I feel like the market is about to suck in the last bit of retail buyers…

…right before the hammer drops.

I’m not about to let that happen, not now not ever.

I’m going to spend the next few minutes explaining why I think that’s the case.

As well as share with you a list of stocks that I’m interested in buy (and shorting).

An iceberg of upside

Business coaches love to use an iceberg as an analogy for all sorts of points. Play all boils down to one concept – what you can see is much smaller than everything you tonight.

Financial media honed this concept after watching market makers and big money use it to plunder retail account coffers.

At this very moment, both continue to work in tandem to drag the last resistance from your being until you buy in. And while, they will unload their shares to the unsuspecting before the floor gives way.

Maybe you noticed that the last couple weeks have been rather difficult to trade. Let me explain why that is.

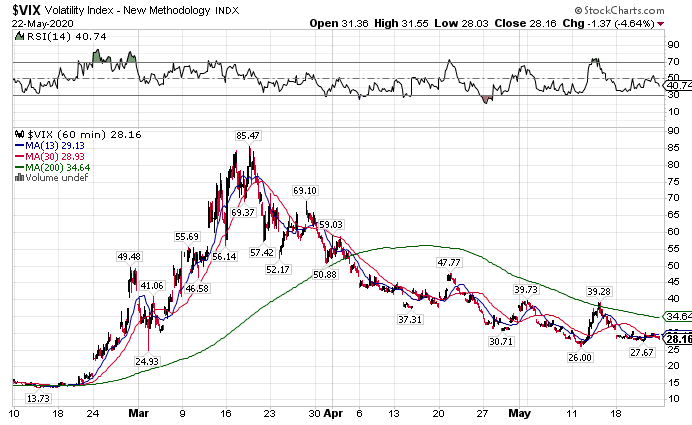

First, volatility hasn’t declined meaningfully since it last contracted when we shot off the bottom in late March. The VIX, which measures option demand on the S&P 500, barely cracked $30. While that is a far cry from where it was at the end of March, it is still exceptionally high by any historical measure.

VIX Hourly Chart

Combined with tight trading ranges, it’s made it extraordinarily difficult to take long positions to swing trade.

So selling options should be profitable right?

Not exactly. These same ranges make it difficult for option sellers to stick with their trades.

Quite often, they’ll find themselves in and out of the money so often that they give up.

That’s not to mention that implied volatility has been higher on near-term expirations, setting up another hurdle to overcome.

Next, the typical breakouts we see with stocks haven’t been forthcoming.

When I see charts like Amazon or Netflix consolidating at all-time highs, I’d expect them to pop higher.

Instead, myself and other traders have been treated to random pullbacks that obliterate directional trading.

Lastly, and this should be quite obvious, even if stocks were to move higher, how much upside do you think there is? The Nasdaq 100 is near all-time highs.

Yet, we’re nowhere near the economic activity we were prior to the pandemic.

So ask yourself, based on where we were and where we are, would you pay the same price for growth?

You can say stocks are forward-looking. But here’s a little forecast for you. 2020s profits are gone, poof. 2021 will come of some disgustingly low base to grow from. If we’re lucky, unemployment will drop under 10% by the end of 2022.

How far out do you want to go to rationalize this market? Any use of a discounted cash flow model or other fundamental analysis tools would explode in smoke trying to validate current equity levels.

Here’s how I’m profiting from the situation

Rather than throw up our hands in defeat, let’s come up with a gameplan.

Short-term, stocks will likely bust through to higher levels. So why not have your cake and eat it too?

I’m playing the bull side on short-term options and the bear den going out further in time. That gives me a balanced portfolio to profit from my outlook.

Already, we’re seeing rotation into some heavily beaten-down names. Industrials (XLI) rose nicely to end last week while some high fliers like Telodoc (TDOC) took a breather.

For me, technicals on the chart are the key to my selections. I’m using the same techniques I teach in my Options Masterclass.

Additionally, I’m using catalysts from the calendar as inflection points. Jobs data always impacts the market. I watch closely to see the market’s reaction. That’s what tells me where things are heading in the short-term.

Same goes for any political fodder tossed out into the public sphere. Things are only going to heat up from now until the election.

While no one can predict a wayward comment, a second Stimulus package is sure to have an impact.

Not sure where to start?

Picking out which stocks to go long and which to short can be difficult. It takes both practice and patience.

However, there’s one way to remove some of the ambiguity – My Bullseye Trade of The Week.

Each week, before the market opens, I send out my top options play with a detailed blueprint that not only covers how I plan to trade it, but why.

One trade can change everything.

Click here to learn more about my Bullseye Trade of the Week.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Jun 4), COST (Mar 5), TTD (May 14), ROKU (May 7), AMZN (Apr 30), TDOC (May 5), MTCH (May 5), NFLX (April 21), CMG (Apr 22)

Stocks I want to buy…

MJ (none), UNG (none), WDAY (May 26), TWLO (May 3), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), GDX (none), GRUB (May 6), RNG (May 6), DKNG (??), BA (Apr 29), ULTA (June 4), GS (July 21)

This Week’s Calendar

Monday, May 25th

- Markets Closed For Memorial Day

Tuesday, May 26th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Chicago Fed National Activity for April

- 9:00 AM EST – FHFA Housing Price Index & S&P CoreLogic CaseShiller for March

- 10:00 AM EST – Consumer Confidence May & New Home Sales April

- 10:30 AM EST – Dallas Fed Manufacturing Activity April

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Booz Allen Hamilton Hldg Cp (BAH), Hibbett Sporting Goods (HIBB), Anaplan Inc (PLAN), Keysight Tech Inc (KEYS)

Wednesday, May 27th

- 7:00 AM EST – MBA Mortgage Applications Data

- 10:00 AM EST – Richmond Fed Manufacturing Index May

- 10:30 AM EST – Weekly DOE Inventory Data

- 2:00 PM EST – Fed Minutes From April Meeting

- Major earnings: Photronics, Inc (PLAB), Ralph Lauren Corp. (RL), Autodesk, Inc (ADSK), Box, Inc (BOX), HP Inc (HPQ), NetApp Inc (NTAP), Nutanix Inc Cl A (NTNX), Toll Brothers (TOL)

Thursday, May 28th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – GDP, Personal Consumption, and Price Index Q1

- 8:30 AM EST – Durable Goods Orders April

- 10:00 AM EST – Pending Home Sales April

- 10:30 AM EST – EIA Natural Gas Inventory Data

- 11:00 AM EST – Kansas City Fed Manufacturing May

- Major earnings: Burlington Stores Inc (BURL), Dollar General Corporation (DG), Dollar Tree Inc (DLTR), Tech Data Corp (TECD), Costco Wholesale Corp (COST), salesforce.com Inc (CRM), Dell Tech Inc (DELL), DXC Technology Company (DXC), Nordstrom Inc (JWN), Marvell Tech Grp (MRVL), Okta Inc Cl A (OKTA), Ollies Bargain Outlet Hldgs (OLLI), Pure Storage Inc Cl A (PSTG), Ulta Beauty Inc (ULTA), Veeva Systems Inc (VEEV), VMWARE Inc (VMW), Workday Inc (WDAY), Zscaler Inc (ZS)

Friday, May 29th

- 8:30 AM EST – Advance Goods Trade Balance April

- 8:30 AM EST – Personal Spending and Income for April

- 9:45 AM EST – Chicago Purchasing Manufacturer Index May

- 10:00 AM EST – University of Michigan Confidence May

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: None of note