When I sell options, I want the contracts to expire worthless, plain, and simple.

You see, I get paid a credit to put the trade on.

And I want to keep as much of that credit as possible.

Typically, time decay works for me when I sell options, gnawing away at the option contract value…

Except in one particular case, most traders don’t realize.

Heck, even my buddy Jason Bond was shocked when I told him about this…

Yes, we talk about stock options on vacation!

At one specific price, time decay flips and starts to work against you.

And if you don’t know where that is, you might as well kiss your assets goodbye.

That’s why I’m here to spread the knowledge and let you in on this coveted information.

So where is this inflection point?

The magic point of option theta

Your breakeven point…happy?

Assuming you want more than just a trite answer…

Time decay, also known as theta, cuts away at the extrinsic value of an option over time, all other things held constant.

If you were to take an option to expiration right now, the value of that option would be its intrinsic value.

For example, a $200 strike call option with a stock trading at $201 would have $1 in intrinsic value.

Everything beyond that is the extrinsic value.

When I sell an option, I get paid a certain premium. The point at which I get zero time decay is the breakeven point for that option.

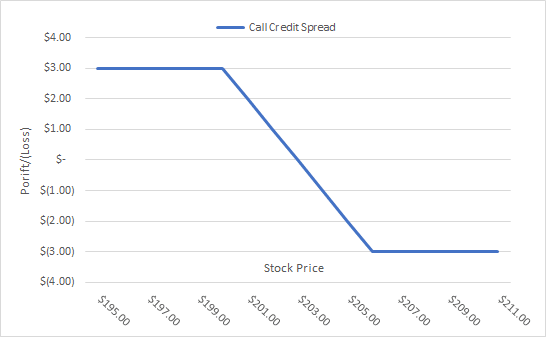

Let me draw this out in a call credit spread example.

In this scenario, I’m going to do the following:

- Sell the $199 call option for $6

- Buy the $205 call option for $3

- Receive a total credit of $3

- My maximum risk is the distance between the strikes less the credit or $205 – $199 – $3 = $3

- My maximum potential profit is the credit I received of $3

This is what the payoff diagram looks like:

The breakeven point in this scenario is $202. At that point, I neither make or lose money.

And THAT is the point where theta turns to zero!

Here’s why that happens.

When you have a spread that is past the breakeven point, every day that goes by reduces the extrinsic value, taking the spread closer and closer to a loss.

Before that breakeven point, every day that goes by takes you closer to a profit.

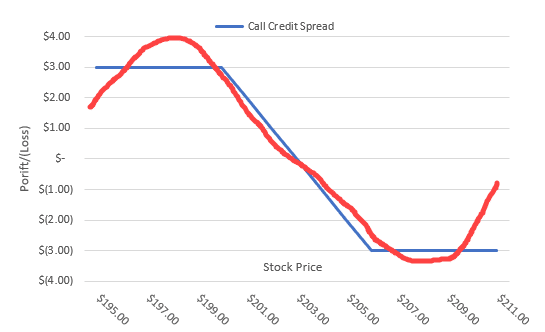

Here’s what the diagram looks like with the red line representing theta.

You can see how time decay starts to work against you once you cross the breakeven point.

It’s also worth noting that there is a point where Theta peaks out and it’s marginal value starts to decline at some point.

Similarly, there’s a point past the upper strike where the marginal time decay impacts you less and less.

Both of these occur because you’re either at a high intrinsic value (way past the upper strike) or extrinsic value (well below the lower strike).

Putting this into action

The theta curve will change over time. It begins to flatten out as you get closer and closer to expiration.

But, we can use this to our advantage.

If we can find that peak in time decay and sell the correct credit spread, we can maximize the impact of time decay working in our favor.

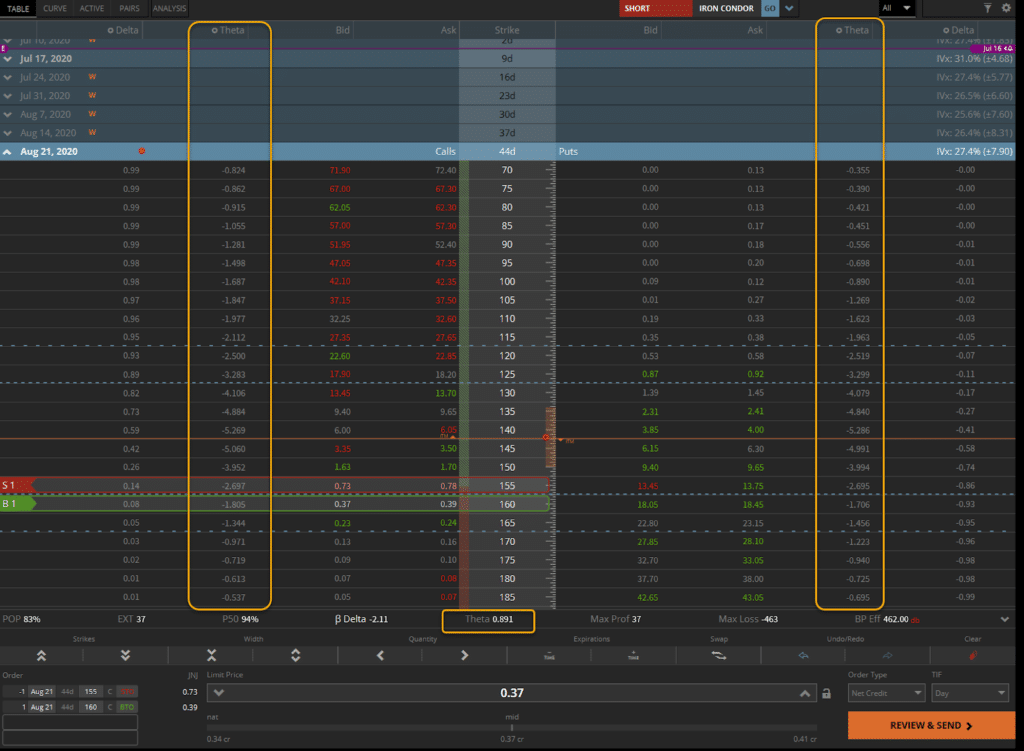

Here’s an example using an option chain for Johnson & Johnson (JNJ).

In the orange boxes, I highlighted the theta, which comes in as a negative number (it’s positive when you sell options).

I created a sample trade by selling the $155 call option and buying the $160 call option. That gives me a net theta of 0.891.

That means for every day that goes by, $0.891 comes out of premium in time decay.

To find the optimal point takes a little bit of work. Depending on the spread or type of option pay you have to wiggle around to get the maximum theta.

Typically that will be somewhere around the 16-20 delta strikes.

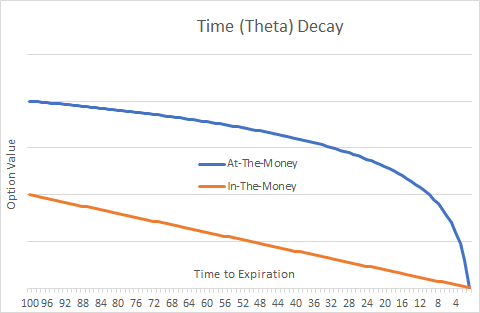

One last thing. The rate of time decay changes over time. As you get closer to expiration it speeds up.

The curve for time decay looks like this.

While you might think that getting as close to expiration as possible would be ideal, you trade that off for the risk that the options become more price sensitive.

Learn even more about options

If you couldn’t tell, I absolutely love options!

But what I enjoy even more is teaching traders about them.

And that’s exactly what I give my High Octane Options members every week.