May marked my biggest trading turnaround in 2020 – flipping my account from a $50,000 loss to a gain of over $150,000!

It’s nice to be back on the green team…

(I took a little time to celebrate with my daughter on a quick boating trip.)

The bulls are in full control at the moment.

However, I still have a longer-term bearish outlook.

But before I tell you about it, let me break down some of the key developments I saw last month…

As I believe they’ll be even more relevant to your trading now…more than ever.

Managing a neutral portfolio

As markets rebounded off the bottom, I found myself in a difficult position.

Like many of you, I didn’t believe in the rally. Yet, the gains to be had were too much to pass up.

So, how do you work both directions at the same time?

That’s where some of my favorite options strategies came into play. Two of my favorites: credit spreads and iron condors.

Credit spreads are risk-defined directional bets where I know exactly how much I can win or lose at the outset. Iron condors are a variation of this where I take both a bullish and bearish bet at the same time, on the same stock.

When I trade, I want the flexibility to create a balanced portfolio but still take advantage of specific stock setups.

How do I do that?

Well, let me give you an example from May.

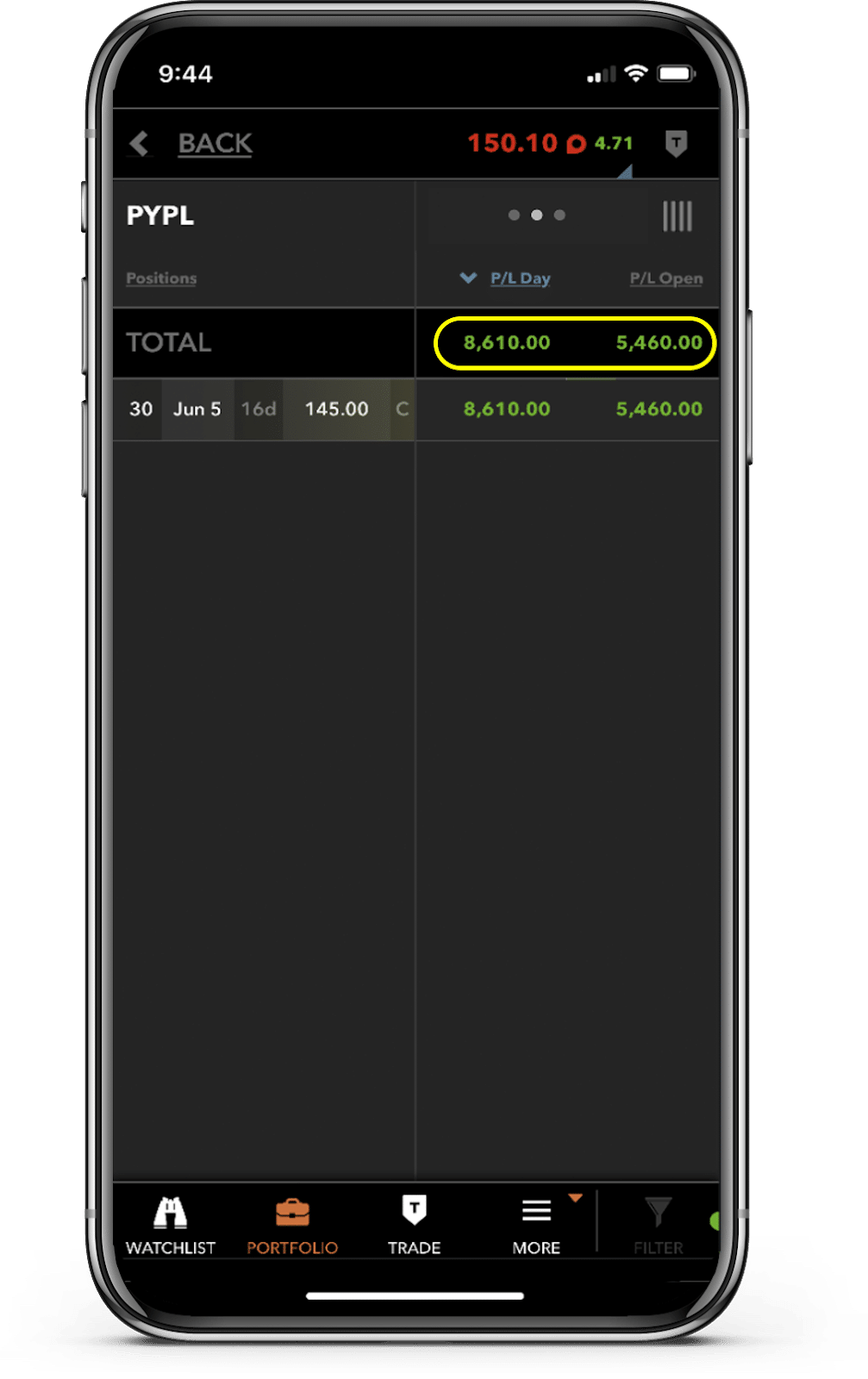

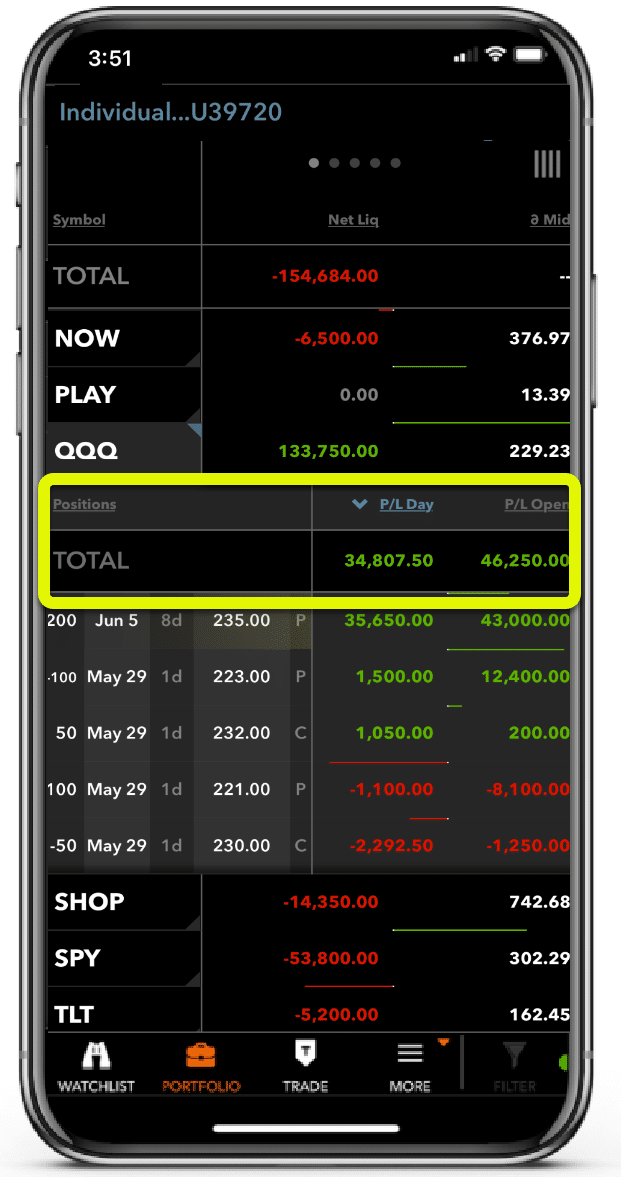

During the month, I found a sweet setup with Paypal (PYPL) for my Bullseye Trade of the Week. This was a long (bullish) play.

How do I match up a bearish trade to this?

Looking at the various stocks in the market, I selected the Nasdaq 100 ETF QQQ as a bearish play.

With two trades pointing in the opposite direction, I capitalized on both sides of the market.

Staying on top of the pandemic

One thing you may not be aware of – Raging Bull Elite members get some pretty special stuff. We provide them with a channel that not only includes extra facetime with the gurus, but some amazing content as well.

