States slowly reopened their economies as if they were tiptoeing through some derelict house.

Instead of creaking floorboards, they found pockets of pent-up demand outsized by citizens reluctant to trust the outside world.

This week’s jump peels back the veneer to see what’s really going on underneath.

Global governments effectively turned populations into Agoraphobes in less than 90 days.

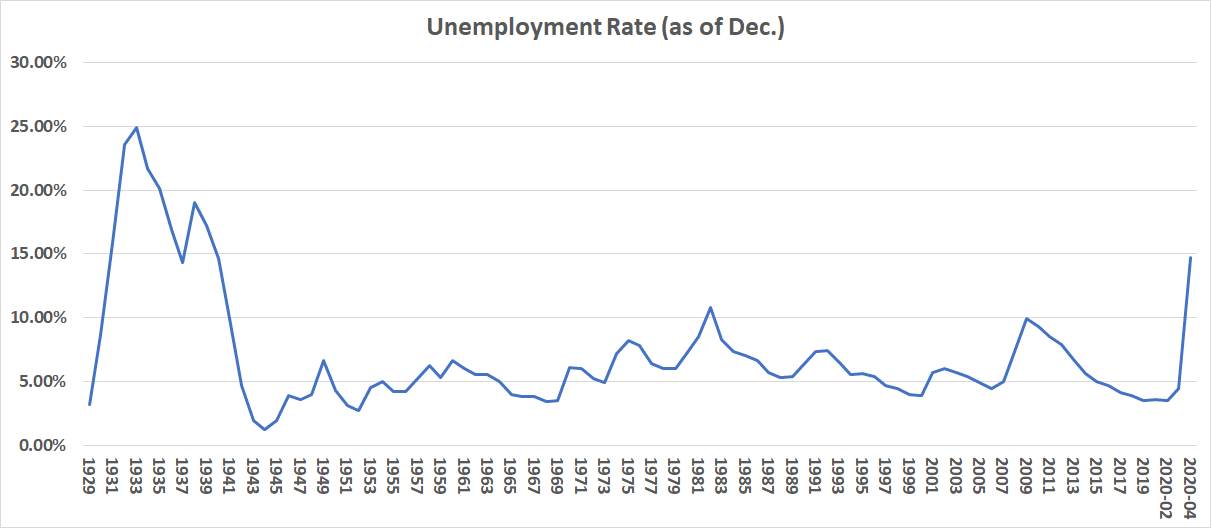

That led to unemployment popping to the highest levels since the Great Depression, and 1st quarter GDP crashing to -4.8%, the worst since Q4 of 2008.

Yet, the financial media would have us believe that our world is returning to normal. Heck, we have plenty of stocks making new highs too.

But bonds tell a different story…

It’s always been said that bond traders are always one step ahead of equity traders.

So what’s the real story here?

Are we being fed a bunch of bull about the stock market, or have we finally turned a corner?

We need to start with what they’re not telling you about the jobs numbers.

It’s all coming to you now, along with the latest earnings and economic announcements for the upcoming week.

78%

That’s the number of people who described themselves as ‘temporarily’ laid off in the April jobs report. For raw numbers, you’re looking at more than 18 million people who expect to return to work within six months.

Compare that with March’s 1.84 million people who thought the same thing. If that holds true, then, what’s the real unemployment rate when the dust settles? Probably still close to 6%, which would still be higher than anything since the last recession.

A paper published by the Becker Friedman Institute at the University of Chicago estimates it’s closer to 60%.

That seems a little more reasonable given the vast amount of bankruptcies already hitting the street. We’ve seen Hertz (HTZ), Neiman Marcus, and even the beloved salad buffet of the south, Sweet Tomato, go under.

True, some of these will be restructuring. Some of the direst predictions of 30% unemployment seem out of reach.

Looking at all the data, I can’t see us recovering to pre-COVID levels for several years, if ever. That rests on the assumption we find a vaccine and it’s effective, neither of which is guaranteed.

For reference, the flu vaccines aren’t 100% effective. Each year they have a certain amount of efficacy, but it doesn’t reach 100%.

Mass obfuscation

If you thought things were difficult to wrap your arms around now, just wait until election season picks up. Nothing generates disinformation like national political campaigns.

Everyone from politicians to Elon Musk are making bold claims about what they did or what we should do that they can’t seem to back up with actual evidence.

The regional power-brokering of states banding together is creating an interesting dynamic, pitting population size and coffers against other areas. All of this without much more than general guidelines about what our end-state should look like.

It’s not lost on me the unprecedented nature we’re facing. But, when our personal and economic livelihoods are on the line, my tolerance for failure is quite thin.

These are the themes

For markets, everything boils down to two elements – participation and uncertainty.

Without participation, you get freezes like the credit markets in 2008. So far, the Fed is doing what they can to keep that at bay. Congress passed a massive stimulus to resurrect the economy.

