Grab for gold

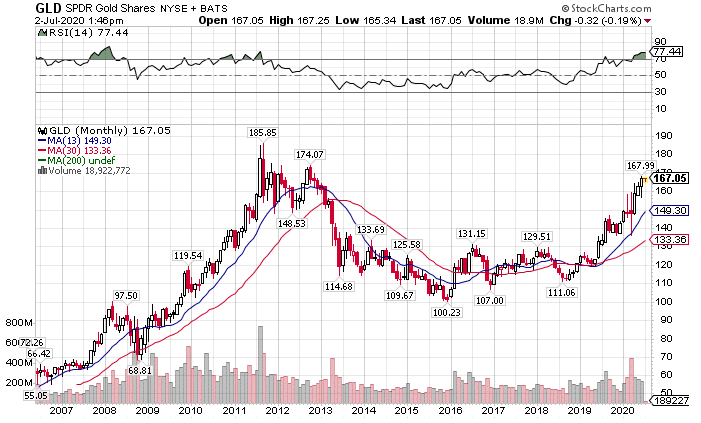

These past few weeks I’ve written extensively about the strength of gold. We’ve seen the precious metal go from $1200 an ounce to surpass $1800 an ounce in just a few short years.

So what makes me a believer in this rally?

Traditionally, physical gold moves from the Western hemisphere to Eastern. Demand in Asia, especially India and China, necessitates the physical transfer.

However, that’s recently changed.

For a variety of reasons, including declining demand, gold actually had to be moved from London to the U.S. A lack of enough gold reserves against a change in contracts caused this shift, even catching the eye of lawmakers.

At several points, we’ve seen the spot price of gold diverge wildly from gold futures.

All of this tells me something is brewing here.

The more I looked into it, the more I realized that the inflation everyone expects may not happen with currencies. Instead, I see it playing out in physical assets such as gold, oil, and even real estate.

My trading plan

Using this theme, I have and plan to trade gold a few different ways.

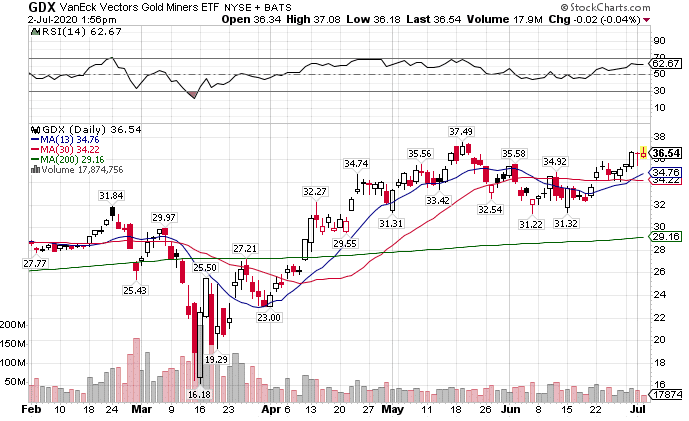

First, I’ve been using the miners as a leveraged proxy. The correlation between gold and miners is quite strong. The only real difference between the two is that miners trade a little more with stocks.

When stocks experience hard selloffs, miners will often fall with them. Recently, gold’s been trading a lot more closely to stocks, so it hasn’t been as much of an issue.

You can see how much miners moved off the March bottom in this chart.

GDX Daily Chart

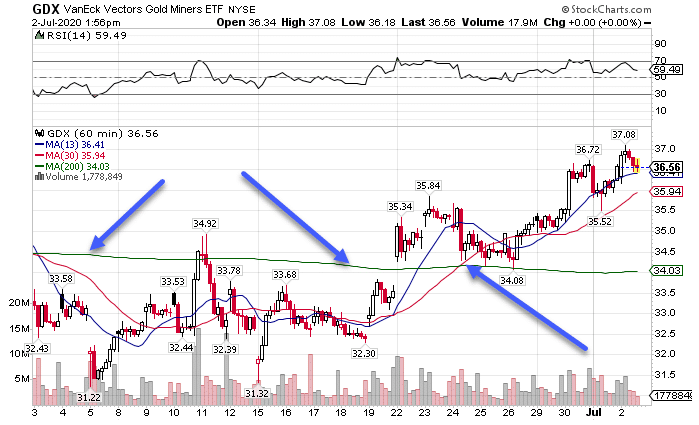

Once I get a macro-level idea, I then break it down to a shorter timeframe to create the trade.

Here’s a recent one that I took on GDX using call options.

In this chart, the green line represents the 200-period moving average, which I refer to as the ‘gravitational line.’ This is an important part of my trading that I use for many of my setups.

You can learn more about gravitational lines in my Total Alpha Bootcamp by clicking here.

As miners consolidated underneath that level, testing it again and again, I noticed gold starting to trend higher.

Since both often trade in tandem, I bought call options on the GDX to play for an upside thrust.

Once I got that, I began to take off a portion of the trade and lock in some profits. Then, I left the rest to try and squeeze more out of it.