This past month, I actually got a chance to interview the heads of Sorrento Therapeutics.

If you hadn’t heard, Sorrento Therapeutics is a biotech company working on treatments for COVID. Their stock saw a lot of action in the month, and I wanted to know whether it was warranted.

Overall, I believe that biotech companies like Amgen (AMGN), Gilead (GILD), and the like are in an excellent position to grow during an economic downturn. If some of the new vaccines that use RNA technology end up working, it could open up a whole new category of medicine.

Of the big names out there, I’ve been trading Gilead (GILD) the most. However, I dabbled into some broader companies like Johnson & Johnson (JNJ) throughout May.

Separating out the stay-at-home trades

You probably could name a list of the stay-at-home stocks right now: Amazon (AMZN), Netflix (NFLX), Zoom (ZM), Telodoc (TDOC), etc etc.

Thing is – not all of them are great companies.

For example, Zoom Communications has already shown they can turn a profit. Any growth they experience pads their bottom line.

On the other hand, Telodoc hasn’t reached profitability yet. In the long-run, they may never get to that stage.

Yes, the smaller stocks do offer some great trading vehicles. But that’s all they are, trading vehicles. I wouldn’t want to drop my retirement on any of these companies.

That’s part of why I continue to play big cap stocks like Amazon and Netflix more often than the little guys. On top of that, these larger names have higher liquidity in the options. That means I give less away to the market makers and get tighter spreads.

Brushing up on the basics

Even with years of trading myself, I always go back to the fundamentals. Engraining these into my brain keeps them fresh and on the right path.

That’s why I’ll say this – whether you’re a new trader or one with years of experience, it never hurts to brush up on the basics.

One great way to do this is The Profit Bridge. This package delivers both education and trade setups, with something for everyone.

Better yet – let me tell you about The Profit Bridge.