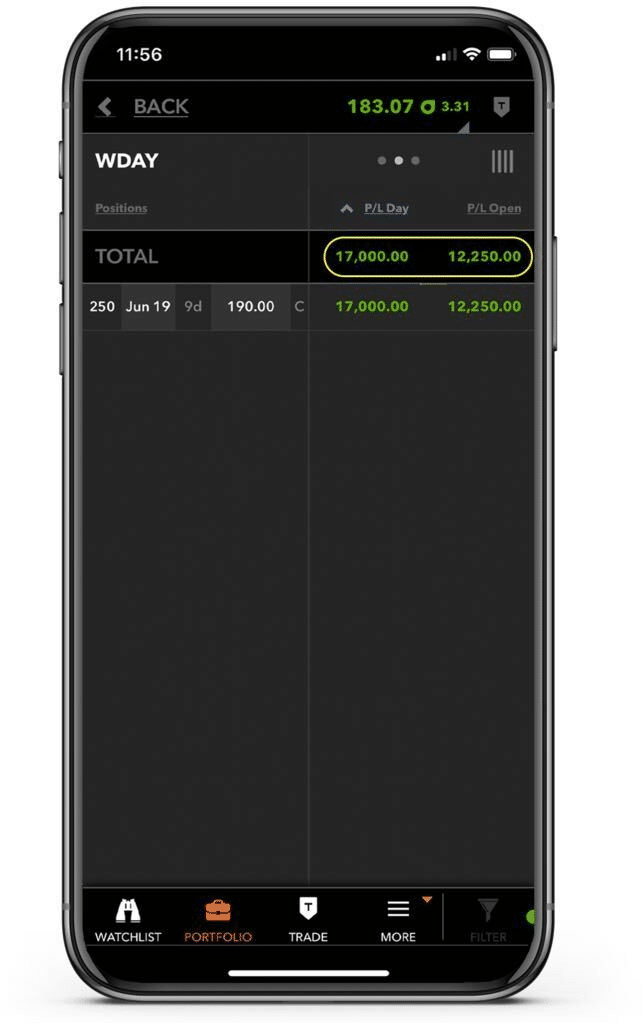

Carvana (CVNA) has yet to turn a single dollar of profit.

Yet, shares exploded to the upside this week, allowing me to capture some High Octane Options.

Watch the exclusive replay of my live event here!

Traders new to options are blown away by how this can happen.

How is it possible a company that doesn’t turn a profit watches their share price skyrocket?

Because value is in the eye of the beholder (or in this case the buyer)!

Allow me to explain.

You see, a lot of folks get into trading and think about it like investing.

WRONG!

Trading is nothing like investing.

You’re not trying to discover the intrinsic value of a company.

No, you look for price action based on supply and demand.

Maybe this seems a little confusing to you or you just want to know how to pick up trades like these.

Well, don’t you worry. Uncle Jeff is here to help.

Why share prices don’t reflect a company’s value

If I had a nickel for every trader who confused investing and trading I would be able to pay off my mortgage.

Think about when you first started trading. Didn’t you read S&P reports or a Morningstar analyst rating?

Yeah…none of that will help you become a good trader.

The simple fact is that a share’s price is determined by buyers and sellers, nothing else.

Think back to the mortgage crisis. Homes were so cheap in many cases, yet you couldn’t give them away.

But it’s not like those homes were worthless right?

Well, that depends on who you ask.

In reality, something only has monetary value if there is a counterparty for the transaction (meaning someone to buy if you’re selling or visa versa). That’s what’s known as liquidity.

It’s part of why you hear the Fed get anxious when no one is buying debt. That causes bond prices to drop to get the yield on them higher until someone bites.

Take Hertz (HTZ) for example.

The company announced bankruptcy a while ago. Yet, in recent days, shares skyrocketed.