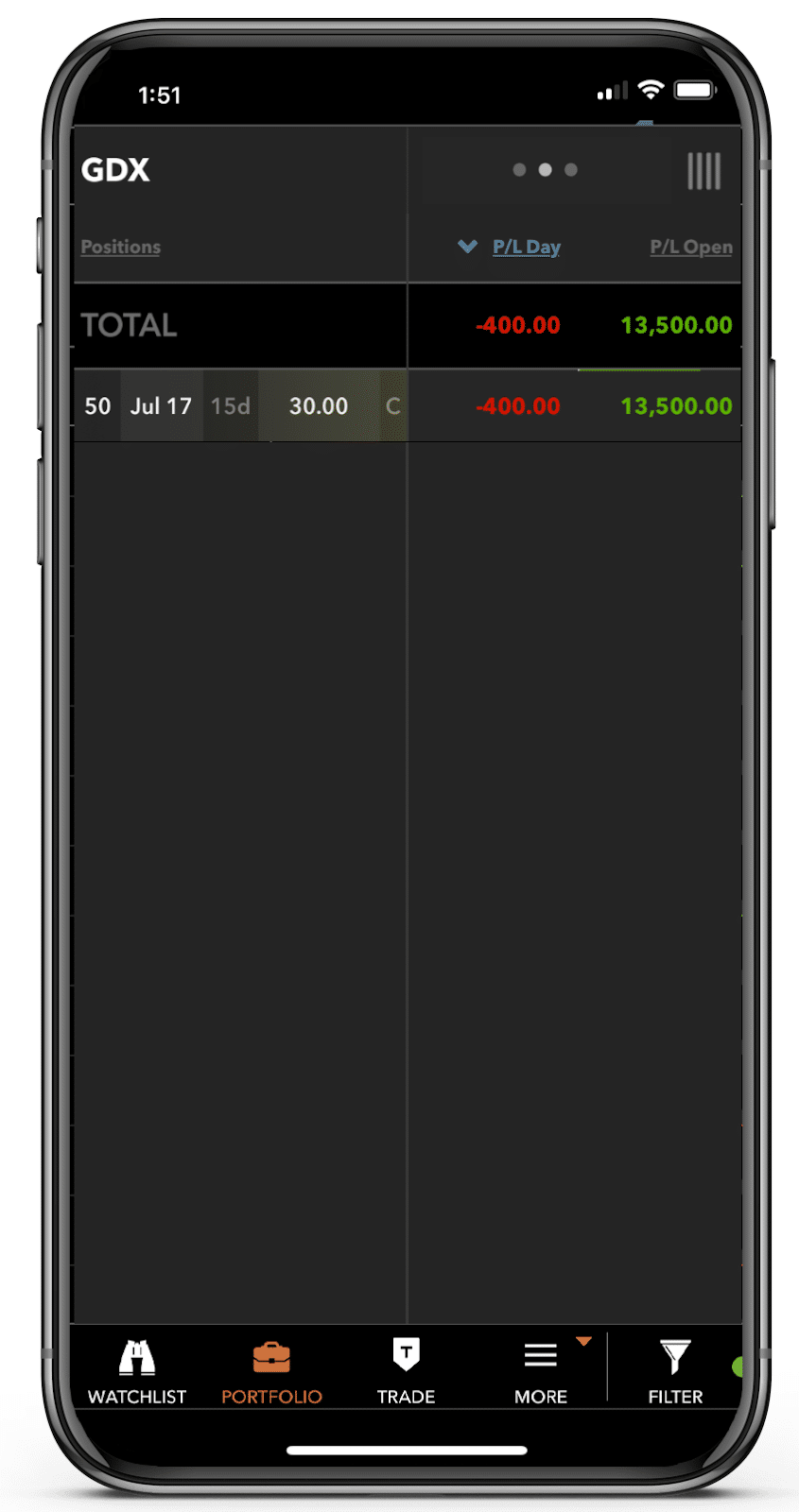

This is a snapshot of the remainder that I let ride.*

*Please see disclaimer below

By locking in some profits early, I then set my remaining balance to breakeven. That way, if the trade goes against me, I already have some gains to walk away with.

Another option for trading gold is with an ETF like the GLD. This tracks gold reasonably well and also is optionable.

Since gold isn’t a big mover day to day on a percentage basis, I can collect premium by selling put credit spreads against the GLD.

This involves selling one put option contract at or below the current stock price and then buying another below that.

Doing this gives me a defined risk/reward. More importantly, it doesn’t rely on big moves, just an overall bullish trend.

Other strategies and techniques

These are only two of the many ways to execute this trade. As I look out in real-time, I will use what I see as the optimal approach, whether it’s one of these two or any other.

If you want to learn about some of the other strategies and techniques I use, a good place to start is with my Total Alpha Masterclass.

Here you’ll get a chance to learn some of my favorite ways to analyze charts and set up trades.

Click here to register for my Total Alpha Options Masterclass