Friday’s market didn’t start the month of May off on a happy note, but it couldn’t dampen everyone’s spirits.

Excitement filled the air as parts of the nation began to ease lockdown orders and start to reopen.

While most people celebrated their renewed freedom, I couldn’t wait to share my epic Friday comeback in Total Alpha!

Every person after lockdown… or maybe just me after a great trade??

You see, I’ve been getting bearish ever since the latest surge in stocks. And on Friday, I finally got paid for it.

That’s why this week’s plan focuses not only on 1st quarter earnings or politics, but on the data points on where we go from here….

Starting with oil.

Slippery path to bankruptcy

Last month gave us negative oil prices for the first time in history. This month delivered West Texas futures that can’t break the crucial $20 a barrel mark.

Exxon Mobil (XOM) posted one of its worst earnings in history. In fact, it lost 14 cents per share including one-time items, its first loss in 30 years.

Think about that for a moment…this company has turned a profit every quarter since the first Bush left the White House.

And, they don’t expect things to get any better. Chevron (CVX) reported massive shut-ins of their wells while curtailing investments in the Permian Basin…all of which leads to more job loss.

As America gets ‘back to business’, the real question is what does that look like.

Oil inventories are expected to fill sometime this month. Output cuts won’t meaningfully impact the market until sometime in Q4. Even Venezuela had to ship a plane full of gold to Iran in order to get help for the Petrostate.

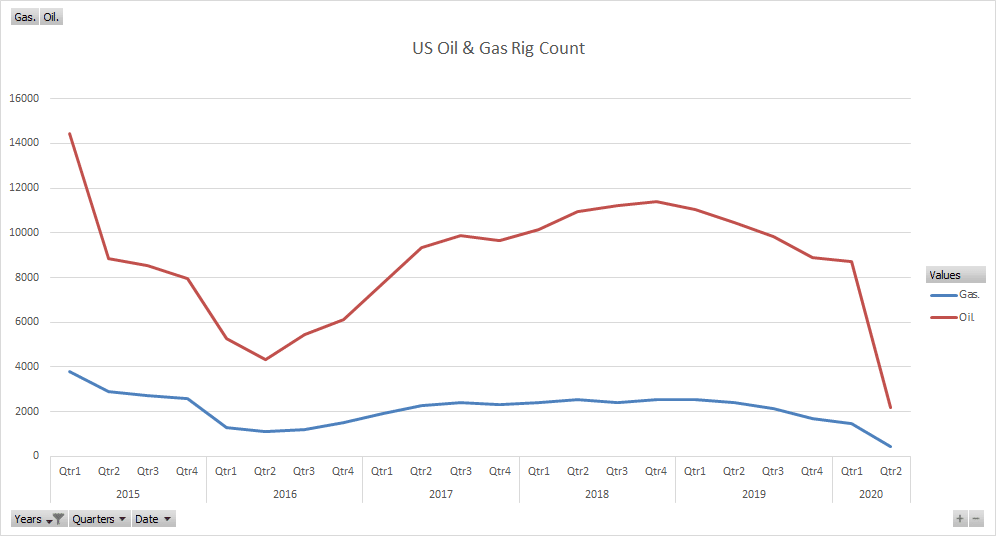

Every Friday, we get the Baker Hughes Rig Count at 1 p.m. I’ve been keeping an eye here as the number of rigs plummets each week

To give you an idea of the scope of what we’re facing, January had ~3,300 active oil rigs. Subsequent months were ~2,700, ~2,600, ~1,800 and last week a healthy 325.

We have 10% of the oil rig count in January running right now. Ohh, and that’s dropping by ~50 each week.

In 2019, the oil and gas industry employed around 155,000 people according to the Bureau of Labor Statistics.

None of the jobs are going to come back online until business starts rolling again. I’m not talking about restaurants running at partial capacity. This sector isn’t about to change until you get transportation rolling again…everything from airlines (domestic and international) to trucking.

All of that relies on Coronavirus case management.

Will cases reemerge?

Some states plan to continue heavy lockdowns through part of May. Yet, places like Georgia plan to open up for business more rapidly.

With an incubation period of two weeks, I’ll be watching how many new cases pop up in places like Georgia, Florida, and Texas. It’s worth keeping in mind that they’ll be increasing the number of tests. Naturally, that will lead to more infections identified.

The real test comes in the pressure on the hospital system. Flattening the curve simply spreads out cases over time. Without a vaccine, the same number of infections will occur before herd immunity takes place.

If Georgia is able to last several weeks without meaningful growth in positive cases and hospitalizations, then I expect that many other states will follow suit.

Still, there remains ample ambiguity in large sectors of the economy including trade and international travel. I hardly expect those issues to be resolved in the next several weeks. Just don’t discount their economic impact.

