Trading in the opposite direction of the trend can feel awful at times.

For decades “The Trend Is Your Friend” has been the mantra repeated by many so-called stock-picking experts.

The fact is most traders are intimidated by the thought of trading against the grain of a move, even though the profits can be larger and faster!

But with understanding, timing, and patience, these contrarian trades can pay huge windfalls.

The question still remains…

When should you fight the trend and go against it?

Here are the 3 Keys To Contrarian Paydays:

- Understand why the trade is trending

- Keep your time frames short

- Be patient

What follows is a pristine example of how I employed these principles to nab $50,000 out of Apple (AAPL) in just a couple of days.

The trade here is my AAPL play executed on May 12th, and the setup is a classic Total Alpha score waiting to happen.

Here’s the skinny on the play…and what you can learn from it.

1. Understand why the trade is trending

Typically, stocks don’t go up or down for no reason. Outside of normal price action, they rely on catalysts. Simply put, a catalyst is an event or expectation that causes traders to either buy or sell.

Sometimes the catalyst is company news, earnings, or even weather…something you can point your finger to and say, “THAT” is why this stock is moving.

But at times, you can spot a trade with zero apparent catalysts. The shares seem to be moving up or down entirely based on market technicals.

Well Why Is That???

Why would traders be running to a stock when nothing seems to be pushing the price up?

The answer is elegantly simple.

That stock simply looks like a ‘safer’ place to put your money compared to the rest of the market.

And recently, these ‘safe’ trades have been extremely rare.

In other words, the trade isn’t necessarily ‘good’. It just isn’t as bad as everything else.

That was the case with the upward move in AAPL in the early to middle part of May. Its best feature was that it wasn’t ‘bad.’

Sure Apple is a solid company, but nothing was truly exempt from reeling in the economic shockwave of COVID-19. The market was looking for a safe place in a storm of selling.

So when AAPL broke the $300 price point, I knew this was the case. There was high buying excitement, but no fundamental catalyst.

2. Keep Your Time Frames Short

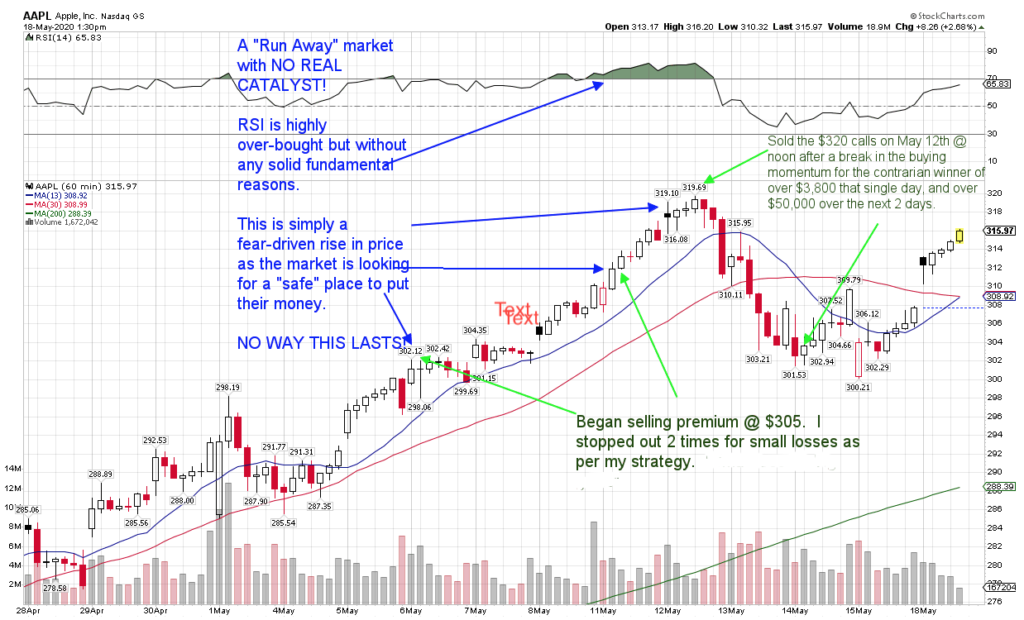

My typical timeframe to trade is the hourly chart. Using the technical analysis noted below, I wanted to make sure I balanced giving the trade enough time to play out versus holding it for too long.

