It’s no secret, more people have picked up day trading over the last few months.

New accounts at brokers from TD Ameritrade and Robinhood have exploded.

Unfortunately, most of them don’t have a clue about what they’re doing.

I’ve heard from numerous traders that lost their shirts trading Hertz (HTZ) after the company declared bankruptcy.

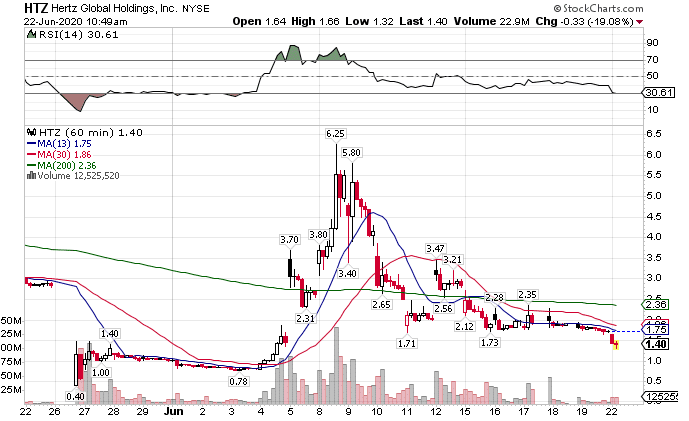

HTZ Hourly Chart

Yes, the chart looks lucrative…but it’s a trap set up to catch retail money.

I don’t want anyone, paying member or not, to fall prey to these shenanigans.

You see, there are certain steps you can take that put in you a position to win…

And others which will almost certainly cause you to lose.

Today, we’re going to focus on what those mistakes are…

And how to button them up.

Chasing momentum for the sake of it

Hertz (HTZ) is a great example of a trade that no one had any business in. The company declared bankruptcy, which should have been the end of it.

Yet, research shows that Robinhood traders gobbled up these shares, hoping to catch part of the pop that occurred afterward.

A lot of trading can be done without knowing much about the company. Ignoring basic fundamentals, even with a runaway market, still leads to disastrous outcomes.

When companies go bankrupt, rarely do shareholders get anything. That means the real value to Hertz shares should be $0. $6 is what they were trading before investors got real scared they would go bankrupt.

Guess how these traders got sucked in?

Professional traders would buy up the stock premarket, putting it on watchlists for retail to see. When the market opened, retail investors would hop on board, hoping to catch a piece of the action.

Happening over and over, pros worked like cat burglars in the night, while retail was left holding the bag.

Anyone can avoid this with some basic research.

Here are some red flags for trading any stock that should make you think twice about trading it:

-

- They’re under investigation for fraud or other malfeasance

- The company is looking at or likely to declare bankruptcy

- Stocks that are trading below $1

- Note: That doesn’t mean you can’t or shouldn’t trade penny stocks. But it is NOT the same thing as trading large caps.

- Company’s primary headquarters is in a foreign country with lax accounting standards

- There are zero revenues for the company yet (outside of biotechs)

None of these are necessarily disqualifiers for trading the stock. But, you NEED to understand what you’re getting into before you trade the stock.

Poor understanding of options

When I first started trading options, I made all the mistakes out there. Plowing headfirst, I didn’t appreciate the intricacies of assignment and really selling options.

So, let me start by offering some material to help you get the basics out of the way.

Here is a link to a pretty comprehensive Options Guide for Beginners.

If you don’t understand all the concepts in this video – you should!

If you walk away from this article with one concept it should be this – selling options contains more risk than buying options.

Buying options limits you to losing the total amount you invested. As the buyer, you hold the right to exercise the option.

Selling options gives someone else that right.

If you sell a put, they have the right to put shares to you (IE force you to buy them). The value of the shares you could receive could far exceed the cost of the options, meaning you could lose more than you invested.

The same thing happens with calls. When you sell a call, if you don’t already own the shares, you have to borrow those shares (sell short) to give them to the option holder.

In both cases, you could end up in positions that could cost you far more than you initially laid out, even if you own offsetting long options, such as in spreads.

A good example is Nikola (NKLA). Available shares to borrow to sell short became so scarce, that call options were being executed far out of the money. With borrowing costs as high as $1.00 per share per day, traders that got exercised could end up owing $100 per day per contract!

Keep learning no matter what

I don’t care if you’ve been trading for 10 minutes or 10 years. Every trader needs to brush up on their core skills and knowledge.

A great place to start is with my Total Alpha Bootcamp.

Here, you’ll get access to a handful of my training videos that cover everything from my money-pattern to maximizing profits.

There’s no better time than now to get on top of your game.

Click here to sign up for my Total Alpha Bootcamp.