Forget about the Apples and Amazons of the world. They could barely hold their own last week.

The real winners this week look to be U.S. Treasuries.

I know, who wants to tie up their money for 10 years and get less than 1% interest?

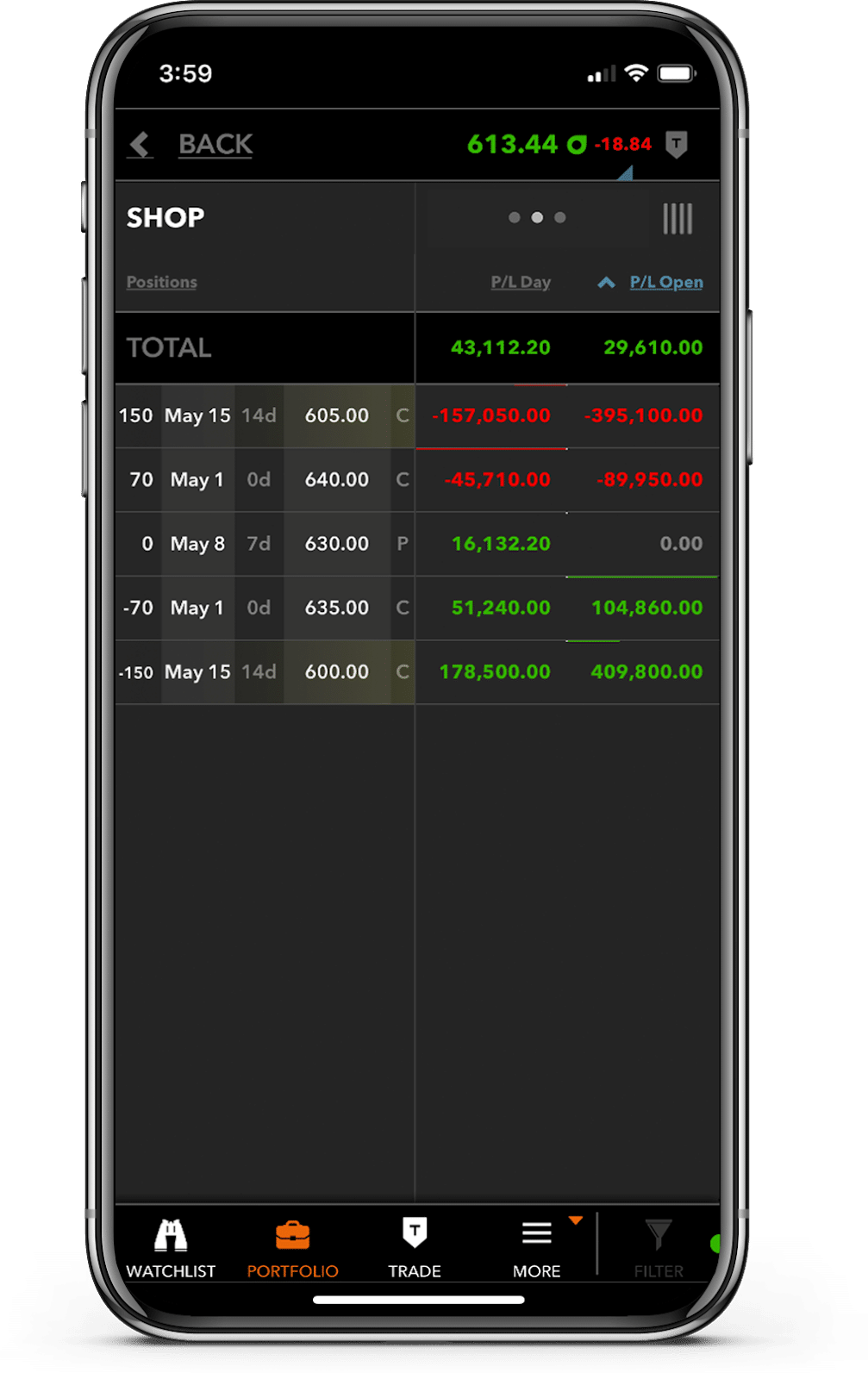

Apparently, the same people pulling their money out of the recent high flyers like Shopify (SHOP).

That’s why I took a pretty bearish bet in this momentum name last week in Total Alpha

I saw the rotation in my own portfolio as gains in Shopify offset my losses in Alibaba (BABA).

This week I plan to bet against names like Tesla and Amazon in favor of treasuries and stay-at-home stocks.

But, there’s one more sector that might pop off too…

Delightful dividends

When you’re a retiree living on a fixed income, bonds work great when they pay 3%-5%. At less than 1%, you’re losing money over the long-run.

As bond yields (the interest rates on bonds) go down (they move the opposite direction of bond prices), high paying dividend stocks become more attractive.

Utilities and telecommunications are favorites for those seeking consistent income streams.