In this particular trade, the swing points I used, as well as the RSI all worked off the hourly chart.

One trick I use to decide on a timeframe is to look at the length of time between the swing points (the major highs and lows). If it’s inside of two weeks, I’ll almost always go with the hourly time frame.

But why do this?

Well, shorter timeframes get me in and out of the trade faster. I’m not as good predicting where these markets will go several weeks from now. However, I can usually get a good read on where they’ll be within the next few days to a week out.

With all the current volatility, I don’t want to hold onto a trade for very long.

Now, as I analyzed the charts, I noticed something.

When I combined a highly overbought RSI reading with previous resistance at the round $320 level, the trade became the prime candidate for the bearish play of selling call options just above the money.

AAPL Hourly Chart

3. Be Patient

Now what’s noteworthy here is that as the price increased, two of my trades stopped out for very small losses.

Remember, ‘Small losses, big gains.’

Finally, around noon on May 12th, I saw the momentum falter as the hourly chart put in a deep red candle and struggled to recover. Now was the time to strike.

I immediately sold a credit spread at $320 and waited for the collapse, simultaneously watching for any further move against me in order to retain ‘small losses’…

And DID IT EVER COLLAPSE.

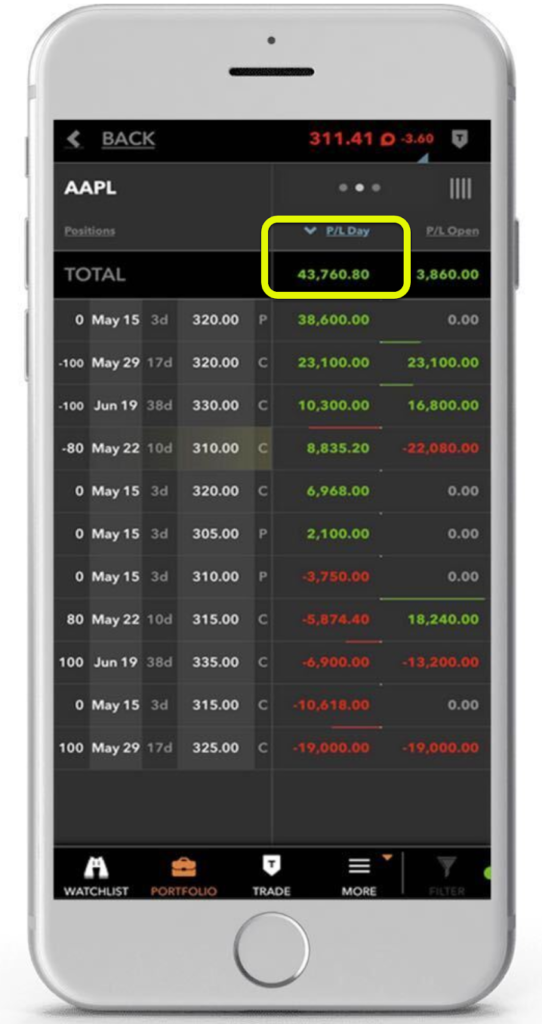

The Result: Over $50,000 Profit in 2 Days.

I didn’t give up on this AAPL trade, even when there were small losses.

This is extremely important!

Once I have a solid analysis and fundamental conviction on the impending reversal, I stick to that plan.

It’s really just a matter of “waiting to be right.

Understanding the trend, keeping time frames short, and being patient with the timing makes all the difference in the world when you’re looking for a huge contrarian payday.

Of course, all of my Total Alpha Premium Members watched this trade from conception to exit.

Following along is super-simple when you’re literally seeing the “play-by-play” in real-time.

I sure hope this helps you better understand the why and the when of the Total Alpha strategy.

Want to follow along in real-time?

Check out all the Total Alpha has to offer Right Here.

Perhaps you’ll be joining me on the next payday!