It’s easy to look around and see stores open and think everything is normal. There’s much that many of us won’t see that remains frozen which contributes to overall economic growth.

For that information, we’ll be looking at service, manufacturing, and trade numbers. But as I said, we’re still months away from that.

Pick the best trade idea from the bunch

I learned that one trade can make all the difference in the world. My Bullseye Trade of the week delivers to you my best options trade idea each week. I lay out my trade idea and plan for you from start to finish, pinpointing the most exceptional edge I can find.

Click here to learn more about Bullseye Trades.

Expected earnings dates listed in (…)

Stocks I want to bet against…

TLT (none), ZM (Mar 4), COST (Mar 5)

Stocks I want to buy…

MJ (none), UNG (none), XLE (none), WDAY (May 26), TWLO (May 3), OLED (May 7), V (Apr 22), IRBT (Apr 28), DPZ (May 20), GOOGL (May 4), CVNA (May 13), CMG (Apr 22), NFLX (April 21), AMZN (Apr 23), UBER (Jun 4), GDX (none), ROKU (May 13), MTCH (May 5), TDOC (May 5), ZS, AYX, RH, WORK, IWM

This Week’s Calendar

Monday, May 4th

- 10:00 AM EST – Factory & Durable Goods Orders March

- Major Earnings: Epizyme Inc (EPZM), Loews Corp (L), Marinus Pharma Inc (MRNS), Pitney Bowes Inc (PBI), Pub Svc Enterprises Gr Incorp (PEG), PetMed Express (PETS), Sempra Energy (SRE), Tyson Foods ‘A’ (TSN), Wabtec Corp (WAB), WEC Energy Group Inc (WEC), Acadia Healthcare Co, Inc (ACHC), Amer Intl Grp (AIG), Allison Transmission Hldg (ALSN), Avis Budget Grp (CAR), Chegg Inc (CHGG), Cirrus Logic (CRUS), Diamondback Energy Inc (FANG), Five9 Inc (FIVN), Hawaiian Hldg Inc (HA), Kennametal Inc (KMT), Knowles Corporation (KN), Leggett & Platt (LEG), Mohawk Indus (MHK), The Mosaic Co (New) (MOS), Realty Income (O), Omega Healthcare Investors Inc (OHI), Shake Shack Inc (SHAK), Skyworks Solutions (SWKS), Tenet Healthcare (THC), Unum Grp (UNM), Varian Medical Systems Inc (VAR), Vornado Realty Trust (VNO), Williams Companies (WMB)

Tuesday, May 5th

- 7:45 AM EST – ICSC Weekly Retail Sales

- 8:30 AM EST – Trade Balance March

- 9:45 AM EST – Markit US Services & Composite PMI April

- 10:00 AM EST – ISM Non-Manufacturing Index for April

- 4:30 PM EST – API Weekly Inventory Data

- Major earnings: AECOM (ACM), Adient plc (ADNT), Alaska Air Grp Inc (ALK), Ametek, Inc (AME), A O Smith Corp (AOS), Aramark (ARMK), Ares Cap Corporation (ARCC), Allegheny Technologies (ATI), BGC Partners Inc (BGCP), Black Knight Inc (BKI), Cincinnati Bell (CBB), Catalent Inc (CTLT), Dominion Energy Inc (D), Diebold Nixdorf Inc (DBD), DuPont de Nemours Inc (DD), Expeditors Intl of Washington (EXPD), Incyte Corp (INCY), Illinois Tool Works (ITW), Karyopharm Therapeutics Inc (KPTI), Leidos Hldg Inc (LDOS), L3Harris Technologies Inc (LHX), Lumentum Hldgs Inc (LITE), Louisiana-Pacific Corp (LPX), MDC Hldg Inc (MDC), Martin Marietta Materials (MLM), Mallinckrodt Pub Ltd Co (MNK), Marathon Petro Corp (MPC), MPLX LP (MPLX), Newmont Corp (NEM), New Residential Inv Corp (NRZ), Regeneron Pharmaceuticals (REGN), Sealed Air (SEE), Sysco Corp (SYY), Tetra Technologies Inc (TTI), US Foods Hldg Corp (USFD), Vistra Energy Corp (VST), Wayfair Inc (W), Westrock Co (WRK), Xylem, Inc. (XYL), Acadia Realty Trust (AKR), Arista Networks (ANET), Ashland Glbl Hldgs Inc (ASH), Activision Blizzard Inc (ATVI), B&G Foods Inc (BGS), Brookdale Senior Living Inc (BKD), Beyond Meat Inc (BYND), Cheesecake Factory (CAKE), The Chemours Company (CC), Cerus Corp (CERS), Clovis Oncology Inc (CLVS), CNO Finl Grp, Inc. (CNO), Deciphera Pharm Inc (DCPH), Disney (Walt) Co (DIS), Delek US Holdco Inc (DK), DaVita Inc (DVA), Devon Energy (DVN), Electronic Arts, Inc. (EA), Exelixis Inc (EXEL), FMC Corp (FMC), Genworth Finl Inc (GNW), Healthcare Trust of America (HTA), Iovance Biotherapeutics Inc (IOVA), KLA Corp (KLAC), Ladder Cap Corp (LADR), LendingClub Corp (LC), Mattel, Inc (MAT), Match Grp Inc (MTCH), Myriad Genetics (MYGN), Nabors Industries Inc (NBR), Newpark Resources (NR), Occidental Petro Corp (OXY), Plains All American Pipeline (PAA), Healthpeak Properties Inc (PEAK), Pinterest Inc (PINS), PerkinElmer Inc (PKI), Planet Fitness Inc (PLNT), Prudential Finl (PRU), Repub Svcs Inc (RSG), Rayonier Advanced Mats Inc (RYAM), SBA Communications’A’ (SBAC), STORE Cap Corp (STOR), Voya Finl Inc (VOYA), Verisk Analytics Inc (VRSK), Western Union Co (THE) (WU)