Why buy a government bond when you can pick up AT&T (T) stock that yields over 6.5%? That doesn’t even take into consideration capital appreciation.

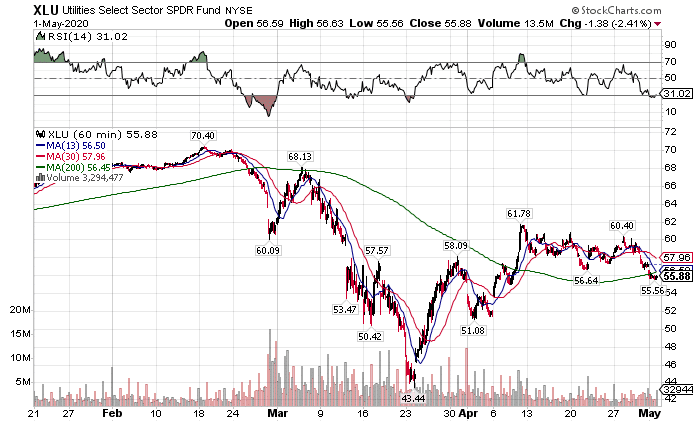

The S&P Utilities ETF XLU pays a hefty 3.3% yield and has been getting hit with the rest of the market.

XLU Hourly Chart

Why would I want to buy something that goes down with the market? In this case, I expect utilities to continue earning money no matter what. True, electricity usage from manufacturing and industry is down. However, retail use remains strong.

Additionally, they quite often fund dividends with debt. Since the Fed made it super cheap to borrow, I expect some of these companies might be hiking dividends in the near future.

However, don’t just grab any old dividend stock out there. High yields can also be a warning sign. There’s plenty of energy companies that paid huge dividends in the past, but won’t be able to keep them going.

I plan to stick with large well-known names. When I can’t decide on those, I’ll lean on the ETFs to reduce my risk through diversification.

Best bond plays

With the Fed backing the debt markets, I expect that government and corporate bonds will do well in the coming weeks.

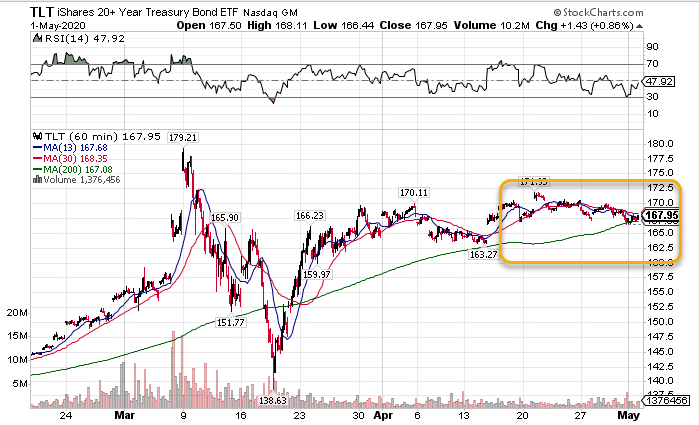

For government bonds, I like the TLT ETF that tracks longer-term treasury bonds. It’s been consolidating for a while now and appears like it wants to break out.

TLT Hourly Chart

With the 200-period moving average as support on the hourly chart, I want to see the TLT hold these levels.

Bearing this in mind, I sold a put credit spread on the TLT in my Total Alpha portfolio last week. That gives me a defined risk/reward trade that pays me even if bonds don’t break substantially higher.

Stocks under pressure

So, why is it now that markets finally pulled back off a massive run? We’re finally getting a chance to resume a semblance of normalcy.

There are a few reasons. First, stocks got a big jolt from the federal government. We’ve never seen that kind of stimulus that early from congress or the Federal Reserve. With that kind of juice, you will get some reaction.

Second, that juice will fade. Markets are forward-looking. As they look past the summer, we see an uncertain fall and winter. Even if cases don’t resurge, how long can businesses hold on running at 50%-75% capacity? Will they be able to deal with the extra cleanliness costs?

I suspect we’re looking at a second round of mass layoffs in the fall as the stimulus fades. We might get another large tranche of money to help out, but eventually, we’ll hit a wall.

Third, we saw a massive amount of outflow in the selloff. Typically, markets need to breathe and digest information before resolving themselves to lower prices.

Consider how little we knew about the Coronavirus outcome to start March versus now. We have a lot more information to use for price discovery. Markets hate uncertainty.

Where does that leave us?

Trading the markets in front of us of course!

There’ll be plenty of long-term investments to be had along the way. But, while I’m waiting for that to happen, I plan to take advantage of volatility and use option strategies to my advantage.

In my free upcoming Masterclass, I go over some of my favorite strategies and setups I use to profit in the market. Even if you’re a seasoned trader, you’ll learn something new.

Click here to register for my free Options Masterclass.