Tell me if this sounds familiar…

You try to do the responsible thing and set a stop loss (ensuring you don’t lose more than you want)…

The stop gets triggered and exits you out of the position…

…the stock then suddenly reverses and goes in the intended direction you thought it would…

…except you’re no longer in the trade.

What if I told you there was a way to limit these type experiences…

…and instead of frustrating you…

…stop losses doing what they’re actually supposed to…

…protect you from further losses.

You see, there are places where you should probably never set a spot.

I’ll teach you where they are, as well as, help you improve your stop selection.

If you’re tired of getting stopped out then this lesson is a must.

What is a stop run

Stop runs are designed to do one thing – push retail traders out of their positions.

But don’t take it personally, it’s nothing against you.

Most of the time, these guys are just trying to fill orders for their clients such as pension funds and the like. Their clients expect them to get the best possible prices.

If they try to buy or sell at the market, they’ll move price, plain and simple. To avoid that, they need someone to trade against…and that person is you.

Now, there’s a handful of ways they’ll try and do this. Plus there are different types of traders that they’ll try to snag in their web.

Keep in mind, some of them have more tools at their disposal. Market makers can see deep into the order book (where resting orders wait), and create plans around them.

How are they engineered

As crazy as this may sound, they sometimes engineer these stop runs! However, that happens more on intraday timeframes than anywhere else.

Let’s start with learning how to identify them.

One of the easiest ways to look for them is to find swing points or consolidation ranges. Traders like to use these to trade against, using them as their stop outs.

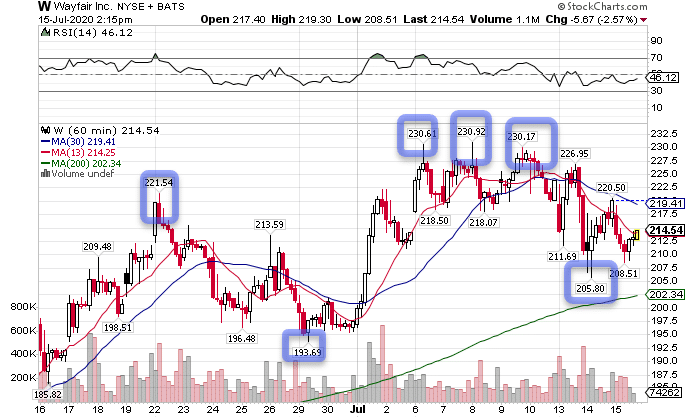

Here’s a look at chart of Wayfair (W).

W Hourly Chart

Blue circles point out where there are obvious swing points. Especially with the three up at the top on the right side, you can see how they either barely break over or fall just short. That is stop hunting at its finest.

Here’s a look intraday at how this can play out.

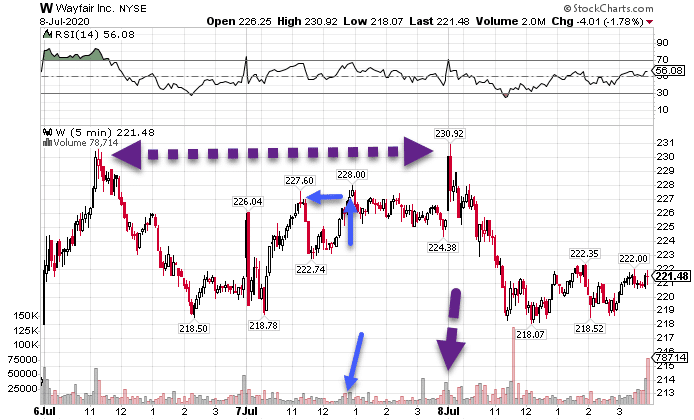

W 5-Minute Chart

I’ve got two scenarios here that I want you to look at. Purple arrows show how a break of the previous high from the prior week showed spike in volume. While that happened at the open, that is still what a stop run looks like.

Think about why this happens. Imagine you were short against that high from the prior week. Once the market hop over that level, it would trip your stop order and knock you out of the trade.

You can even see how this works with smaller swing points like what the blue arrows highlight. This one is more indicative of a manufactured stop run since it’s on a really small timeframe.

Creating trades out of stop runs

Here’s where the rubber meets the road.

You now know how to identify the stop runs. So think about how to use them to your advantage.

One easy way is to create a scalp countertrend trade.

If you watch these moves in real-time, you’ll often find that once they run the stops, there’s a quick snap back in the other direction.

If you’ve struggled to find a place to start developing a trading strategy, this is a great place to start studying!

Another option is to use these as places to initiate swing trades or to add onto an existing trade. Entering a longer-term trade near a potential stop area gives can potentially set up a nice risk/reward relationship.

A word of caution. Sometimes these stop hunters get overwhelmed. Markets can and do break through these areas and keep going.

The difference between losing and making money in these areas often comes down to trade management.

Trade management is how you define your entry, exits, and control risk. Two traders can use the same chart and idea to trade. But, if one of them tries to ‘wing it’, they’ll find themselves out of the picture pretty fast.

Learning the ins and outs of trade management

Since trade management is so important, I created bootcamp where I discuss how to maximize profits as well as create a gameplan.

These are core elements to what’s made me a successful trader over the years. And I want to share them with you.