Just before tech stocks can challenge their all-time highs…

Investors have begun rotating into the major laggards: airlines, restaurants, cruise lines, financials, you name it.

But before you jump in with both feet…

… you need to understand which industry rallies are sustainable and which are just a fakeout.

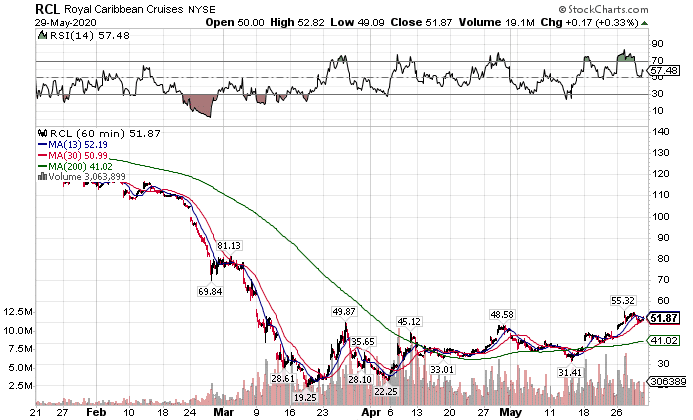

Take a look at Royal Caribbean Cruises (RCL) which rallied +20% last week and ask yourself whether this rally can continue.

RCL Hourly Chart

Considering the stock hasn’t even filled the gap at $60, there’s certainly more upside possible.

But, then I look at Delta Airlines (DAL) and see even more potential, and here’s why.

Relative recovery

Royal Caribbean is off more than 60% from its highs. Delta is roughly the same.

But ask yourself, which business is in a better position to recover as the economy reopens.

While cramped, airlines provide a more practical need than cruise lines. That’s not to mention the stories of ships that saw severe outbreaks or that they receive a disproportionate amount of their revenues from older clients.

That’s why I won’t just grab any old stock in the basket of the beaten-down names. I look for relative value – stocks with upside potential and better business prospects.

For me, that means looking at restaurant stocks like Darden (DRI), Cheesecake Factory (CAKE), and the like. Restaurants continue to operate in limited capacities and are more likely to return to normalcy before cruise lines.

Plus, with high short-floats in many of these names, and declining implied volatility, these make great trading vehicles as long as this rotation continues.

But, there’s two other sectors that look fantastic in the short and long term.

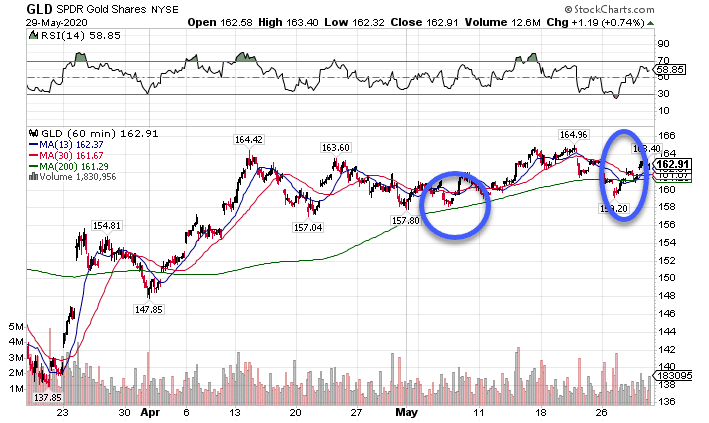

Gold’s glorious run

I can’t think of one week lately where I haven’t advocated for the gold trade. Normally, you would expect gold to fall in the face of a rising market, being the ‘safety trade.’

Yet, week after week it continues to hold its own.

GLD Hourly Chart

In particular, I like how it continues to hold the 200-period moving average, a key support that I talk about extensively in my Total Alpha Bootcamp.

Now, this trade hasn’t been able to break out, but that doesn’t mean there aren’t ways to make money. In fact, one of my favorite trades, the put credit spread, has been a great way to play the continual uptrend.

You can learn about credit spreads in my previous newsletter here.

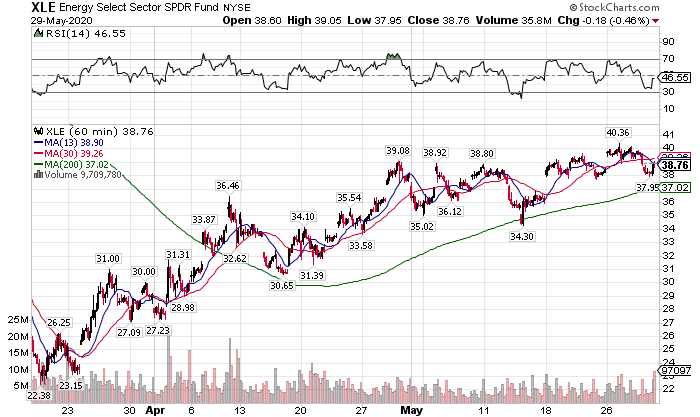

More room for crude to run

One of the best trades lately has been riding the oil trade higher.

However, one of my favorite ways to play this has been through the energy ETFs like the XLE.

XLE Hourly Chart

Since the bottom in late March, this basket of energy stocks has nearly doubled. Yet, I think there’s still more room to run and here’s why.

When oil prices went negative on a lack of crude storage, it forced many drillers to cut production both in the U.S. and globally. You simply don’t turn that back on quickly.

In fact, many oil analysts believe we could see a huge run up in crude oil prices by the end of this year due to a shortage.

How could we go from a surplus to a shortage?

As demand ramps back up, supply simply can’t keep up. That leaves an imbalance that could chew through the backlog by Christmas time.

My favorite ways to play this are through the large integrated names like Exxon Mobil (XOM) and Conoco Phillips (COP). However, the XLE itself is a great vehicle to work with.

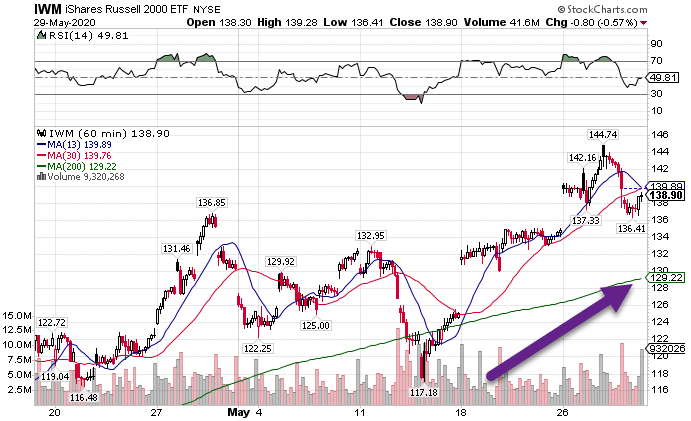

Keep an eye on small caps

Even though they ran pretty far last week, I still expect small caps to push higher. Their relative outperformance should continue as long as financials keep climbing.

IWM Hourly Chart

However, they’ve moved pretty far away from the 200-period moving average. That opens up the possibility of a sharp pullback before their next move higher.

Why financials you ask?

They make up a larger portion of the Russell 2000 index the S&P 500. That gives them a little extra juice the SPY just doesn’t have.

Finding the right trades on these takes a little bit of practice and education.

That’s why I created my Options Masterclass. Here you’ll learn some of my favorite techniques and setups to trade the markets…many of which I’m using right now.