola Co (KO), Lockheed Martin Corp (LMT), PACCAR Inc (PCAR), Prologis Inc (PLD), Philip Morris Intl Inc (PM), Signature Bank (SBNY), Synovus Finl Corp (SNV), Synchrony Finl (SYF)

Wednesday, July 22nd

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:00 AM EST – Existing Home Sales June

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Amphenol Corp A (APH), Biogen Inc (BIIB), Baker Hughes a GE Co Cl A (BKR), Cadence BanCorp (CADE), Dover Corp (DOV), Evercore Partners Inc (EVR), HCA Healthcare Inc (HCA), IQVIA Hldgs Inc (IQV), KeyCorp (KEY), NASDAQ Inc (NDAQ), New Residential Inv Corp (NRZ), Northern Trust (NTRS), Silgan Hldg (SLGN), Thermo Fisher Scientific Inc (TMO), Align Tech (ALGN), BrandyWine Realty Trust SBI (BDN), Chipotle Mexican Grill Inc (CMG), CSX Corp (CSX), Discover Finl Svcs (DFS), Danaher Corp (DHR), First Industrial Rlty Tr (FR), Graco Inc (GGG), Helix Energy Solutions Grp (HLX), Kinder Morgan Inc (KMI), Las Vegas Sands Corp (LVS), Microsoft Corp (MSFT), Meritage Homes Corporation (MTH), SEI Inv (SEIC), SLGreen Realty (SLG), SLM Corp (SLM), Texas Cap Bancshs (TCBI), Trinity Industries (TRN), Tesla Inc (TSLA), Umpqua Hldg (UMPQ)

Thursday, July 23rd

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing July

- Major earnings: Associated Banc-Corp (ASB), BJ’s Restaurants Inc (BJRI), Columbia Banking System Inc (COLB), eHealth Inc (EHTH), E Trade Finl Corporation (ETFC), Edwards Lifesciences Corp (EW), FirstEnergy Corp (FE), Glacier Bancorp (GBCI), Intel Corp (INTC), Manhattan Associates (MANH), Mattel, Inc (MAT), MaxLinear Inc (MXL), Bank OZK (OZK), People’s United Finl Inc (PBCT), Scientific Games Corp (SGMS), SVB Finl Grp (SIVB), Skechers U.S.A. (SKX), Skyworks Solutions (SWKS), Del Taco Restaurants Inc (TACO), Verisign Inc (VRSN), The Alkaline Water Co Inc (WTER), American Airlines Grp inc (AAL), AllianceBernstein Hldg L.P. (AB), Alliance Data Systems (ADS), Alaska Air Grp Inc (ALK), AutoNation Inc (AN), Air Products & Chem Inc (APD), The Blackstone Grp Inc (BX), CMS Energy (CMS), Cintas Corp (CTAS), Citrix Systems Inc (CTXS), Quest Diagnostics (DGX), Dow Inc (DOW), Entegris Inc (ENTG), Freeport-McMoRan Inc (FCX), Fifth Third Bancorp (FITB), Huntington Bancshares (HBAN), The Hershey Co (HSY), Kimberly-Clark Corp (KMB), Southwest Airlines Co (LUV), M&T Bank (MTB), Nucor Corp (NUE), PulteGroup, Inc (PHM), Patterson-UTI Energy (PTEN), Reliance Steel & Aluminum (RS), AT&T Inc (T), The Travelers Companies Inc (TRV), Tractor Supply (TSCO), Twitter Inc (TWTR), Union Pacific Corp (UNP), Valley National Bancorp (VLY), Webster Financial Corp (WBS), Whirlpool Corp (WHR), West Pharmaceutical Svcs (WST)

Friday, July 24th

- 9:45 AM EST – Markit US Manufacturing & Services PMI July

- 10:00 AM EST – New Home Sales June

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Altra Industrial Motion Corp (AIMC), American Express Co (AXP), Bloomin’ Brands Inc (BLMN), First Hawaiin Inc (FHB), Gentex Corp (GNTX), Honeywell Intl (HON), Idex Corp (IEX), NextEra Energy Inc (NEE), NextEra Energy Partners LP (NEP), Schlumberger Ltd (SLB), TRI Pointe Grp Inc (TPH), Verizon Communications (VZ)