Most of us realize that the stock market no longer reflects reality…or at least traditional measures of value.

Obviously, with quarterly profit expectations nearly half of the prior year, an 11% unemployment rate, and rising Coronavirus cases— means we should challenge all-time highs.

That makes sense right?

Times like these are exactly why I began trading – to take advantage of imbalances and push my edge.

And this upcoming week is no exception.

As we kick off the 3rd quarter, there’s plenty of opportunities if you know where to look.

Which is why I’m going to lay out my vision and plan for the next 90 days.

But before we get to that, I want to tell you what I plan to look for in the upcoming earnings reports.

It’s what they say, not what they did

I wouldn’t be surprised to see companies throw in the kitchen sink with the latest earnings release.

With Covid shutting down most of the global economy, it’s as good a time as any to ‘blame’ things on the pandemic, whether they’re related or not.

Q2 estimates for a 43% decline are the worst on record since Q4 of 2008 with a -69.1% decline year over year.

But get this – on March 31st, the estimated earnings decline for Q2 was only 13.1%. Apparently, April and May really changed the minds of Wall Street.

Yet, stocks shrugged all this off to climb out of the gutter and back to their former glory.

So, why should earnings matter at all then?

What companies report is immaterial. Not only is it in the past, but it’s not indicative of the future prospects either.

Seeing this movie before, I will be keeping an eye out for anything thrown out there as ‘Covid’ related that shouldn’t be.

More importantly, I want to know what the companies think about the future. Specifically, do they expect any cash flow or financing issues.

On top of that, I want to hear how much demand has picked up and whether it’s accelerating, remaining the same, or flat-lining.

Any word of credit problems or bankruptcies will hurt the rally. The Fed has done everything in its power to finance debt. If CEOs and CFOs state that isn’t enough to keep them afloat, we can expect a wave of equity selling to ensue.

One area that I’m keenly focused on is the energy sector. That’s where I see the most opportunity in the upcoming quarter.

The next 90 days

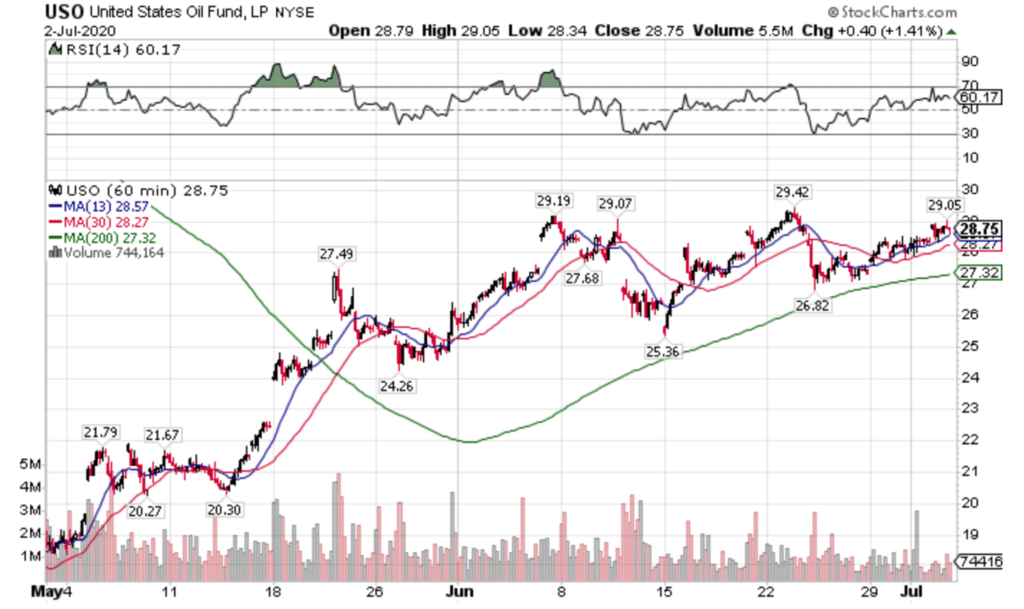

Negative oil prices shook the industry, forcing companies on the brink to collapse under their own weight. As demand troughed and rallied, crude managed to recover back to $40 a barrel, the price it broke to when Saudi Arabia and Russia’s oil talks collapsed.

USO Hourly Chart

Despite the rising demand, many drillers that shut-in production won’t be able to turn back on anytime soon. Some simply can’t afford working with oil prices near $40. Others take months to resume production.

That leaves a perfect storm for a potential shortage in crude stocks and a spike in oil prices.

With debt cheaper than water, large integrated oil companies from Exxon Mobil (XOM) to ConocoPhillips (COP) have huge war-chests to scoop up assets at rock-bottom prices. That makes them especially valuable in my opinion.

Shedding large amounts of their workforce already, these individual companies or energy ETFs like the XLE should outperform the broader market in the coming months. Should heavy selling hit equities, these stocks won’t be spared either, just be relatively less bad.

Coronavirus resurgence

I would be remiss if I didn’t discuss the implications of increasing case loads.

Already states like Florida, Texas, and New York either stopped or pulled back on their phased reopenings. Even if they kept going, polls show folks rightfully cautious about returning to normal life.

So far, markets couldn’t give a hoot about reality. I don’t see any reason for them to start now.

Instead, I expect that if they’re heading lower, that they’ve already started that path. Otherwise, there’s a good chance they could trade sideways for a very long time.

Even with economies slowly restarted, the extent of the damage is enormous.

In fact, the Congressional Budget Office recently stated the unemployment rate won’t recover for the next decade…as in 10 years.

The Federal Reserve and congress may be able to prop up the economy for a long time. If these projections are right, then stocks will find little reason to do anything other than remain range bound for years to come.

Stocks I want to bet against this week…

TTD, CAT, TDOC, SC, DFS, PENN, SHOP, AVLR, IWM, SNAP, SPOT

Stocks I want to buy this week…

MJ, DKNG, FSLY, PYPL, OKTA, ZM, TWLO, MTCH, NOW, CVNA, SIX, ABT, GAN, SPOT, REGN, KWEB, ECL, CARR, TW, GMBL, GDX, EXPE, RNG, WYNN, WORK, NEM, CLX, EBAY, VAPO, NKLA, CTXS, GOOGL, MDB, DPZ, COUP, WK

This Week’s Calendar

Monday, July 6th

- 9:45 AM EST – Markit US Services & Composite PMI for June

- 10:00 AM EST – ISM Non-Manufacturing Index June

- Major earnings: None of note

Tuesday, July 7th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Paychex Inc (PAYX), Levi Strauss & Co (LEVI),

Wednesday, July 8th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: MSC Industrial Direct Co Inc A (MSM), Simply Good Food Co (SMPL), Bed Bath & Beyond (BBBY)

Thursday, July 9th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Walgreen Boots Alliance Inc (WBA)

Friday, July 10th

- 8:30 AM EST – Producer Price Index for June

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: None of note