20% Unemployment…

That’s not a headline from 1930…it’s the consensus estimate for non-farm payrolls in May.

Despite the ballooning unemployment figure… the stock market is closing in on all-time highs again.

It’s not that market participants don’t care…but more so…are concerned with the factors below:

- Whether the jobs come back

- Progress on the economic reopening

- Congressional appetite for further spending

- Expansion of the trade war

Understand these, and you’ll be well on your way to navigating the market this week.

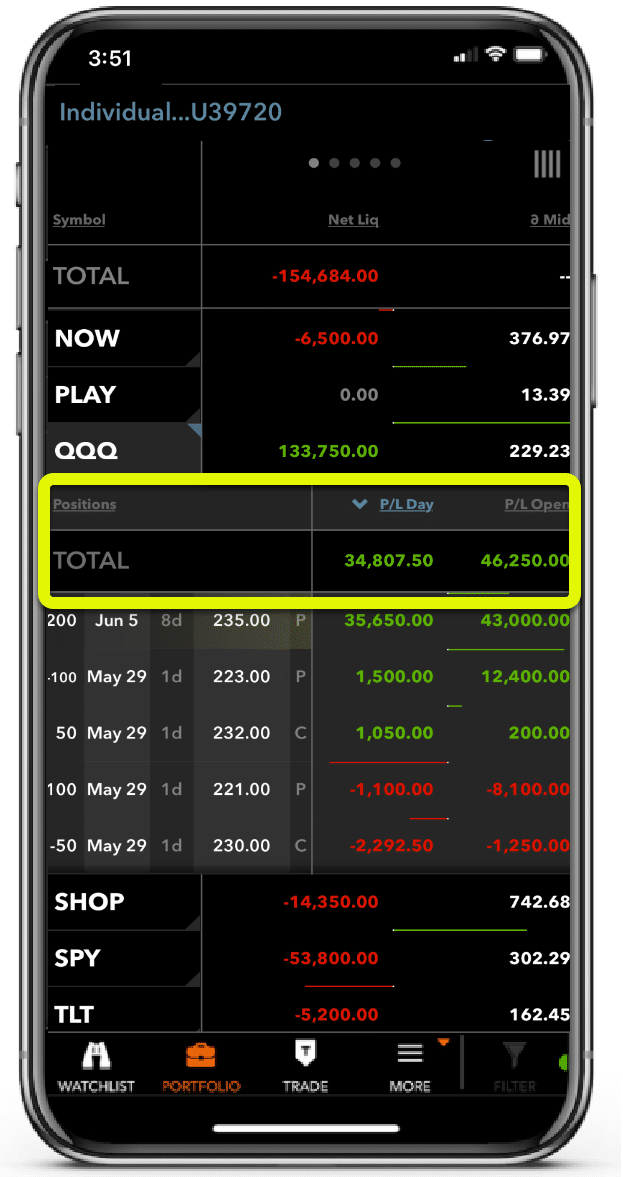

In last week’s Jump, I laid out my general bearish bias on the market.

I used it to leverage some quick trades on the Nasdaq 100 (QQQ) ETF for a nice day trade.

Your first question should be – Jeff, what about those massive losses in the S&P 500 (SPY) ETF below?

Excellent point!

You see, I’m using these large swings in the markets to rack up some short-term cash to pay for my long-term bearish bets, many of which go well into June and July.

Now, let’s discuss how I plan to apply the four themes above for the upcoming week.

As well as, rundown the earnings, and economic calendar.

1. Will the jobs come back?

Optimists hope our recovery looks like a ‘V.’ Similar to natural disasters, they think that reflating the economy is just around the corner.

‘Not so fast ‘ say the pessimists. Without a vaccine and meaningful treatment that’s widely available, how can we get back to the way we were – the good old days from six months ago.

I tend to agree with the second camp. While we should see a rebound in jobs, we’re still likely end the year above 10%.

Consider the number of bankruptcies that already hit the street. Everything from JCrew to Diamond Drilling couldn’t remain solvent even with the Fed handing out money like candy.

Simply put – there are far too many headwinds to expect businesses to recover and take us anywhere close to the record unemployment we saw.

That’s why I have a tough time buying into any labor sensitive industries and sectors at the moment.

2. Progress on the economic reopening

Here’s something interesting. Georgia was one of the first states to loosen restrictions from lockdown. Yet, they haven’t seen the job growth or economic recovery they were hoping for.

Sweden never committed to any lockdown restrictions. Yet, they’re facing one of the worst economic declines in decades.

Unfortunately, while America reopens, consumers aren’t necessarily prepared.

Currently, the market has priced in perfection. News to the contrary won’t be taken well. However, the early stages of the reopening are fairly set in stone.

Unless we get word of a second wave, which so far has not appeared, I don’t expect this will act as a headwind. If anything, I think it might buoy some of the airlines and restaurant stocks more than banks and other financials.