HTZ Hourly Chart

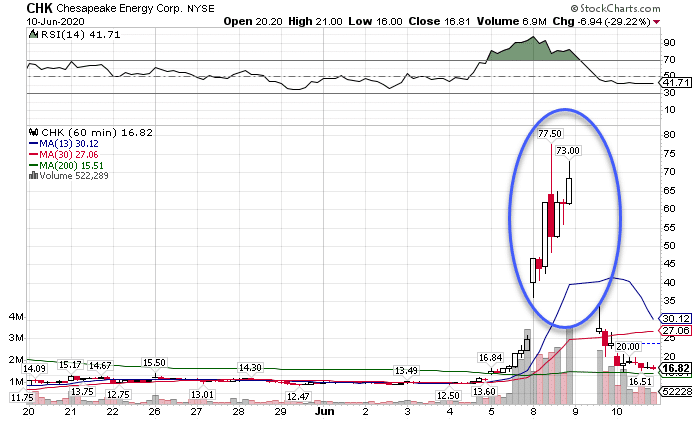

Or how about Chesapeake Energy (CHK)…

CHK Hourly Chart

Normal people would look at that and say, “what in the world?”

What happened is this.

With COVID, you had tons of retail traders enter the trading market. They see a cheap hot stock taking off, and they pile on board. That created this massive, unsustainable swoon.

In reality, the company isn’t probably worth anything to stockholders. But, as long as there were buyers and sellers (and in this case more buyers), you had tradeable opportunities.

Understanding momentum stocks

One place where you see stocks move around in wide ranges with significant volume are so-called ‘momentum’ stocks. Typically, these are recent IPOs that garnered a lot of attention due to high growth potential.

Back during the dotcom bubble, we used to see these with companies that may not have sold anything but had lots of clicks.

Today, it’s about small tech startups with low overhead and an ability to expand without adding significant fixed costs.

That includes companies like Carvana (CVNA), Shopify (SHOP), Wayfair (W), Zoom Media (ZM), and more.

Some of them do actually make money. Most don’t.

In fact, nearly 80% of the IPOs in 2018 didn’t turn a profit before they went public.

Heck, Amazon (AMZN) trades at an insanely high multiple compared to its earnings.

But I LOVE Trading these stocks!

Some of the most explosive moves in momentum stocks come around catalysts such as events or themes.

