You probably heard the saying ‘Don’t Fight the Fed.’

But have you ever wondered how exactly they force stock prices higher?

It’s not like they go out and just buy equities outright…

…even though some conspiracy theories would lead you to believe this.

If that’s not the case, how exactly does the money sleight of hand work?

Two words – Opportunity Cost

It’s why stocks rise swiftly even during the worst economy in a century.

And it’s also why the words and actions of the Fed matter more than any other macroeconomic factor right now.

Because what’s riskier right now – a 10-year bond that pays next to 0% or a 3% dividend stock?

Now you see the dilemma that faces investors, allow me to explain more.

Death by a thousand cuts

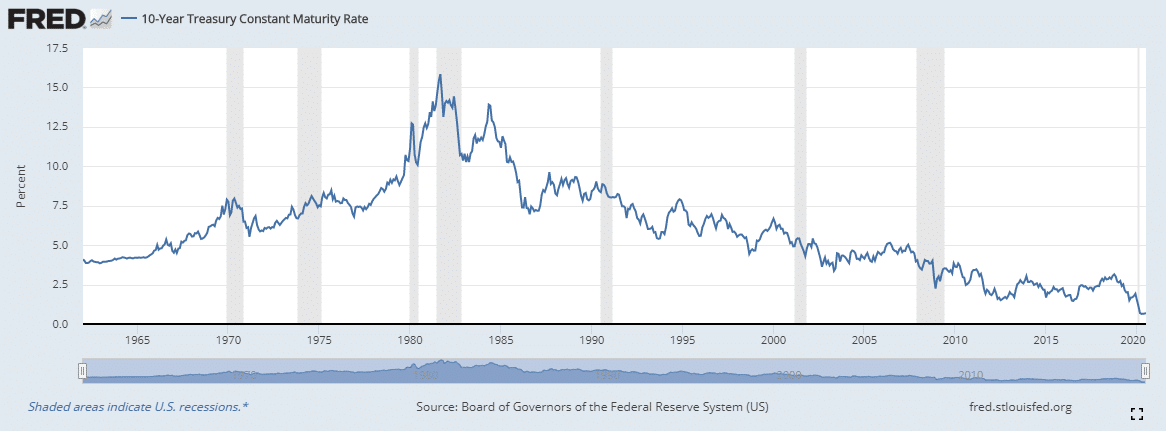

Back in the early 1980s, the 10-year treasury rate paid over 15%.

Guess what it pays today?

0.70%.

With the Federal Reserve dropping interest rates and buying mass quantities of treasuries, they drove bond prices up and their corresponding yields down.

This isn’t some new phenomenon either. It’s been happening over decades.

You would have thought we learned our lessons about cheap debt from the Great Recessions. Except our solution to that problem was even cheaper debt.

Imagine being an insurance company trying to meet your obligations through conservative investments in various bonds.

With such a horrid interest rate, how would you do that?

Low interest rates create a paradox for investors.

It lowers the cost of debt, allowing companies to expand by borrowing, or at the very least stay afloat. Investors in that debt now get less for their money.

So, they go hunting for yield. At some point, the risk in equities is offset by the lack of another opportunity in bonds. In turn, they buy stocks because they are the least worst option.

How long does it continue?

This is a question we just started to answer before the pandemic. At the end of 2018, the Fed raised rates much faster than the market was willing to tolerate, creating a massive selloff into Christmas.

Backtracking their moves, the Fed held rates at a constant, but extremely low level. They wanted to drive more inflation into the economy.

Inflation occurs when the demand for something increases faster than supply, driving up prices.

Except, that hasn’t happened in the last decade. A combination of factors including technological advances have increased supply with demand, keeping prices in check.

It’s led to a baffling global scenario, where central banks around the world tried to lower their interest rates out of it.

While that should have led to runaway inflation, so far, we’ve seen none of it.

That’s led the Federal Reserve and other central banks to keep interest rates low, which in turn drives down treasury interest rates, which then incentivizes investors to pour money into stocks.

So how long can this last?

As long as the Fed wants it to!

That doesn’t mean stocks go up forever. But it creates a floor that has lovingly been referred to as ‘the Fed put.’

What this means to traders

Intraday traders might not find this useful. But swing traders absolutely will. Knowing there’s a floor provides the bulls with ammo to buy up pullbacks.

You’re probably wondering why the markets cratered in March.

As we watched the free-fall, the Fed took several weeks before they came out and acted in two important ways.

First, they lowered interest rates. That is great when there’s demand, but the real worry at the time was companies going bankrupt. They needed debt just to make it through the day.

That’s where their second action, direct purchases of treasuries, and asset-backed securities in sufficient quantity stabilized the market.

Eventually, they began buying the actual debt of publicly traded companies. But, when they implemented their second action, they communicated they would do whatever it took to stabilize the credit markets.

In this case, it meant making sure companies that needed to borrow to survive could do so.

Right or wrong, that will be for history to decide.

At the moment, it’s driven equities back to their all-time highs for companies not as hard hit by the pandemic such as Apple, Amazon, Netflix, and the like.

And, as long as the Fed continues to support the debt markets, there will be plenty of zombie companies (those alive only because of cheap debt) that continue operations.

That’s why I not only look for news around the Fed, but choose my trades carefully based on this information.

In fact, it’s one of the main reasons I traded gold miners (GDX) recently.

As the Fed devalues our currency, hard assets will benefit.

It’s exactly why I began picking up call options using the same techniques I talk about in my Total Alpha Masterclass.

And you can get in on the action by signing up today, right here.

Click here to register for my upcoming Total Alpha Masterclass.