But the appetite for both appears to be waning. Congress isn’t eager to pass additional funding, and the Fed doesn’t have many bullets left we aren’t aware of.

However, I believe that a lot of the participation issues are solved with certainty. Right now, we have no way of knowing what the next few months or years will look like. That keeps markets capped, even with massive liquidity.

As an example, remember when stocks cracked off the initial tariff tiff between China and the U.S. It’s entirely possible the president tears up that accord and takes us back to square one.

Or look at the general travel and leisure segment. Sure, they can borrow for a time. But how many of them want to accumulate debt to run their establishments at 25% capacity?

Markets can trend much further than most realize and remain solvent. That doesn’t change the pressures on them. Eventually, they weigh enough to create crashes like what we saw in March.

One trade is all you need

I learned that one trade can make all the difference in the world. My Bullseye Trade of the week delivers to you my best options trade idea each week. I lay out my trade idea and plan for you from start to finish, pinpointing the most exceptional edge I can find.

Click here to learn more about Bullseye Trades.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Jun 4), COST (Mar 5), TTD (May 14), ROKU (May 7), AMZN (Apr 30), TDOC (May 5), MTCH (May 5), NFLX (April 21), CMG (Apr 22)

Stocks I want to buy…

MJ (none), UNG (none), WDAY (May 26), TWLO (May 3), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), GDX (none), GRUB (May 6), RNG (May 6), DKNG (??), BA (Apr 29), ULTA (June 4), GS (July 21)

This Week’s Calendar

Monday, May 11th

- Major Earnings: AMAG Pharmaceuticals Inc (AMAG), Avaya Hldg Corp (AVYA), BlueBird Bio Inc (BLUE), Cardinal Health Inc (CAH), Cleveland-Cliffs Inc (CLF), Continental Resources Inc (CLR), Coty Inc (COTY), Callon Petro (CPE), Entergy Corp (ETR), Fate Therapeutics Inc (FATE), Golub Cap BDC Inc (GBDC), GoGo Inc (GOGO), Halozyme Therapy Inc (HALO), Intercept Pharmaceuticals Inc (ICPT), Marriott Int’l Cl A (MAR), Mylan NV (MYL), Oasis Petro Inc (OAS), ON Semiconductor Corp (ON), Simon Ppty Grp (SPG), Under Armour Inc Cl A (UAA), Xenia Hotels & Resorts Inc (XHR), Zimmer Biomet Hldgs Inc (ZBH), Ameren Corp (AEE), Aimmune Therapeutics Inc (AIMT), Bloom Energy Corp (BE), Caesars Entertainment Corp (CZR), Datadog Inc (DDOG), Eventbrite Inc (EB), Eldorado Resorts Inc (ERI), Energy Transfer L.P. (ET), GENPACT LIMITED (G), Green Dot Corporation (GDOT), Grocery Outlet Holding Corp (GO), GreenSky Inc (GSKY), Intl Flavors/Fragr (IFF), Inovio Pharmaceuticals Inc (INO), Livent Corp (LTHM), Maxar Tech Ltd. (MAXR), Mimecast Ltd (MIME), RPT Realty (RPT), Tanger Factory Outlet Centers (SKT), Extraction Oil & Gas Inc (XOG), YRC Worldwide Inc (YRCW)

Tuesday, May 12th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Consumer Price Index April

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: Dynatrace Holdings LLC (DT), Duke Energy Corporation (DUK), Ingersoll-Rand Plc (IR), Macerich Co (MAC), MBIA Inc (MBI), Envista Holdings Corp (NVST), Vishay Intertech (VSH), Adaptive Biotech Corp (ADPT), 8×8 Inc (EGHT), Infinera Corp (INFN), RLJ Lodging Trust (RLJ), Rexnord Corp (RXN)

Wednesday, May 13th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:30 AM EST – Producer Price Index April

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Applied Genetic Technologies (AGTC), Biocept Inc (BIOC), Cisco Systems (CSCO), Flowers Foods Inc (FLO), Oceaneering Intl Inc (OII), SmileDirectClub Inc (SDC), STERIS plc (STE)

Thursday, May 14th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Import/Export Prices April

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Achieve Life Sciences Inc (ACHV), EQM Midstream Partners LP (EQM), KEMET Corp. (KEM), Stratasys Ltd (SSYS), TransEnterix Inc (TRXC), Applied Materials (AMAT), Covetrus Inc (CVET), Nortonlifelock Inc (NLOK)

Friday, May 15th

- 8:30 AM EST – Retail Sales April

- 8:30 AM EST – Empire Manufacturing May

- 9:15 AM EST – Industrial Production & Capacity Utilization April

- 10:00 AM EST – Business Inventories March

- 10:00 AM EST – University of Michigan Sentiment May

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: DraftKings (DKNG), VF Corp (VFC)