Markets cheered employment gains of 2.5 million jobs in May, sending the Dow soaring by nearly 1,000 points.

Caught up in the moment, politicos and pundits didn’t bother to tell you the critical fact…

…The Jobs Numbers Were A Lie!

The actual unemployment rate WAS NOT the 13.3% reported.

The real number: 14.4%.

In fairness, that’s a big improvement from 19.7% in April.

But it obscures vital information that ties into the current civil unrest.

This edition of the Jump on the Week delivers you the honest analysis the financial media won’t bother to cover.

I also want to offer an objective look at the current protests and events of late, because they affect not just the markets, but our communities and cities.

The real story behind jobs

Within minutes of the unemployment data hitting the wires, futures took off running, and the president started tweeting.

And why wouldn’t they?

Analysts predicted a climb in unemployment to nearly 19.5%, but we showed job gains!

That’s certainly something to cheer for.

Except it’s not spread out equally, nor even 100% correct.

Initial data contained a ‘misclassification error’ which occurred in the last three months. The footnote in the last few months identified issues with some collectors identifying workers as ‘employed not at work’ when they should have been classified as ‘unemployed on temporary layoff.’

However, that doesn’t change the fact that the trend was in the right direction.

Accounting for this data error, the March rate would have been 5.4%, not 4.4%, April 19.7% not 14.4%, and May 16.3%, not 13.3%.

In reality, all of these numbers are insanely high.

Tying into the current civil unrest

Here’s where things get dicey.

Note: Understand that I’m not trying to make any political statements, just simply stating the facts and analysis on how others will perceive or act on it.

As I mentioned earlier, the jobless rate recovery didn’t occur evenly.

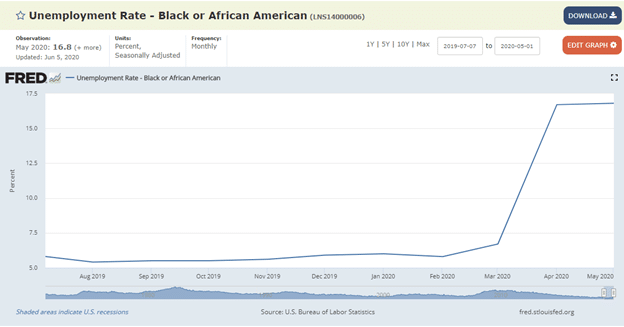

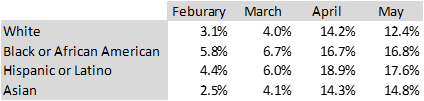

African Americans saw an increase in the unemployment rate from 16.7% to 16.8% month over month as more workers entered the workforce. However, the unemployment rate for whites dropped from 14.2% to 12.4%.

Here’s a full breakdown of the measured demographics:

With protests around the nation centered on systemic racism and inequality, these numbers, although one data point, don’t boost the administration’s case, nor help the President.

Here’s why this time might be different

The U.S. has only deployed an active military in 10 instances within our borders. 7 of those were related to the civil rights movement, with an eighth in the wake of the Rodney King riots in 1992.

We’ve seen more than 17,000 National Guard troops activated in 23 states and DC activated.

In the last decade we saw protests like Occupy Wall Street that amounted to little, and most recently related to the lockdowns that dissipated as states reopened.

Even the protests related to Ferguson, Trayvon Martin in Florida, and multiple other cases never created the pressure this has.

The events of George Floyd’s death shook people more than some realize.

With one video, we were faced with unequivocal facts of what occurred. No one could say it didn’t happen this way or provide mitigating circumstances that carried much meaning.

And for the first time in recent memory, the vast majority of people agreed there was a problem.

What we couldn’t agree on was the cause.

Couple that with months of tension built up from lockdowns, and you’re looking at the explosion of a powder keg we created. One that isn’t likely to disappear anytime soon.

Now we’re stuck at an impasse that isn’t likely to resolve itself quickly.

Protests morphed into a global movement. However, an element rose within this that turned things violent.

Much like our historical confrontations, there isn’t agreement on who instigated the clash.

Videos of law enforcement over aggression are juxtaposed against external groups creating problems and hijacking an otherwise peaceful movement.

We’re also faced with a real possibility of a second Coronavirus wave as massive groups gather in close quarters.

Taking all of this together, it creates a future that isn’t clear for anyone, especially the markets.

Stores continue to close early or entirely to avoid looting and violence. Staged reopenings may not matter much if people refuse to leave their homes.

Effectively, we face additional economic headwinds that could cap recovery.

And if history repeats itself, things could get worse before they get better.

Videos continue to surface of aggression by protestors and authorities. Even if warranted, deployment of active military will directly tie now into a line of events centered on racial injustice.

My take

I think markets, politicians, and investors truly underappreciated the sustainability of what we’re seeing and the potential impact.

These protests create a potential cascade of uncertain outcomes from more Coronavirus cases to an effective shutdown in parts of certain cities.

That’s why I will continue to watch these events closely in the coming months.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Jun 4), COST (Mar 5), TTD (May 14), ROKU (May 7), AMZN (Apr 30), TDOC (May 5), MTCH (May 5), NFLX (April 21), CMG (Apr 22)

Stocks I want to buy…

MJ (none), UNG (none), WDAY (May 26), TWLO (May 3), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), GDX (none), GRUB (May 6), RNG (May 6), DKNG (??), BA (Apr 29), ULTA (June 4), GS (July 21)

This Week’s Calendar

Expected IPOs – VROOM (VRM) 18.75M shares between $15-$17

Monday, June 8th

- Major earnings: Thor Indus (THO), Coupa Software Inc (COUP), Stitch Fix (SFIX)

Tuesday, June 9th

- 6:00 AM EST – NFIB Small Business Optimism May

- 7:45 AM EST – ICSC Weekly Retail Sales

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Conn’s Inc (CONN), Fuelcell Energy (FCEL), HD Supply Hldg Inc (HDS), Signet Jewelers Ltd (SIG), AMC Entertainment Hldg Inc (AMC), Five Below Inc (FIVE), Gamestop Corp (GME), Senseonics Hldgs Inc (SENS)

Wednesday, June 10th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Consumer Price Index May

- 10:30 AM EST – Weekly DOE Inventory Data

- 2:00 PM EST – FOMC Rate Decision

- Major earnings: Chico’s Fas (CHS), Guess? Inc (GES), United Natural Foods (UNFI)

Thursday, June 11th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Producer Price Index May

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Advaxis Inc (ADXS), Children’s Place Inc (The) (PLCE), Adobe Inc (ADBE), Dave & Busters Entertainment (PLAY), PVH Corp. (PVH)

Friday, June 12th

- 8:30 AM EST – Import/Export Prices May

- 10:00 AM EST – University of Michigan Sentiment for June

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: Party City Holdco Inc (PRTY)