There are times when being a buyer of options makes the most sense…

And others…where being a premium seller is the right play.

However, most traders, even some experienced ones, have a time deciphering when that time is.

Today, I’m going to share how you can be a cut above the rest.

And once we’re done, you’ll understand why the current market favors option buyers instead of sellers, and why I’m gearing up for some High Octane trading.

You could be leaving a lot of money on the table from taking the wrong option trades.

That’s why you need to understand one of the most important concepts in options trading – Implied Volatility

It’s the only component of option pricing that we can’t control.

But, by understanding it better, you’re certain to make better trading decisions which could lead to greater profits…and money in your account.

Understanding implied volatility

Option prices come out of three components: distance between the strike price and the current stock price, time until expiration, and implied volatility.

Obviously, we can control the first two through the contract we select. But implied volatility isn’t a different sort of beast.

Quite often, you’ll hear people say it’s the “market’s expectations for a percentage move on an annual basis.”

Yes, that’s true, but it misses something obvious.

Implied volatility is the demand for the option. Higher demand leads to higher implied volatility and higher option prices.

Options are essentially insurance products. People buy them to hedge against uncertainty. That’s why implied volatility rises into earnings and falls afterward. Once the company’s performance becomes known, a lot of the uncertainty is removed.

Mean-reversion

There’s one important characteristic of implied volatility you need to be aware of.

Implied volatility tends to be mean-reverting. That means it moves towards the average over time.

Think about it like this. Even at the best and worst of times, stocks only get so bullish or bearish. After that, things settle down.

Unless a company is going bankrupt or getting bought out, chances are, it will start trading normally at some point.

This creates cycles of high implied volatility and low implied volatility.

As option buyers, we want to buy when implied volatility is low. Sellers want implied volatility high.

What is the VIX

The broadest market gauge for implied volatility is known as the VIX. Put out by the Chicago Board of Options Exchange (CBOE), the VIX tells you the implied volatility on the S&P 500 index for the next 30 days.

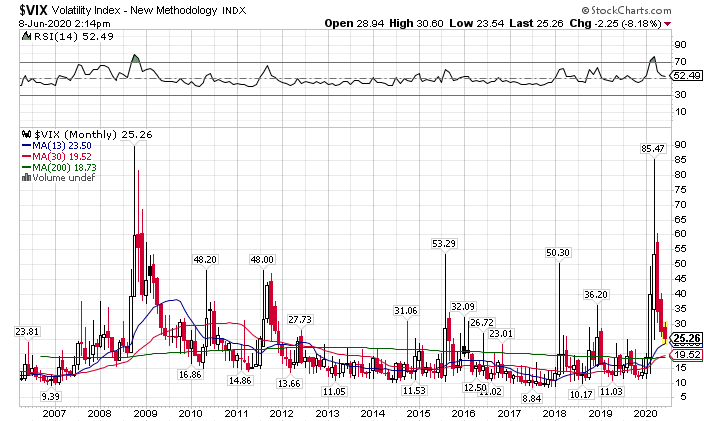

Historically, the VIX trades anywhere from $15-$18. It rarely trades below $10 or above $40.

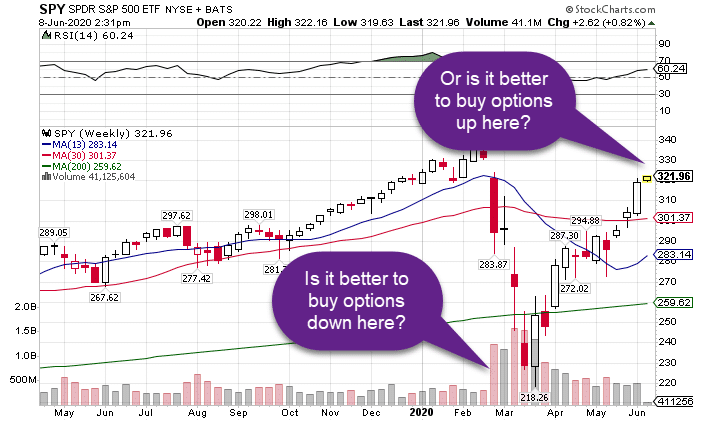

Here’s a monthly chart of the VIX going back over a decade.

VIX Monthly Chart

You can see how the index spike to historic levels back in March when the market dropped. That set up optimal conditions to sell options.

Since then, we’ve come back down to normal prices, currently trading around $25. While that’s higher than the historical average, it’s much lower than it has been. Plus, we haven’t had any pullback since bouncing off the lows in late March.

Why it pays off when markets drop

Now you might be asking, why is now an ideal environment for buying options?

Well, let’s start with the fact that I have a generally bearish thesis at the moment. That means I am a buyer of put option contracts.

We already know that when implied volatility rises, it helps option buyers that own contracts.

Here’s the trick – when stocks fall, implied volatility tends to rise.

So, if I bet against stocks when implied volatility is low by buying put options, I get them cheaper than normal.

Plus, when stocks start to sell off, not only does the movement in price increase the value of my options, but so does the rise in implied volatility.

It’s like getting a two for one sale!

Pay attention to individual stocks

Just because the overall market is great for buying or selling options doesn’t mean that every stock is in the same position.

While the VIX tells you implied volatility at the broad market level, you still need to evaluate the implied volatility on each individual stock. Look at the current implied volatility and compare it to the last year or a couple of years and see how it stacks up.

If it’s at the higher end of the range, chances are it’s a better option selling environment than a buying one.

That being said, the recent market drop threw a lot of these measures out of whack. So, I don’t just look at where a stock’s implied volatility was for the past year, but how far it’s come down from the highs.

This combines historical analysis while considering more recent events.

Which are the best stock options I’m looking at right now?