Wednesday, May 6th

- 7:00 AM EST – MBA Mortgage Applications Data

- 8:15 AM EST – ADP Employment April

- 10:30 AM EST – Weekly DOE Inventory Data

- Major earnings: Amer Electric Pwr (AEP), Allstate Corp (ALL), Allogene Therapeutics Inc (ALLO), Biocryst Pharm’l (BCRX), Bunge Ltd (BG), Borg Warner (BWA), Cars.com Inc (CARS), Chimera Invt Corp (CIM), CVS Health Corp (CVS), Discovery Inc Ser A (DISCA), Extreme Networks (EXTR), Flir Systems (FLIR), General Motors Co (GM), Genuine Parts (GPC), Horizon Therapeutics PLC (HZNP), KKR & Co Inc (KKR), Nisource Inc (NI), New York Times’A’ (NYT), Office Depot (ODP), Owens & Minor Inc (OMI), Sinclair Broadcast Grp’A’ (SBGI), Spirit Aerosystems Hldgs Inc (SPR), TherapeuticsMD Inc (TXMD), Vulcan Materials (VMC), The Wendy’s Co (WEN), Waste Mgt Inc (WM), Wyndham Destinations Inc (WYND), Albemarle Corp (ALB), ANGI Homeservices Inc CL A (ANGI), Apache Corp (APA), Avalonbay Communities (AVB), Bruker Corporation (BRKR), CF Industries Hldgs Inc (CF), Carvana Co Cl A (CVNA), 3D Systems Corp (DDD), Etsy Inc (ETSY), Exact Sciences (EXAS), Extrage Space Storage Inc (EXR), Fitbit Inc (FIT), Fortinet Inc (FTNT), Glbl Blood Therapeutics Inc (GBT), GoDaddy Inc (GDDY), GrubHub Inc (GRUB), Hyatt Hotels Corporation (H), HubSpot Inc (HUBS), IAC/InterActive Corp (IAC), Ironwood Pharmaceuticals Inc’A (IRWD), Lannett Co (LCI), Lincoln Natl Corp (LNC), Livongo Health Inc (LVGO), Lyft Inc (LYFT), Metlife Inc (MET), MannKind Corporation (MNKD), Marathon Oil Corp (MRO), Orasure Technologies (OSUR), Pioneer Natural Resources (PXD), PayPal Hldgs Inc (PYPL), Qurate Retail Inc (QRTEA), Radian Grp (RDN), Ringcentral Inc (RNG), The Rubicon Project Inc (RUBI), Sunrun Inc (RUN), Sabra Healthcare REIT, Inc. (SBRA), Square Inc (SQ), Extended Stay America Inc (STAY), T-Mobile US Inc (TMUS), Twilio Inc Cl A (TWLO), Two Harbors Inv Corp (TWO), UDR Inc (UDR), Energous Corporation (WATT), WPX Energy Inc (WPX), Zynga Inc Cl A (ZNGA)