3. Congressional appetite for further spending

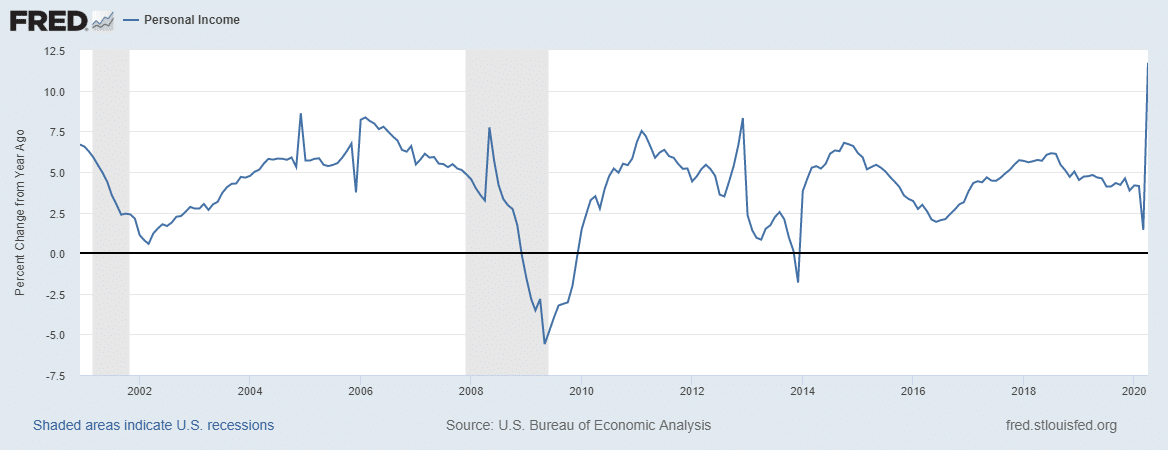

What if I told you that Personal Income soared last month? Would it surprise you?

How did this happen amidst the lockdowns?

Two words – Stimulus Payments.

With many Americans getting direct payments from the government, the timing overlapped with residual income from their employers prior to furlough.

That will change as the benefits dry up.

And it’s not just individuals. States that relied on revenues face severe shortfalls to their coffers. That means spending projects will be suspended across the nation.

Without additional stimulus, this could be one of the most significant headwinds to full economic recovery. So far, this doesn’t look promising.

While there’s broad agreement to supplement states to fight COVID, may in Congress don’t want to supplement state revenues.

Depending on the shortfalls, this could lead to job loss in everything from construction to teaching.

That’s why I haven’t been big on any of the industrials at the moment. I don’t buy the total economic recovery story. Seeing stocks like Deere (DE) and Caterpillar (CAT) start rising, makes me question the conviction of current buyers.

4. Expansion of the trade war

In an effort to hold China accountable for Hong Kong and other issues, the Trump administration laid out a series of steps it planned to take on Friday.

Markets breathed a sigh of relief as none of those appeared to derail any current trade agreements.

However, I wouldn’t put that out of the picture quite yet.

Given the turmoil and tension across the nation, we could easily see executive action against China as a means of political gain, rightly or wrongly.

Any whiff of that would put stocks like Bidu (BIDU), Alibaba (BABA), or JD (JD) in serious trouble.

So where am I playing this week?

Day to day, I’m taking opportunities in liquid stocks such as Apple (AAPL), Amazon (AMZN) and the like to sell option premium.

It’s one of the foundational trading strategies I use in Total Alpha.

If you’re not familiar with selling option premiums, then check out Ultimate Beginners Guide to Options Trading Video. Here you’ll learn the foundational elements to some of my favorite options trading strategies.

Click here to watch my Ultimate Beginners Guide to Options Trading.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Jun 4), COST (Mar 5), TTD (May 14), ROKU (May 7), AMZN (Apr 30), TDOC (May 5), MTCH (May 5), NFLX (April 21), CMG (Apr 22)

Stocks I want to buy…

MJ (none), UNG (none), WDAY (May 26), TWLO (May 3), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), GDX (none), GRUB (May 6), RNG (May 6), DKNG (??), BA (Apr 29), ULTA (June 4), GS (July 21)

This Week’s Calendar

Monday, June 1st

- 9:45 AM EST – Markit US Manufacturing May

- 10:00 AM EST – Construction Spending April

- 10:00 AM EST – ISM Manufacturing May

- Major earnings: NGL Energy Partners LP (NGL), ProPetro Hldg Corp (PUMP)

Tuesday, June 2nd

- 7:45 AM EST – ICSC Weekly Retail Sales

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Dick’s Sporting Goods (DKS), Ambarella Inc (AMBA), Digital Turbine Inc (APPS), CrowdStrike Holdings Inc (CRWD), Everi Hldgs Inc (EVRI), HealthEquity Inc (HQY), Medallia Inc (MDLA), Zoom Video Communications (ZM)

Wednesday, June 3rd

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:15 AM EST – ADP Employment May

- 9:45 AM EST – Markit US Services & Composite PMI May

- 10:00 AM EST – Factory Orders April

- 10:00 AM EST – ISM Non-Manufacturing Index May

- 10:00 AM EST – Durable Goods Orders May

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: American Eagle Outfitters Inc (AEO), Cinemark Hldg Inc (CNK), Campbell Soup (CPB), Express Inc (EXPR), Change Healthcare Inc (CHNG), Cloudera Inc (CLDR), Elastic NV (ESTC), Guidewire Software Inc (GWRE), Smartsheet Inc (SMAR), Zuora Inc (ZUO)

Thursday, June 4th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Nonfarm Productivity & Unit Labor Costs Q1

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Ciena Corp (CIEN), Kirkland’s Inc (KIRK), The Michaels Companies Inc (MIK), Sportsman’s Warehouse Hldg (SPWH), United Natural Foods (UNFI), Broadcom Inc (AVGO), DocuSign Inc (DOCU), Domo Inc (DOMO), Gap Inc (GPS), MongoDB Inc (MDB), Pagerduty Inc (PD), Slack Tech Inc (WORK), Yext Inc (YEXT)

Friday, June 5th

- 8:30 AM EST – NonFarm Payrolls & Unemployment May (AKA the Jobs Number)

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: StitchFix (SFIX)