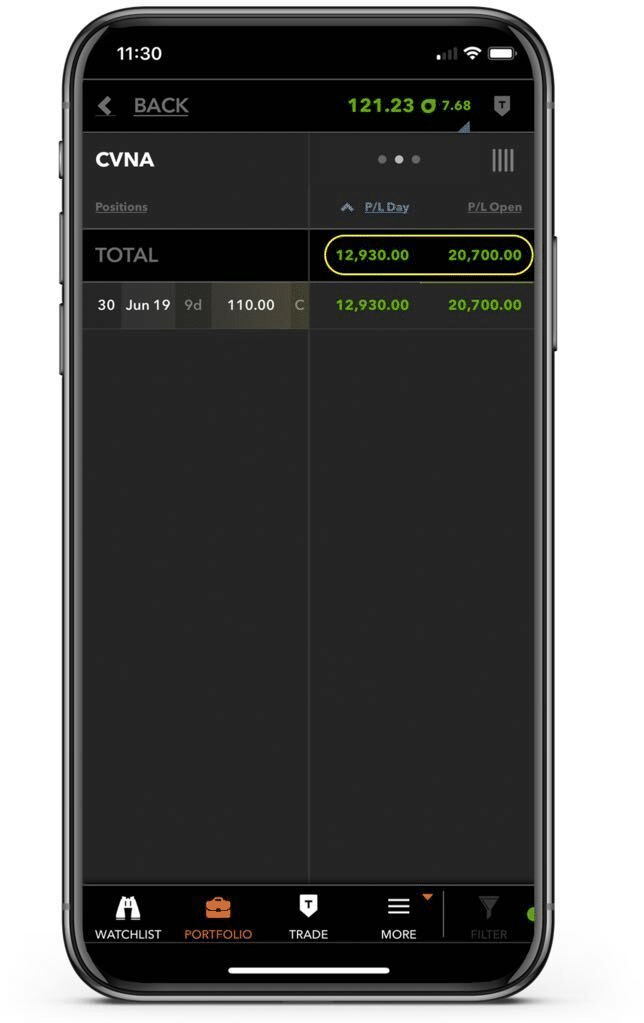

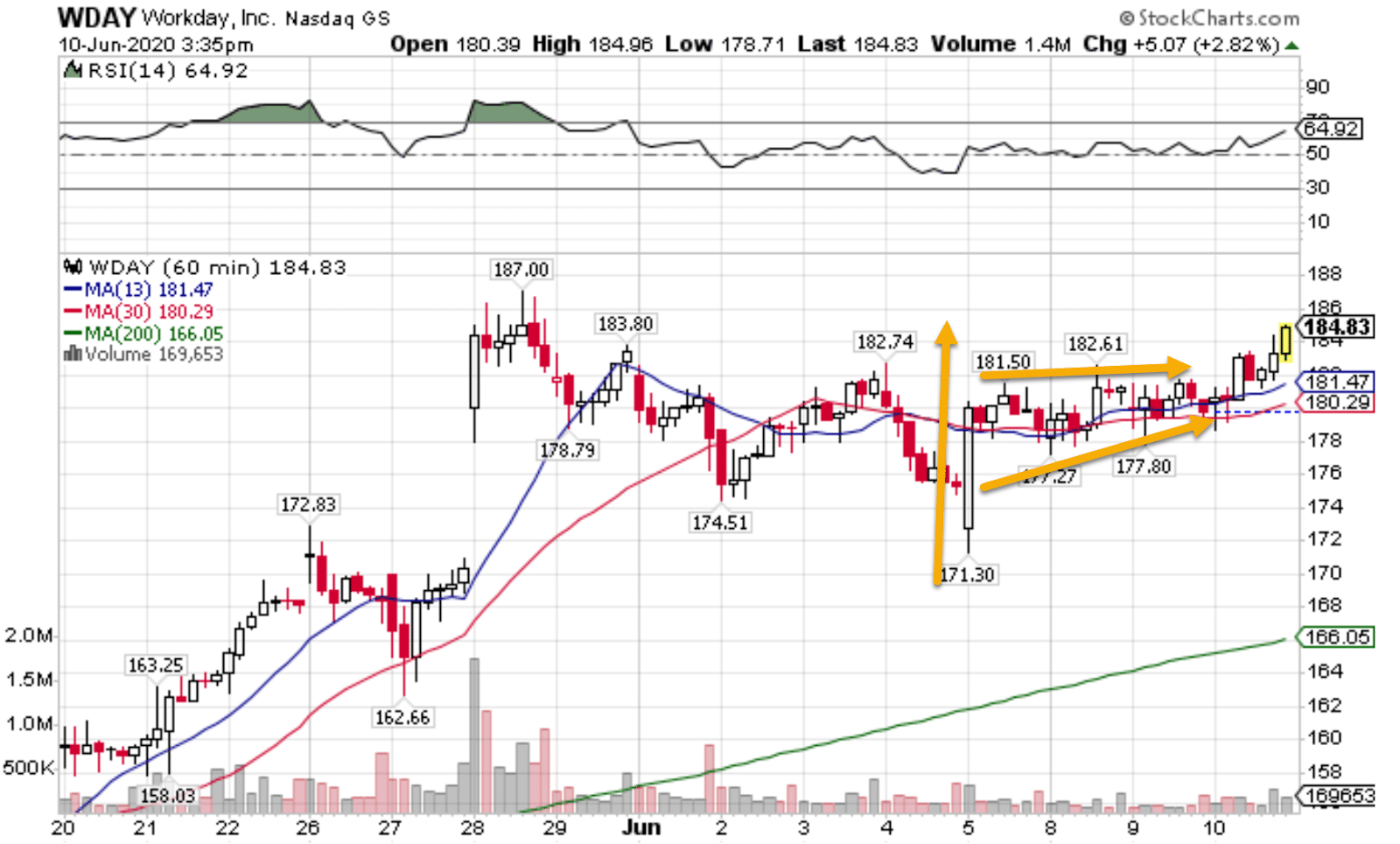

Take Workday (WDAY) for example.

Recently, I saw a setup in the chart that looked

WDAY Hourly Chart

Opening up poorly one day, buyers stepped in to push price up violently. From there, it traded sideways in a narrowing channel.

But that wasn’t enough for me.

When I take swing trades, like High Octane Options, I want there to be a story behind the trade, not just the chart setup.

Looking at the bigger picture, I saw the market moving up into the Fed announcement. In fact, that’s such a common occurrence, it’s statistically measurable!

On top of that, I noticed that a lot of the ‘stay-at-home’ stocks were finally starting to turn a corner.

With all those clues to higher prices in my corner, I grabbed some call options and rode this riptide higher.

Separating out the best trades

I know It’s not easy combining chart analysis and storylines. It takes practice.

One great way to cut the learning curve is by learning from a skilled options trader and educator.

That’s why I created High Octane Options – a service that combines my trading with a proprietary scanner, providing a stream of trades to choose from.