Thursday, May 7th

- 8:30 AM EST – Weekly Jobless & Continuing Claims

- 8:30 AM EST – Non-Farm Productivity & Unit Labor Costs Q1

- 9:45 AM EST – Chicago PMI

- 10:30 AM EST – EIA Natural Gas Inventory Data

- Major earnings: Aaron’s Inc (AAN), AmeriSourceBergen Corp (ABC), AES Corp (AES), Becton, Dickinson (BDX), Bausch Health Companies Inc (BHC), Ball Corp (BLL), Bristol-Myers SQUIBB (BMY), Colfax Corporation (CFX), Centerpoint Energy (CNP), CommScope Hldg Co Inc (COMM), Corteva Inc W* (CTVA), Diversified Healthcare (DHC), Danaher Corp (DHR), Elanco Animal Health Inc (ELAN), Energizer Hldgs Inc (ENR), Equitable Resources (EQT), Fidelity National Information (FIS), Amicus Therapeutics Inc (FOLD), Gannett Co Inc (GCI), Hain Celestial Grp Inc (HAIN), Hess Corporation (HES), HollyFrontier Corporation (HFC), Hecla Mining (HL), Hilton Worldwide Hldg Inc (HLT), Iron Mountain Inc REIT (IRM), Intra-Cellular Therapies Inc (ITCI), JetBlue Airways (JBLU), Liberty Media Corp A SiriusXM (LSXMA), Lexington Realty Trust (LXP), Momenta Pharmaceuticals (MNTA), Moderna Inc (MRNA), Murphy Oil Corp (MUR), NRG Energy Inc (NRG), OGE Energy Corp (OGE), Penn National Gaming (PENN), Quanta Svcs (PWR), Shell Midstream Partners LP (SHLX), Starwood Ppty Trust Inc (STWD), TEGNA Inc (TGNA), Targa Resources Corp (TRGP), Vonage Hldg Corp (VG), ViacomCBS Inc Cl B (VIAC), Virtu Finl Inc Cl A (VIRT), Xcel Energy (XEL), YETI Holdings Inc (YETI), Applied Optoelectronice Inc (AAOI), Axon Enterprise Inc (AAXN), ACADIA Pharmaceuticals Inc (ACAD), ADT Inc (ADT), Apt Inv & Mgmt’A’ (AIV), Air Lease Corp (AL), Appian Corp Cl A (APPN), Apollo Commercial RE Fin Inc (ARI), Athersys Inc (ATHX), Cargurus Inc (CARG), Clean Energy Fuels Corp (CLNE), Americold Realty Tr (COLD), Cognizant Tech Solutions’A’ (CTSH), Dropbox Inc (DBX), Digital Realty Trust Inc (DLR), Amdocs Ltd (DOX), Dynavax Tech Corp (DVAX), Consolidated Edison (ED), Enlink Midstream LLC (ENLC), EOG Resources (EOG), Equitable Holdings Inc (EQH), Evolent Health Inc (EVH), Fiserv Inc (FISV), Flex Ltd (FLEX), Fleetcor Technologies Inc (FLT), Glue Mobile Inc (GLUU), GoPro Inc Cl A (GPRO), Host Hotels & Resorts Inc (HST), Alliant Energy Corporation (LNT), Live Nation Entertainment, Inc (LYV), Microchip Tech (MCHP), Allscripts Healthcare Solution (MDRX), Monster Beverage Corporation (MNST), MGIC Inv (MTG), CloudFlare Inc (NET), Nuance Communications Inc (NUAN), News Corp Cl A (NWSA), Puma Biotech Inc (PBYI), Pebblebrook Hotel Trust (PEB), Plug Power, Inc. (PLUG), Insulet Corporation (PODD), Post Hldg Inc (POST), Roku Inc Cl A (ROKU), Sage Therapeutics Inc (SAGE), SailPoint Tech Hldg Inc (SAIL), SunPower Corp (SPWR), Synaptics Inc (SYNA), Teradata Corp (TDC), TrueCar Inc (TRUE), Uber Technologies Inc (UBER), Weingarten Rlty Invst (WRI), Yelp Inc (YELP), Zillow Grp Inc Cl A (ZG), ZIOPHARM Oncology Inc (ZIOP)

Friday, May 8th

- 8:30 AM EST – Jobs Report for April

- 1:00 PM EST – Baker Hughes Rig Count

- Major earnings: American Axle & Manufacturing (AXL), Bloomin’ Brands Inc (BLMN), Broadridge Finl Solutions Inc (BR), Colony NorthStar Inc (CLNY), Exelon Corp (EXC), Gulfport Energy Corp (GPOR), Harsco Corp (HSC), Kimco Realty Corp (KIM), Lear Corporation (LEA), Noble Energy (NBL), Outfront Media Inc (OUT), PBF Energy Inc Cl A (PBF), Pinnacle West Cap Corp (PNW), PPL Corp (PPL), Sabre Corp (SABR), SeaWorld Entertainment Inc (SEAS), Sunstone Hotel Investors Inc (SHO), SunCoke Energy Inc (SXC), Tenneco Inc (TEN), Domtar Corp (UFS)