I’m sure you’ve seen it before…

A company issues a press release…and its shares skyrocket.

The story could be completely fugazi…but momo chasers are in and driving the stock up.

We all know the eventual outcome…

The stock will come back to earth, possibly give up all its gains and then some.

But you don’t have unlimited funds, and as much as you believe you are right… it’s hard to get in front of a moving train and not expect to get slaughtered…

Believe it or not… this doesn’t just happen in small-cap stocks.

But even large cap stocks can get on the hype train.

After all, we just saw it with the stay-at-home stocks like Zoom (ZM), Shopify (SHOP), and Netflix (NFLX)…

Eventually there has to be a pull-back I thought…

But buying puts are expensive, and shorting stock outright can be career suicide.

That’s why I decided to implement a strategy which allowed me to reduce my risk, while giving me the opportunity to profit from a sell-off.

Two Total Alpha trades that paid big bucks!

Today I’m going to explain to you what that options strategy is.

But most importantly, describe what you need to see on the charts before pulling the trigger.

If you feel that some stocks have run-up too much, then this is the strategy that you need in your arsenal.

Money Rotation

You probably heard about business cycles back in your economics class or on CNBC. While economists debate their validity, I’m here to talk to you about a cycle that does exist – money rotation.

Believe it or not, there are traders who simply follow the herd. They aren’t the first ones to the party, but they certainly aren’t the last. Rather than coming up with trade ideas themselves, they follow the flows of money that bounce from one sector to the next.

Ever noticed how some days the financials are up more than the industrials, or technology more than healthcare? When that happens over a sustained period, that’s known as sector rotation. It’s an indication money is flowing out of companies in one area and into another.

So, how does that apply to these stay-at-home trade stocks?

Well, think of them like a sector by themselves.

Big funds will try to hide their money in these companies because they’re the best game in town. As more of them pile in, the stocks push higher.

Some of these deserve the respect. Netflix picked up huge subscribers, while Amazon has become the defacto provider of everything.

But then you have companies like Telodoc who haven’t earned a penny yet, and you have to question how long it can last.

You see, money will only hide out in these names for so long. Without a sustainable business, funds can’t justify their holdings and will toss them for the blue chips at the first signs of recovery.

That brings us to the present.

Trading against the momentum names

Now for the good stuff!

My trade of choice with these names is the call credit spread.

For those of you who aren’t familiar with a call credit spread, it’s a risk defined trade where you know exactly how much you can win or lose at the outset.

It involves selling one call option at or above the current price and buying another further out to cap the risk.

This transaction pays you a credit, which is the maximum amount you can make. Your potential downside is the distance between the strikes minus the credit you receive up front.

You can read more about credit spreads in my blog.

First, with any contrarian trade, I like to use my money-pattern as the setup.

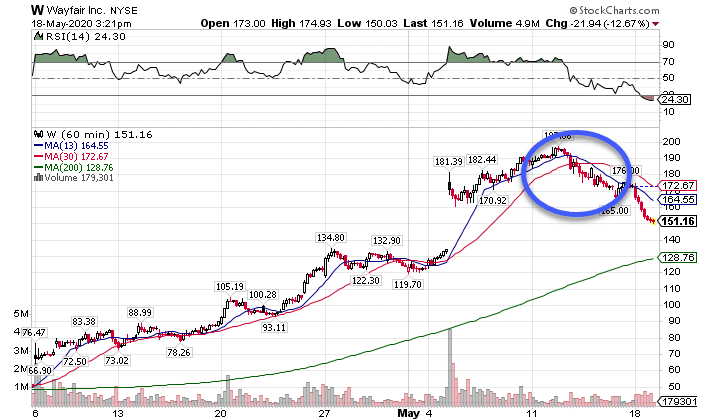

Check out the sweet setup with the Wayfair hourly chart.

W Hourly Chart

When I see the 13-period moving average cross over the 30-period moving average, and they haven’t touched in a while, that’s a good sign a reversal is underway.

Once I had that signal, I sold a short-duration call credit spread. I didn’t want to hold the trade open for too long, as I expected the pullback to be short-lived.

In this case, it happened to get a pretty violent reaction in the other direction, which worked out great for me.

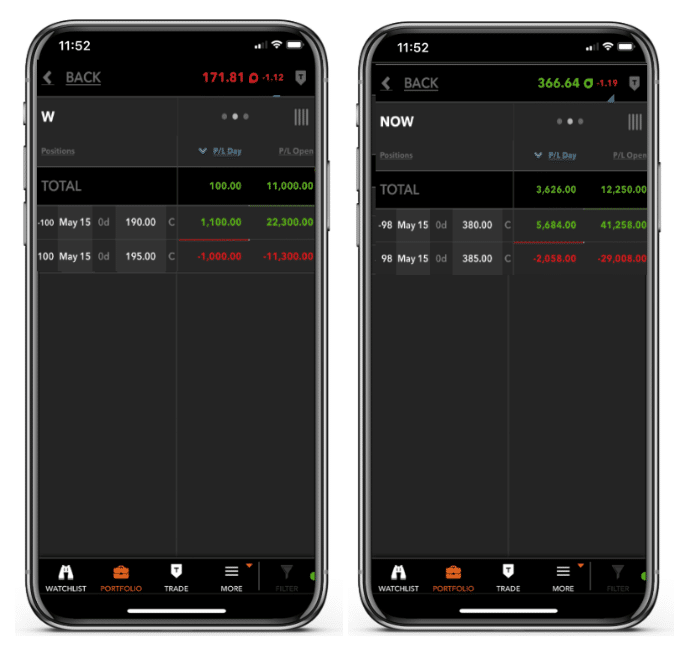

With the call credit spread, I sold the $190 calls and bought the $195 calls that expired on that week’s Friday. That put the strikes right above the recent highs, which I expected to act as resistance if the stock bounced.

Ready for options Bootcamp?

You can click around hoping to catch the next great trade…or you can join me for my options Bootcamp. This comprehensive options course teaches you my top three strategies, how to identify profitable setups, and more.

It’s all starting soon, so don’t miss your chance to sign up.

Click here to sign up for Total Alpha Options Bootcamp.